Visa: A Lucrative Toll-Booth Model

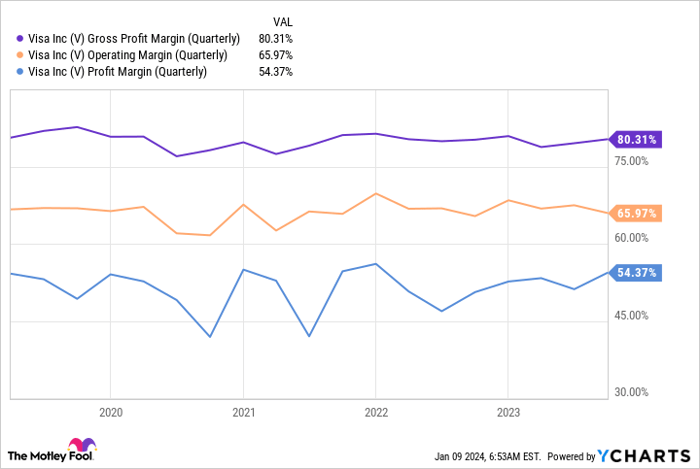

Warren Buffett is renowned for favoring toll-booth-style companies, and Visa (NYSE: V) features a quintessential example of this business model. By establishing an infrastructure and levying fees on transactions passing through it, Visa has recorded exceptional profitability. With the company consistently maintaining high profit margins, its impressive 11% revenue growth in fiscal Q4 2023 signifies an auspicious investment opportunity.

Despite its impeccable business model and robust growth, Visa’s current valuation at 32 times trailing earnings and 27 times forward earnings presents an attractive entry point for long-term investors, especially considering historical valuation levels over the past five years.

Amazon: Propelling Profits under New Leadership

While Berkshire Hathaway’s position in Amazon (NASDAQ: AMZN) has been diminished, the company has experienced a significant transformation under CEO Andy Jassy. Amazon’s emphasis on enhancing profitability has translated into a remarkable 13% revenue surge in the third quarter. This resurgence across multiple facets of its operations positions Amazon as an enticing investment option, notwithstanding Berkshire’s reduced stake in Q3.

Apple: A Shrinking Behemoth

Undoubtedly Berkshire Hathaway’s top holding, Apple (NASDAQ: AAPL) comprised nearly half of its portfolio in late 2023. However, the company’s dwindling revenues throughout fiscal 2023 divulge internal struggles, indicating a disconcerting divergence from its stock performance. Valued at 32 times trailing earnings and 29 times forward earnings, Apple’s steep price tag for a stagnating company dampens its investment appeal compared to the aforementioned companies.

Overall, despite being Berkshire’s favorite, Apple’s present standing does not warrant favorable investment considerations. Thus, investors seeking Berkshire-adjacent stock selections should turn their attention to Visa and Amazon.