Tesla(NASDAQ: TSLA) finds itself in the throes of intense competition and weakening demand, a confluence that is striking at the core of its sales profitability. Consequently, Tesla shares languish 43% below their zenith in 2021.

Amid these fierce headwinds, the electric vehicle (EV) titan slashed prices by an average of 25.1% last year, in a bid to counteract these unfavorable trends. Yet, in the first quarter of 2024 – as evidenced by data from Cox Automotive – the industry resorted to further price reductions, piling pressure on Tesla’s bottom line. Indeed, during the second quarter of 2024 alone, Tesla witnessed a wincing 46% year-on-year decline in its earnings per share.

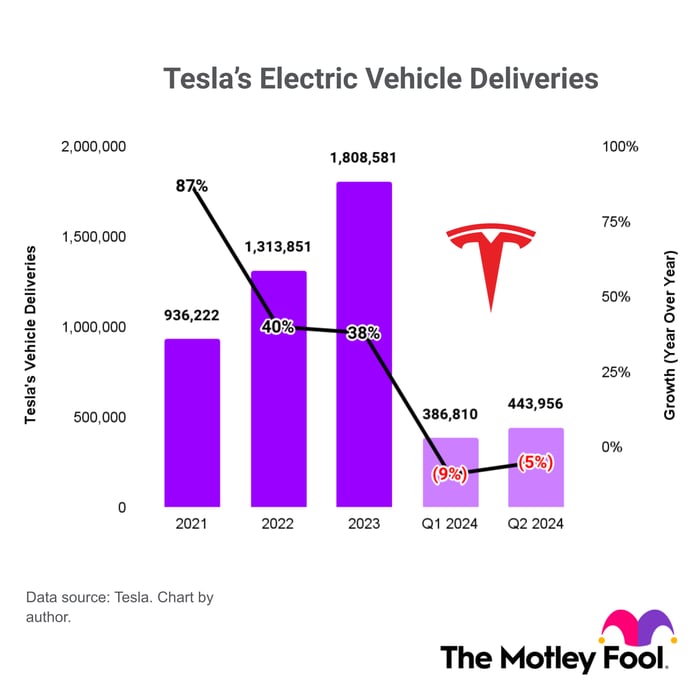

Regrettably, these price cuts failed to meaningfully elevate sales, with Tesla recording deliveries of a record 1.8 million EVs in 2023. However, a growth rate of 38% pointed to a deceleration trend for a second consecutive year. Matters exacerbated in the initial two quarters of 2024 as deliveries shrank compared to the same period a year prior.

Revving up Growth: Tesla’s Strategic Blueprint

In response to these challenges, China-based BYD unveiled an EV priced below $10,000, potentially heralding a foray into the European market – a traditional stronghold for Tesla. To counter, Tesla is gearing up to launch a budget-friendly EV model next year, slated to carry a price tag of just $25,000. While not directly matching the BYD offering on price, Tesla aims to leverage its premium brand image to allure cost-conscious consumers.

Yet, Tesla’s ambit extends far beyond EVs. With groundbreaking strides in autonomous self-driving software, a futuristic humanoid robot, and a burgeoning presence in solar energy and battery storage, Tesla has diversified its revenue streams. While it might be a stretch before these segments outshine the EV business in revenue terms, some analysts are already predicting a meteoric rise in Tesla’s stock value.

Investor Dilemma: The Tesla Conundrum

Contemplating an investment in Tesla? Here’s a dose of reality:

The esteemed analyst team of Motley Fool Stock Advisor recently unveiled what they deem as the 10 best stocks for investors at present, with Tesla conspicuously missing from the illustrious list. These selected stocks hold the promise of delivering stellar returns over the forthcoming years.

Consider the precedent set by Nvidia on April 15, 2005 – an investment of $1,000 then would have ballooned to a jaw-dropping $669,193* following the advisory. The Stock Advisor service unfolds a lucid pathway to success for investors, imparting tailored guidance on portfolio construction, periodic updates from seasoned analysts, and two fresh stock recommendations monthly. Since 2002, this service has eclipsed the returns of the S&P 500 by more than fourfold*.

*Stock Advisor returns as of July 29, 2024

Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends BYD Company and Tesla. The Motley Fool has a disclosure policy.