The realm of artificial intelligence (AI) has emerged as a beacon of hope and opportunity for investors across the spectrum, from seasoned professionals to casual market navigators. The inception of OpenAI’s ChatGPT has indubitably sparked a resurgence in interest in AI, triggering a plethora of tech companies to veer towards this burgeoning market.

As per data from Grand View Research, the AI market soared to nearly $200 billion in 2023 and is anticipated to chart a steadfast growth trajectory with a compound annual growth rate of 37% persisting until at least 2030. This promising ascent could potentially propel the industry to near the $2 trillion mark by the conclusion of this decade.

Advanced Micro Devices: Breaking Ground in AI

Advanced Micro Devices, a prominent chipmaker, positions itself as a formidable player in the AI landscape. Despite lagging behind Nvidia in securing a foothold in AI chips by a whisker last year, AMD is gearing up to disrupt Nvidia’s market dominance and carve out a lucrative niche of its own in the industry.

Last December, AMD unraveled its MI300X AI graphics processing unit (GPU), a strategic move aimed at offering an alternative to Nvidia’s offerings. Noteworthy tech behemoths such as Microsoft and Meta have already hopped on board as clients, underscoring the appeal of AMD’s new chip.

Not content with only snatching market share from Nvidia in GPUs, AMD is fervently bolstering its presence in AI by intensifying its focus on AI-powered PCs. IDC’s research foresees a substantial uptick in PC shipments this year, with AI integration poised to serve as a pivotal catalyst. Furthermore, a Canalys report anticipates that 60% of all PCs dispatched in 2027 will be AI-enabled.

AMD published its fourth-quarter 2023 earnings on Jan. 30, unveiling a 10% year-over-year revenue surge to $6 billion, eclipsing analysts’ projections by approximately $60 million. The company’s AI-centric data center segment witnessed an impressive revenue growth of 38%. Simultaneously, advancements in the PC market propelled AMD’s client segment to a striking 65% year-over-year growth.

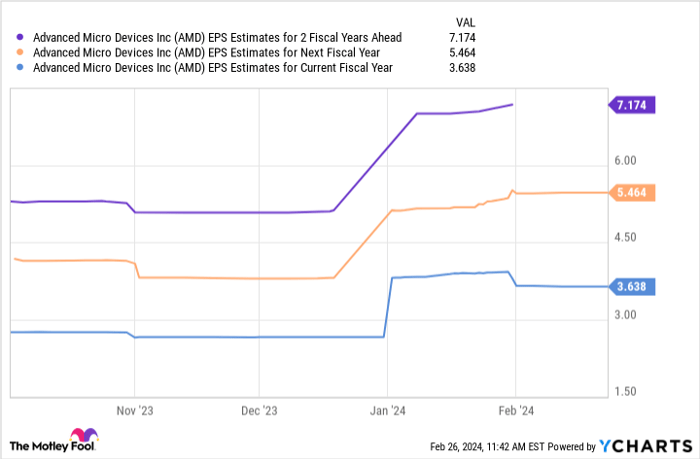

The company’s bullish long-term outlook is mirrored in the earnings per share estimates, underlining a positive trajectory ahead.

Data by YCharts

This chart forecasts AMD’s earnings potentially exceeding $7 per share over the next two fiscal years. Multiplying this figure by the company’s forward price-to-earnings ratio (P/E) of 49 yields a projected stock price of $352. If these projections hold true, AMD’s stock price could witness a twofold increase by fiscal 2026, making AMD a compelling investment opportunity before it skyrockets.

Amazon: Harnessing the Power of AI Software

While AMD shines in the hardware arena of AI, Amazon is swiftly emerging as a formidable player in AI software. With a dominant presence in e-commerce and cloud computing, Amazon boasts multifaceted applications for AI, which stand to augment its business dynamics significantly.

Being the proprietor of the world’s largest cloud platform, Amazon Web Services (AWS) commands a substantial 31% share of the cloud market. The convergence of cloud computing and AI has emerged as a pivotal growth domain for companies like Amazon, leveraging their expansive data centers to steer the generative AI market in their favor.

Since the outset of 2023, Amazon has heeded the escalating demand for AI by expanding AWS. In September, the company introduced Bedrock, a tool furnishing an array of models for customers to construct generative AI applications.

AWS also rolled out CodeWhisperer, a platform facilitating code generation for developers, and HealthScribe, a feature adept at transcribing patient-physician interactions.

In tandem with enhanced cloud capabilities, the integration of AI could amplify Amazon’s e-commerce ambit, enhancing its ability to discern shopping trends and proffer personalized product recommendations to customers. The company has already initiated the integration of this technology on its retail platform, recently unveiling an AI shopping aide dubbed Rufus to elevate the customer experience.

In Amazon’s fourth quarter, revenue soared by 14% year over year to $170 billion, surpassing analyst estimations by a substantial $4 billion. Concurrently, the company witnessed a meteoric 904% surge in free cash flow over the past year, amounting to $32 billion.

Data by YCharts

Amazon stands poised with substantial potential in AI for the long haul, harboring substantial cash reserves to fuel further investments in its enterprise. The illustration above posits that the retail giant’s earnings could ascend close to $7 per share over the subsequent two fiscal years. Employing a akin calculation to that of AMD, the product of multiplying this figure by Amazon’s forward P/E of 42 forecasts a stock price of $294.

Considering its current standing, these estimations portend a 68% surge in Amazon’s stock price by fiscal 2026. Coupled with its commanding presence in AI, Amazon’s stock is an irresistible proposition ripe for exploration.

Investing Allegiance in the Creators of Tomorrow

When our analysts crack the code of a lucrative stock play, yielding octaves of success, prudence behooves a keen ear to their tune. The venerable newsletter, Motley Fool Stock Advisor, with a storied legacy spanning two decades, has consistently overshadowed the market with its acumen.*

They’ve recently disclosed what they deem as the 10 best stocks for investors to seize at this opportune moment… and Advanced Micro Devices made the cut – yet, nine other stocks might be slipping beneath your radar.

*Stock Advisor returns as of February 26, 2024

Beaming with boundless potential, the AI sector beckons investors, inviting them to witness and partake in the creational symphony of tomorrow’s technological landscape.