The Bitter Reality of Apple’s Stagnant Growth

Apple, a company that has held a firm grip on the hearts (and wallets) of consumers, is facing a turbulent period as its growth trajectory stutters. The tech giant, known for its high-end electronic products, is feeling the pinch of demand fluctuations exacerbated by inflationary pressures.

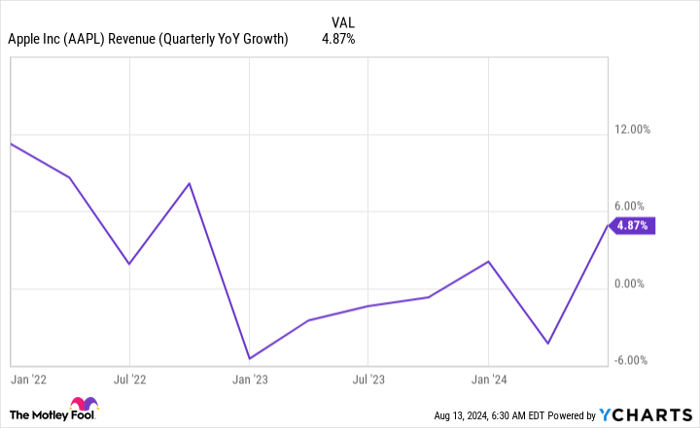

Recent data reflects a concerning trend for Apple, with the company struggling to deliver robust revenue expansions. While a flicker of hope remains with a slight year-over-year revenue increase in the latest quarter, sales of its flagship iPhone have shown a decline from the previous year.

Amidst this gloom, Apple’s saving grace has been its services division, encompassing revenue streams from advertising, the App Store, and subscription-based offerings like Apple TV and Apple Music. This segment, marked by a more stable income flow, has shielded Apple from the harsh realities of its hardware sales volatility.

Crunching the Numbers: Apple’s Weak Financial Performance

In the world of premium companies, lofty valuations are justified by exceptional performance. Although Apple has enjoyed premium status in the market, a closer inspection reveals chinks in its armor. Lackluster revenue growth coupled with tepid earnings expansion paints a concerning picture for the tech giant.

With Apple teetering on the edge of lackluster results for nearly three years, investors are left questioning the justifiability of its premium valuation. At 32 times forward earnings estimates and 33 times trailing earnings, Apple seems to cling to a valuation reminiscent of its stellar performance back in early 2021.

Investor optimism surrounding Apple Intelligence, an upcoming generative AI feature, underpins hopes for a surge in iPhone upgrades. Yet, this expectation remains uncertain and fails to address the broader narrative of Apple’s underwhelming financial performance.

Comparatively, tech behemoths like Microsoft and Meta Platforms offer compelling investment alternatives. Microsoft, trading at a similar valuation, has consistently demonstrated robust revenue and earnings growth. On the other hand, Meta Platforms boasts impressive growth figures, showcasing a stark disparity in performance compared to Apple.

Seeking Greener Pastures in the Stock Market

Amidst the allure of tech investments, Apple stands out as an overpriced option struggling to match the financial vigor of its counterparts. With superior alternatives available in the market, investors might find more promising avenues for growth and returns.

At its current valuation, the value proposition of Apple seems to falter, prompting investors to explore more lucrative opportunities elsewhere. The tech landscape offers a multitude of choices, and Apple’s subdued performance might just drive investors towards greener pastures.

As the market grapples with uncertainty and shifts in investor sentiment, the evolution of tech stocks will likely dictate where astute investors should allocate their capital for optimal returns.