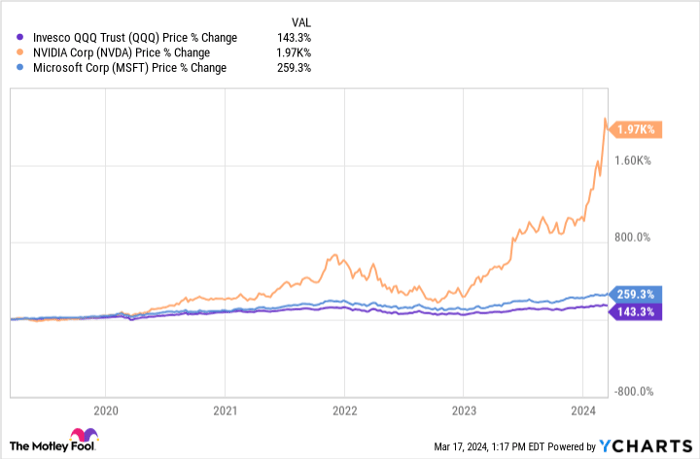

The tech-heavy Nasdaq index recently made new highs, ushering in a new bull market. Even after a couple of weeks, the Invesco QQQ Trust, which tracks the Nasdaq index, is just 2.5% off its new high, having risen 63% since the start of 2023.

The gains are driven by investors clamoring for a piece of the artificial intelligence (AI) boom and by massive gains in stocks like Microsoft and Nvidia.

With these stocks trading at nosebleed valuations and speculative names like SoundHound AI taking flight, many investors believe the market is overvalued, possibly even in a dreaded bubble. If you are wondering how to invest for the long term, one option is to focus on stocks producing tons of free cash flow (FCF), which is the cash left over after operating expenses and equipment have been paid for.

Companies making money this way build value for shareholders. The two below are excellent examples.

Arm Holdings: Innovating the Chip Architecture Landscape

Arm Holdings (NASDAQ: ARM) plays a crucial role in the semiconductor market without manufacturing chips. Arm designs chip architecture, licenses it to tech giants like Nvidia, Amazon, and Apple, and earns royalties for each unit sold. As of the third quarter of fiscal 2024, 280 billion products containing an Arm-designed chip have been sold, with 99% of smartphones housing a central processing unit developed by Arm.

Arm’s reach extends beyond smartphones to the automotive industry, data centers, and the Internet of Things (IoT), encompassing smart appliances, security cameras, and drones.

Various industries employ Arm’s chip designs for electric vehicles, autonomous systems, and advanced driver-assist features such as lane control and collision warnings.

Wall Street celebrated Arm’s third-quarter results, noting a 14% year-over-year sales increase to $824 million. Operating income dipped from $244 million to $134 million due to elevated stock-based compensation from going public. However, cash flow, market share, and backlog stood out.

Arm generated $251 million in FCF, translating to 30 cents of every dollar converted to cash. The company boasted a 51% market share, signaling significant growth. This advancement is critical as Arm’s royalties ensure recurring sales.

The company also revealed a robust remaining performance obligation, hinting at substantial revenue to be realized in the future.

Promising Prospects: Palantir Technologies as an Investment in 2024

The Rise of Palantir Technologies

Palantir Technologies (NYSE: PLTR) has defied expectations over the past year, demonstrating profitability and expanding its presence in the commercial sector. While the company has established a strong foothold among government clients, particularly defense departments, it aims to broaden its reach further.

Challenges regarding profitability have been swiftly addressed, with four consecutive quarters of profitability and a noteworthy uptick in commercial sales: a 20% rise in fiscal 2023 and a notable 32% surge in the fourth quarter. The company’s clientele has significantly increased, signaling promising growth.

Palantir’s innovative software equips clients to analyze data from diverse sources, enhancing operational efficiency and aiding in strategic decision-making. The introduction of its Artificial Intelligence Platform (AIP) caters to both business entities and defense establishments, facilitating informed choices based on data analytics.

Financial Performance and Outlook

Source: Palantir.

The company’s revenue and cash flow exhibit a positive trajectory, with a recurring revenue model suggesting continued growth potential. Palantir’s robust financial position is underlined by a formidable balance sheet boasting $3.7 billion in cash and investments alongside no long-term debt.

Trading at a price-to-sales ratio (P/S) of 24, Palantir’s valuation, although not inexpensive, aligns with that of comparable tech firms such as CrowdStrike (25 P/S) and Cloudflare (24 P/S), positioning it favorably in the market.

Palantir, alongside Arm Holdings, presents an appealing prospect for investors considering long-term commitments, representing compelling options for strategic investment, notably during market downturns.

Stock Evaluation and Investment Considerations

Stock Advisor insights suggest ten stocks primed for substantial returns in the foreseeable future, with Arm Holdings among the notable mentions. The service, renowned for guiding investors with a user-friendly blueprint for success, has consistently outperformed the S&P 500 index since 2002.

Before delving into investing in Arm Holdings, it’s essential to assess the comprehensive analysis provided by Stock Advisor and its strategic advice on portfolio management, coupled with regular updates and expert stock picks.

Investors seeking to capitalize on the potential presented by strategic investments should carefully navigate the landscape and capitalize on promising opportunities such as those offered by Palantir Technologies and Arm Holdings.

*Stock Advisor returns as of March 21, 2024