For investors seeking diamonds in the rough, scouring the market for underappreciated stocks priced under $10 can be akin to uncovering hidden treasures in a vast sea of rocks.

ADT: Safety, Security, and Steady Growth

ADT, a stalwart in the realms of security and smart home solutions, stands ready to deliver substantial rewards to investors who recognize its enduring value.

The company’s strategic expansion efforts and reliable revenue streams position it as a beacon of hope in the unpredictable waters of the stock market.

Global Business Travel Group: Navigating the Path to Profitability

Global Business Travel Group, a prominent player in the travel management space, represents a compelling opportunity for investors looking to capitalize on the resurgence of corporate travel.

With a sharp focus on innovation and efficiency, the company is poised to ride the wave of economic recovery towards increased market share and profitability.

GoodRx Holdings: Prescription for Success

GoodRx Holdings, an innovative platform addressing the burgeoning issue of rising healthcare costs, offers a prescription for prosperity to investors who appreciate its potential for growth.

With a unique approach to cost-saving in healthcare and a foray into telehealth services, GoodRx is well-positioned to carve out a lucrative niche in the evolving landscape of the healthcare industry.

Rush Street Interactive: Betting on the Future

Rush Street Interactive, a trailblazer in the realm of online gaming and sports betting, presents a tantalizing opportunity for investors seeking to ride the wave of digital entertainment.

With a focus on customer experience and strategic partnerships, the company is primed to seize a larger share of the growing online gaming market, paving the way for substantial revenue growth.

Alignment Healthcare: Caring for the Future

Alignment Healthcare, a provider of innovative healthcare solutions tailored to seniors, embodies a beacon of hope for investors seeking to capitalize on the demographic shifts in the healthcare industry.

With a personalized approach to care and a strategic focus on technology, the company is poised to navigate the complexities of the healthcare landscape with finesse, driving long-term growth and profitability.

Ardelyx: Pioneering the Path to Progress

Ardelyx, a pioneering biopharmaceutical company on a quest to develop cutting-edge therapies, represents a frontier of opportunity for investors willing to embrace the uncertainties of the healthcare sector.

With a steadfast dedication to innovation and medical progress, Ardelyx is on a trajectory towards meaningful growth and value creation in the ever-evolving landscape of biopharmaceuticals.

Analyzing Undervalued Stocks with Promising Futures

Ardelyx, a biopharmaceutical company, has been pushing the boundaries of medical innovation, particularly in the realms of kidney and gastrointestinal diseases. The approval and positive market reception of its flagship product, IBSRELA, herald a bright future.

Insights into Ardelyx’s Potential

- Current Price: $5.93

- Fair Value Estimate: $7.32 (+18.5% Upside)

- Market Cap: $1.2 Billion

Ardelyx’s robust pipeline of drug candidates and strategic focus on high-demand therapeutic areas position it as a strong contender for future success. Models from InvestingPro indicate that Ardelyx is currently undervalued, presenting an enticing growth opportunity for investors.

In a similar vein, Real Brokerage, a technology-powered real estate brokerage firm, has been making waves in the real estate industry with its innovative platform and attractive commission structure. The Real Brokerage’s growth trajectory is underpinned by evolving market dynamics, promising to expand its market share further.

Opportunities with Real Brokerage

- Current Price: $5.93

- Fair Value Estimate: $7.15 (+20.5% Upside)

- Market Cap: $1.2 Billion

Meanwhile, National Energy Services Reunited (NESR) has established itself as a top player in the oilfield services domain within the Middle East and North Africa region. Given the rising energy demands and potential uptick in oil prices, NESR’s strategic positioning bodes well for continued growth.

Unlocking Potential with National Energy Services Reunited

- Current Price: $9.00

- Fair Value Estimate: $11.12 (+23.5% Upside)

- Market Cap: $859.6 Million

SelectQuote, a technology-driven insurance platform, has been capitalizing on the shift towards online insurance services. The company’s data-centric approach and extensive network of carriers position SelectQuote favorably in the insurance landscape, setting the stage for substantial growth.

Evaluating SelectQuote’s Prospects

- Current Price: $3.68

- Fair Value Estimate: $5.13 (+39.3% Upside)

- Market Cap: $622.5 Million

Lastly, SIGA Technologies, a pharmaceutical company specializing in infectious diseases, has its sights set on addressing critical medical needs. With the heightened concerns around bioterrorism and infectious outbreaks, SIGA’s innovative solutions and undervaluation present a compelling investment opportunity.

Leveraging Opportunities with SIGA Technologies

- Current Price: $7.72

- Fair Value Estimate: $12.52 (+62.2% Upside)

- Market Cap: $550.9 Million

Diving Deeper into Undervalued Stocks

These undervalued stocks priced under $10 hold significant growth potential driven by strong market trends and robust business models. The AI-powered Fair Value models from InvestingPro spotlight not only the attractive valuations of these stocks but also the promising upside they offer to investors.

For investors seeking high-reward opportunities, these stocks present compelling additions to portfolios, primed to capitalize on favorable market dynamics in the foreseeable future.

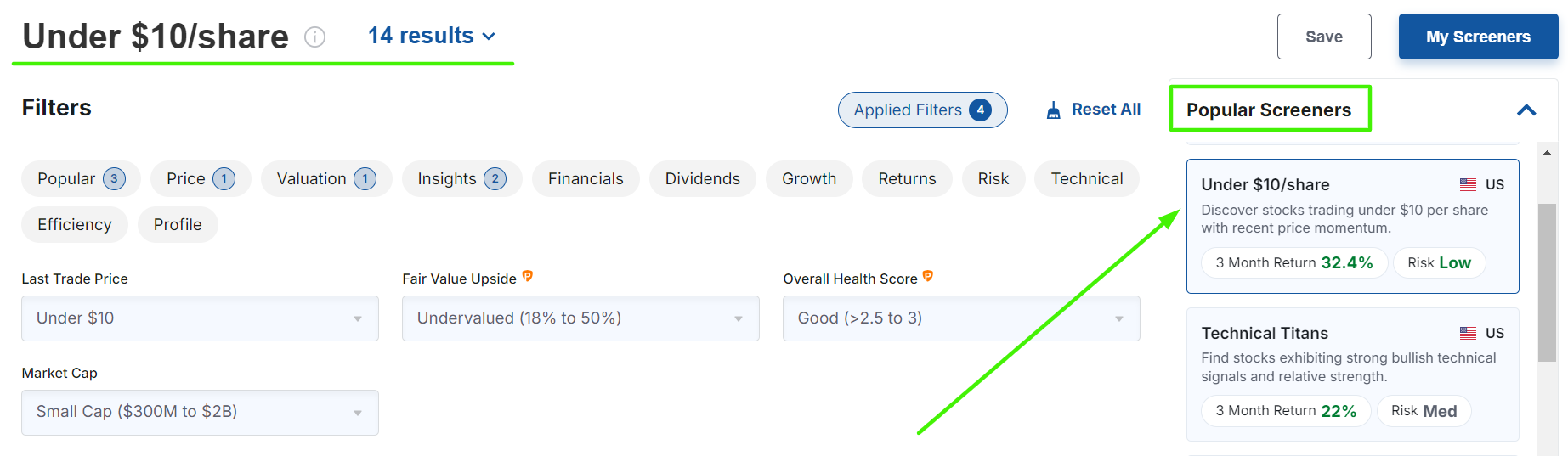

The Investing.com stock screener serves as a valuable tool to pinpoint stocks that meet such criteria, facilitating informed investment decisions.

Embark on Your Investment Journey Today!

The content of this article represents the author’s personal opinion and should not be construed as investment advice.