Some stocks paint total-return charts that rival the beauty of fine art. Demonstrating unwavering returns year after year, these stalwart enterprises embody the adage, “winners keep winning.”

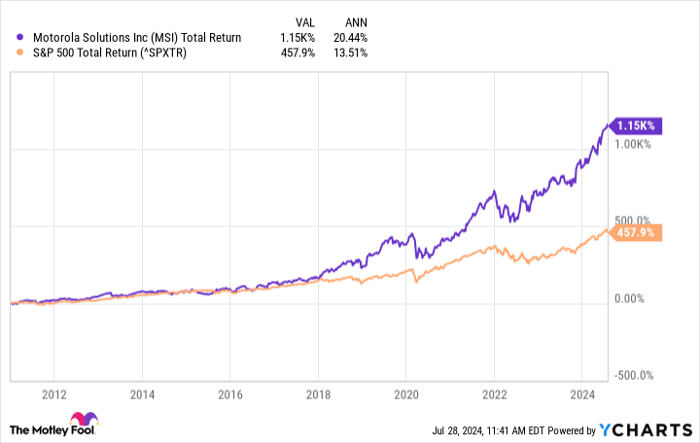

Among these stands out a notable figure – the renowned public safety and enterprise-security services provider Motorola Solutions ((NYSE: MSI)). Since its spinoff in 2011, Motorola has more than doubled the total returns of the S&P 500 index, consistently surging to new heights.

MSI Total Return Level data by YCharts.

Hovering near all-time highs once more, Motorola Solutions stands poised to scale even greater peaks. Let’s delve into what sets this company apart as a magnificent S&P 500 dividend stock ideal for long-term investment.

Image source: Getty Images.

An Examination of Motorola Solutions’ Vital Offerings

Catering to 100,000+ public safety and enterprise clients across 100+ countries, Motorola Solutions is dedicated to “making everywhere safer for all.” The company operates through three core product categories:

- Land Mobile Radio (LMR) Communications (75% of revenue): Supporting 13,000 networks globally, Motorola’s robust and reliable LMR communications are indispensable for public safety departments and enterprise clients requiring uninterrupted coverage. These solutions proved critical during calamities like Hurricane Ian or the Maui wildfires, ensuring essential communications amid overloaded or failing cell towers. With devices in this segment typically upgraded every six to eight years, sales remain steady and recurring owing to the mission-critical nature of these solutions.

- Video Security and Access Control (17% of revenue): Operating over 5 million fixed video cameras at 300,000 sites, Motorola’s video portfolio extends beyond mere footage. Incorporating artificial intelligence (AI) in 90% of its video products, the company aims to revolutionize video surveillance. Given that human detection rates for incidents within 20 minutes hover at 20%, Motorola’s AI and machine vision capabilities have swiftly garnered market share in the traditional surveillance domain. Apart from fixed-camera solutions, the company markets body cameras, creating natural cross-selling opportunities with its LMR and command-center clientele in the public safety domain.

- Command Center (7% of revenue): Despite being the smallest segment, Motorola’s command-center unit leads its sector. With 60% of public safety answering points relying on the company’s call-handling software, Motorola reigns supreme in yet another crucial industry domain. Encompassing the entire spectrum from event detection to response and resolution, the company’s end-to-end software dovetails seamlessly with its product suite, creating a broad switching-cost moat.

The cherry on top for investors? Half of Motorola’s revenue stems from recurring sources tied to software and services essential across its product categories. These dependable sales, coupled with indispensable products, furnish the company with a robust sales base that proves resilient even in times of economic downturns.

Robust Cash Generation Powers Motorola Solutions’ Expansion

While Motorola can bank on repeat contracts from clients every few years, the company doesn’t rest on its laurels. With 8,000 out of 21,000 employees engaged in research and development (R&D), Motorola maintains a high R&D-to-revenue ratio of 8%, underscoring its unwavering commitment to safety innovation.

Despite (or perhaps due to) this elevated R&D expenditure to reinvigorate its product range, Motorola has yielded a solid free-cash-flow (FCF) margin of 16% over the past five years. This advantageous FCF margin equips management with surplus cash for strategic mergers and acquisitions (M&A).

Since 2015, Motorola has channeled roughly $6 billion into over 20 acquisitions, fortifying its technological prowess across all three product verticals. Management estimates that these acquisitions foster annual sales growth exceeding 10%, generate over $3 billion in annualized revenue, and sustain an adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) margin of 20%.

Boasting a robust cash return on invested capital (ROIC) of 30% across the last five years, Motorola’s management excels at extracting cash from the debt and equity employed to fund acquisitions. Historical evidence suggests that serial acquirers like Motorola adept at maintaining… Read More

The Resilience of Motorola Solutions: A Diamond in the Rough for Investors

In the tumultuous world of investments, finding a company with the ability to outpace the market is akin to discovering a diamond in the rough. Motorola Solutions (MSI) stands out as a testament to this phenomenon, consistently demonstrating a strong tendency to surpass market expectations, much like a skilled archer hitting the bullseye.

Unveiling a Premium Business at a Fair Price

Motorola Solutions emerges as a beacon of promise for prospective investors, boasting a stellar history in acquisitions, robust cash generation, and a dominant foothold in its specialized sectors. However, the discerning eye of the market has not overlooked these feats, leading to the company trading at a multiple of 31 times its Free Cash Flow (FCF).

A critical evaluation unveils that despite Motorola’s dividend yield hitting a decade-low, a streak of 13 consecutive years of increased payouts underlines its strength. Has the ship sailed for potential investors? Absolutely not.

While the current yield hovers around 1%, the company’s quarterly dividend payments have grown fourfold since 2011, culminating in an impressive 11% annual dividend growth rate. Remarkably, only 28% of Motorola’s FCF is utilized to sustain these dividends, suggesting ample room for further escalation in the future, especially with the company’s unwavering sales foundation.

Imagine a scenario where investors had acquired Motorola shares a decade ago; they would now enjoy a 7% yield compared to their initial investment. Secondly, propelled by a management ethos centered around innovation, propelled by Research and Development (R&D) and Mergers and Acquisitions (M&A), and the projection of a 7% sales upturn in 2024, Motorola appears poised for sustained, steady growth akin to a sturdy oak tree weathering the seasons.

While caution is warranted given the current premium valuation, Motorola Solutions epitomizes a quintessential example of a premium dividend-growth stock available at an equitable price, making it an ideal candidate for methodical, phased investments.

Is Motorola Solutions Worth a $1,000 Investment Now?

Prior to diving into Motorola Solutions’ stock, it is prudent to consider that the Motley Fool Stock Advisor team has spotlighted what they believe to be the top 10 stocks for immediate acquisition, with Motorola Solutions not making the coveted list. These selected 10 stocks are tipped to yield substantial returns in the forthcoming years.

Reflect on the standout example of Nvidia, which gained entry into this elite club back on April 15, 2005. Investors who heeded the recommendation then would be reveling in a staggering return of $657,306 on a $1,000 investment!* Such feats underscore the prowess of the Stock Advisor, with its comprehensive support structure for investors, including portfolio-building guidance, regular analyst updates, and two fresh stock picks each month. Since 2002, the Stock Advisor service has eclipsed the returns of the S&P 500 fourfold.*

Is it time to explore the possibilities further? Dive into the top 10 stocks now!

*Stock Advisor returns as of July 29, 2024