In a financial nod to the classic Western film “The Magnificent Seven,” Bank of America analyst Michael Hartnett identified a new cadre of Wall Street giants, dubbed the “Magnificent Seven.” Among this commanding consortium are:

- Microsoft (NASDAQ: MSFT)

- Apple (NASDAQ: AAPL)

- Nvidia (NASDAQ: NVDA)

- Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL)

- Amazon (NASDAQ: AMZN)

- Meta Platforms (NASDAQ: META)

- Tesla (NASDAQ: TSLA)

While most are stalwarts in their arenas, two are standout investments currently: Alphabet and Meta Platforms.

Engagement with Generative AI

Both Alphabet and Meta Platforms have delved into artificial intelligence (AI) as a revenue-driving force, with advertising reigning supreme. While AI garners fanfare, advertising yields the bulk of income for both entities.

Alphabet drew a substantial 77% of its revenue from ads in Q1, while Meta Platforms raked in a staggering 98% from the same source. Remarkably, the efficient marriage of AI and adverts cements the allure of these stocks in the market.

Furthermore, these tech giants are leveraging generative AI models internally to boost ad strategies. Meta Platforms empowers advertisers with tools to swiftly churn out varied ad versions while Alphabet facilitates ad campaign creation per its stringent guidelines. The agility in integrating AI innovations underscores strategic supremacy over peers.

Robust Business Growth

In Q1 alone, Alphabet’s ad revenue surged by a notable 13%, propelling it to $61.7 billion, with standout performer YouTube marking a 21% revenue uptick to $8.1 billion. Despite the maturity of its advertising realm, Alphabet’s 13% companywide growth showcases an impressive feat in business evolution.

On the other hand, Meta Platforms outpaced Alphabet with a robust 27% growth in ad revenue during Q1, amounting to $35.6 billion. Global revenue escalation across all regions further solidified Meta’s financial standing.

Analysts prophesy a 13% and 11% revenue growth for Alphabet in the following years, while Meta Platforms is anticipated to witness an 18% and 13% growth trajectory. These bullish forecasts render both stocks enticing investment prospects.

Value Propositions for Investors

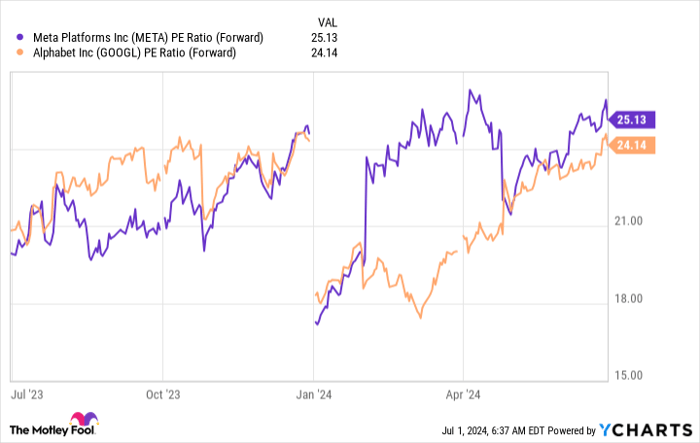

Notably, when scrutinizing the valuation metrics of the “Magnificent Seven,” comprising Microsoft, Nvidia, Amazon, Apple, and Tesla, each bears a hefty price tag. With forward price-to-earnings ratios soaring above 30, investors might rebuff these lofty valuations. In distinct contrast, Alphabet and Meta Platforms bear more modest premiums.

Trading at 24 and 25 times forward earnings, Alphabet and Meta Platforms faintly edge above the market standard of 22.3 (tracked by the S&P 500). Nevertheless, their operational finesse and market eminence validate these slight markups.

Given their stellar performance, projected growth prospects, and reasonable valuations, Alphabet and Meta Platforms emerge as prime contenders amongst the “Magnificent Seven” cohort.

The Path to Alphabet’s Investment Decision

Before plunging into Alphabet’s stock, a crucial deliberation is warranted:

The Motley Fool Stock Advisor analysts have identified 10 premier stocks for investors to explore, unfortunately omitting Alphabet from the roster. Surging potential ripples through the 10 listed stocks, promising substantial returns in the foreseeable future.

Reflect on the monumental success story of Nvidia, which graced the list on April 15, 2005. Those who heeded the advice would have seen a minute $1,000 investment balloon into a staggering $786,046!* Unlocking a treasure trove of investment insights, the Stock Advisor service arms investors with a lucid blueprint for success and showers them with bi-monthly stock recommendations. Since 2002, the service has capitalised by leaps and bounds on the S&P 500 return.*

*Stock Advisor returns as of July 2, 2024