Investing in popular stocks can often be equated with riding a roller coaster – there are highs and lows, twists and turns. However, amidst the sea of companies, there are two shining stars that stand out not just for their fame but for their quality and potential longevity. These two stocks, Alphabet (NASDAQ: GOOG, NASDAQ: GOOGL) and Netflix (NASDAQ: NFLX), have made a mark on the investing landscape, earning a spot among the top 100 holdings on the well-known investing app, Robinhood. Let’s delve into why these tech giants are not just good investments, but excellent “forever” picks.

Alphabet: The Tech Powerhouse

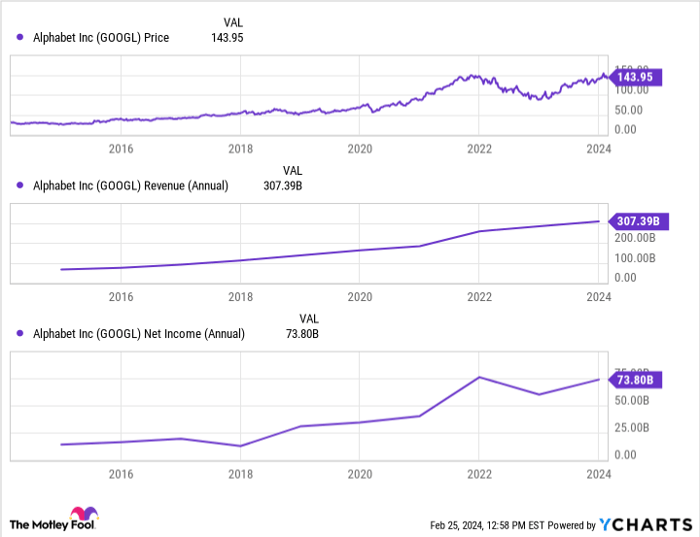

While the roster of Robinhood’s top 100 stocks is ever-changing, one constant in the mix is Alphabet, holding steady at a respectable No. 18 slot. Alphabet, with Google as its flagship entity, boasts leadership in its key industries, a robust competitive edge, and a myriad of growth opportunities. Google’s ubiquitous presence as the world’s go-to search engine exemplifies the company’s prominence, solidifying its position in people’s daily lives. Even Microsoft’s Bing, backed by AI wizardry, couldn’t quite shake Google’s dominance. Alphabet’s prowess extends to video streaming via YouTube and the burgeoning cloud computing domain.

Central to Alphabet’s strength is its moat built on the network effect – the more users, the better the search results, creating a virtuous cycle of improvement driven by data. YouTube and Alphabet’s cloud services also benefit from this dynamic, demonstrating resilient switching costs. Looking ahead, Alphabet’s foray into generative AI adds an exciting layer to its narrative, positioning the company as a major player in a burgeoning industry.

Despite momentary doubts surrounding Alphabet’s AI capabilities in the wake of ChatGPT’s launch, the introduction of Bard (now Gemini) swiftly quashed any concerns, reiterating the company’s deep-rooted expertise in the AI realm. Alphabet’s trajectory points to a promising future, with AI, cloud computing, video streaming, and its enduring Google advertising arm paving the way for sustained growth. In a nutshell, Alphabet’s track record speaks for itself – a stellar performer destined to remain a top-tier investment.

Netflix: Streaming Into Success

Netflix, occupying the 13th spot on Robinhood’s elite list, has proven its mettle time and again, especially with its stellar performance at the onset of the year. A standout move was the introduction of a lower-priced ad-supported tier, driving robust subscription growth and propelling the company to exceed 260 million global paid memberships, marking a notable 12.8% increase year over year.

The platform’s introduction of a crackdown on password sharing and the expansion of ad-supported options have bolstered revenue, reflected in Q4’s impressive $8.8 billion revenue, marking a stellar 12.5% growth compared to the previous year. These strategic initiatives, though nascent, hold significant promise for Netflix’s revenue streams and underscore the platform’s commitment to innovation and profitability.

Netflix’s competitive landscape might be evolving, but its pioneering spirit and robust content development strategy position it strongly in the streaming realm. Despite heightened competition, Netflix’s content library and unique offerings are set to carve a distinct niche in the streaming universe, promising enduring returns for investors. It’s clear – Netflix is a stock worth holding onto for the long haul.

Disclaimer: Stock investing involves risks and fluctuations. Before making any investment decisions, it is crucial to conduct thorough research and seek professional advice tailored to your financial objectives and risk tolerance.