Diving into Tech Stock Market Trends

Bulls took the reins of the stock market, propelling the Nasdaq to its first record close since late 2021 following in-line PCE data. The surge in tech stocks hints at the market’s overarching optimism.

While a pullback looms on the horizon, concerns of a tech bubble akin to the Dot-Com era seem unfounded. The current tech landscape portrays companies generating substantial profits and wielding significant cash reserves, positioning them at a considerable advantage.

Tech stocks today trade below their early 2000s valuation levels, indicating potential room for growth. Wall Street’s appetite for bullish investments remains strong, fueled by factors such as corporate earnings growth, anticipated Fed rate adjustments, a stable economic backdrop, and the surge in AI-driven advancements.

High-Tech Behemoths: TSMC

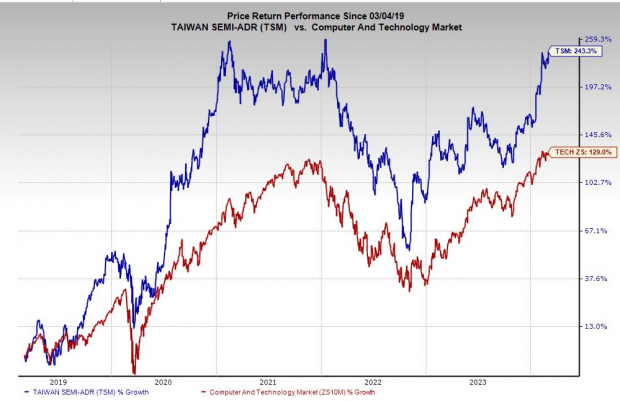

Taiwan Semiconductor Manufacturing Co, revered as TSMC, stands at the forefront of global chip manufacturing, crafting cutting-edge semiconductors driving AI, smartphones, and various advanced technologies, boasting a clientele including Apple and Nvidia.

TSMC’s strategic focus on manufacturing exclusively has fortified its market position, underpinned by extensive expertise and formidable capital requirements to lead in the production of intricate technology.

Having surpassed Q4 EPS estimates and issuing a positive outlook, TSMC is anticipated to witness sales growth of 23% in FY24 and 20% in FY25. The company’s revenue surged by an average of 18% between FY18 and FY22. TSMC’s adjusted earnings are forecasted to rise by 19% and 24% correspondingly.

Netflix’s Entertainment Empire

Netflix revolutionized the entertainment landscape with its expansive content library, outshining competitors like Disney, Apple, and Amazon in the streaming realm. NFLX’s resilient performance over the past year, bolstered by robust fourth-quarter results and expanding subscriber base, underscores its dominance.

Fueled by a burgeoning ad-supported tier and a strategic crackdown on account sharing, Netflix’s foray into video games and live content augurs well for its growth trajectory. The recent decade-long partnership with WWE showcases Netflix’s commitment to diversifying its offerings.

Netflix’s optimistic sales outlook positions it with a Zacks Rank #1 (Strong Buy). Projected sales growth of 15% in FY24 and 12% in the subsequent year is expected to boost adjusted earnings by 42% and 22%, respectively.

Encompassing this dynamic tech landscape are renowned players in the form of TSMC and NFLX, poised for continued success amidst a backdrop of innovation and robust fundamentals. Investors eyeing sustainable growth prospects would be wise to monitor these stalwarts closely.