Revolutionizing E-Commerce Unnoticed

As the landscape of e-commerce evolves, an obscure powerhouse emerges on the scene. Global-e Online facilitates cross-border commerce effortlessly for business-to-business platforms, offering a myriad of international services for retailers to expand their reach. With an interface that streamlines localized currencies, instant customs calculations, and diverse shipping options, Global-e simplifies international shipping for retailers on a global scale.

Its impressive client roster includes renowned brands like Heydude by Crocs and Donna Karan in the U.S., as well as Antler and SoHo Home in the U.K., demonstrating robust revenue growth. Global-e soared with a 32% increase in Gross Merchandise Volume (GMV) and a 24% surge in revenue in the first quarter of 2024. Partnerships with industry titans like Adidas and Coty further solidify its growth trajectory.

Innovative Partnerships and Promising Forecast

Global-e’s partnership with e-commerce giants Shopify and Wix.com cements its position as a key player in the industry. Anticipating an upsurge in the second half of the year, management projects accelerated growth with promising large-scale partnerships and the integration of Shopify Market Pro. The company’s optimistic outlook underscores a robust pipeline of new clients and anticipates heightened momentum in revenue, GMV, and EBITDA throughout the year.

Weighing the Risks Against the Rewards

While Global-e continues to edge closer to profitability, challenges loom on the horizon. Despite notable improvements in financial metrics, the company is yet to achieve GAAP profitability. The encumbrance of amortized expenses from warrants issued to Shopify tempers its current financial standing. External factors such as inflation and potential economic downturns pose additional risks, albeit mitigated by its focus on upscale clientele.

An Opportunity Too Good to Pass Up

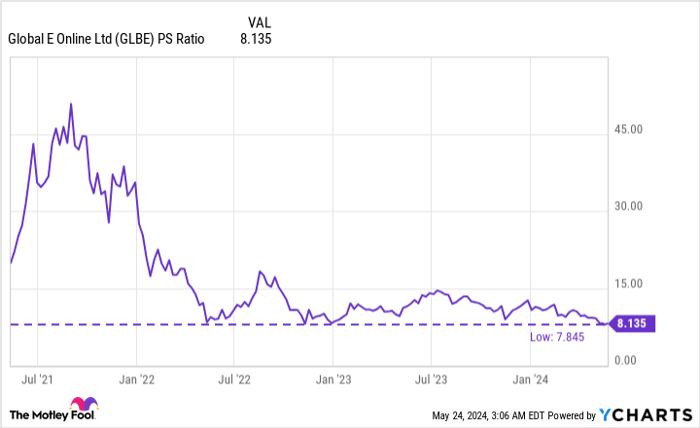

Trading at historically low price-to-sales ratio, Global-e stock presents an enticing investment proposition. The confluence of high-growth potential and undervaluation underscores a prime opportunity for investors to capitalize on the ascent of Global-e stock.

Conclusion

As Global-e charts a trajectory of sustainable growth and operational excellence, investors find themselves at the nexus of an investment opportunity not to be missed. The convergence of innovative technologies, strategic partnerships, and a burgeoning e-commerce landscape propels Global-e into the realm of indispensable e-commerce facilitators. While risks loom on the periphery, the vast potential and favorable valuation of Global-e stock make it a standout contender in the realm of growth investments.