The Vanguard Information Technology ETF (NYSEMKT: VGT) returned a staggering 1,500% over the past 15 years, experiencing an impressive annual growth rate of 20.3%. An investment of $400 per month in this ETF would have grown to over $350,000 today.

These exceptional gains were fueled in part by artificial intelligence (AI) giants Nvidia (NASDAQ: NVDA) and Broadcom (NASDAQ: AVGO), which saw extraordinary growth of 50,130% and 14,510%, respectively, during this decade and a half.

Recent stock splits by Nvidia and Broadcom have reset their share prices, but these chipmakers continue to showcase promising growth prospects along with other AI stocks.

The Evolution of AI in the Tech Sector

Analysts at UBS believe that AI represents a monumental innovation and one of the most significant investment opportunities in history, underscoring the Vanguard Information Technology ETF as a compelling choice for investors seeking growth.

The Vanguard ETF and its Dominance in the Tech Sector

The Vanguard Information Technology ETF tracks the performance of 320 technology stocks categorized into internet services, technology consulting, hardware, semiconductors, and more.

With top holdings like Microsoft, Apple, Nvidia, Broadcom, and Advanced Micro Devices, the ETF positions investors to benefit from the increasing focus on AI technologies in the market.

Leading analysts foresee Microsoft, Apple, Nvidia, Broadcom, and Advanced Micro Devices as significant players poised to profit from the rise in AI adoption among businesses and consumers.

Moreover, the Vanguard ETF boasts a reasonable expense ratio of 0.10%, making it an attractive option compared to similar funds with higher fees.

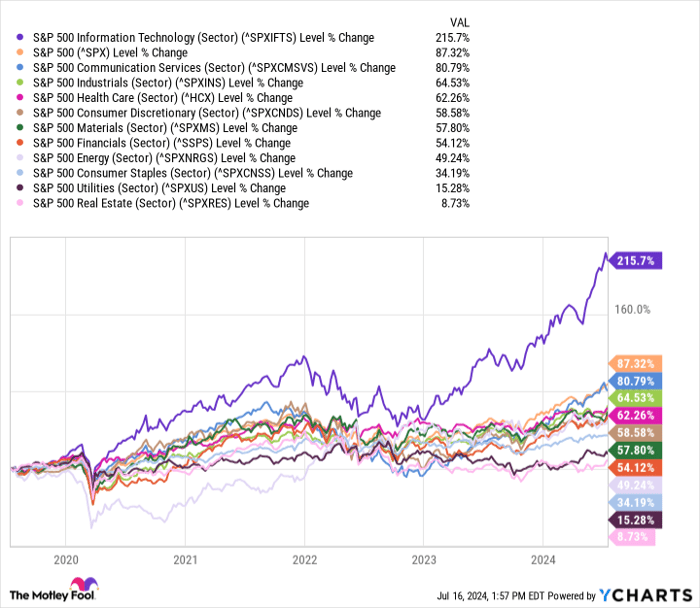

If you are comfortable with some volatility, investing in this Vanguard ETF could be a strategic move, especially considering the potential for AI spending to drive the fund’s growth trajectory above that of the S&P 500.

Unveiling the Stock Market Wizardry: The Rise of Vanguard World Fund – Vanguard Information Technology ETF

A Missed Opportunity

The Motley Fool Stock Advisor analyst team has uncovered a treasure trove of investment opportunities, pinpointing what they predict to be the 10 best stocks for savvy investors. Surprisingly, among the chosen few, the Vanguard World Fund – Vanguard Information Technology ETF did not make the cut. These selected stocks are projected to yield substantial returns over the next few years, potentially rivaling the most legendary investment successes in history.

The Spectacular Journey of Nvidia

Reflecting on the past can often provide valuable insights into the future. A prime example is the inclusion of Nvidia in a similar list back in April 2005. Investors who heeded the advice and allocated $1,000 into Nvidia would now be sitting on a monumental sum of $787,026! This remarkable growth underscores the power of strategic investing and the potential windfalls that can be reaped by making well-informed choices.

The Recipe for Success

The Stock Advisor service acts as a guiding compass for individuals venturing into the complex world of investment. It offers a clear roadmap to prosperity, including expert advice on constructing a robust portfolio, regular insights from seasoned analysts, and two fresh stock recommendations every month. The sensational success story of the Stock Advisor service speaks for itself – outperforming the S&P 500 by an astonishing margin, having quadrupled its return since its inception in 2002.

Seize the Moment

Opportunities in the stock market are fleeting and often disguised. As the investment landscape continues to evolve, it becomes increasingly crucial for investors to stay ahead of the curve and identify the hidden gems that have the potential to redefine their financial future. The world of investment beckons with promises of exponential growth and unparalleled wealth creation – offerings that can only be realized through strategic decision-making and a keen understanding of market dynamics.