Embracing the AI Frenzy: A Potential Goldmine

With the year 2023 marking the onset of a sweeping fascination with artificial intelligence (AI), the investment landscape has been abuzz. Projections by Precedence Research indicate a promising trajectory for the AI market, slated to grow at a compelling compounded annual rate of 19% from 2023 to 2032 – potentially hitting a staggering $2.6 trillion. The allure of AI has captivated various industries, paving the way for unprecedented growth.

While industry giants like Nvidia (NVDA), Amazon (AMZN), and Microsoft (MSFT) dominate the AI sector, smaller players such as SoundHound AI (SOUN) are positioned to seize significant opportunities.

SoundHound AI: A Symphony of Success

SoundHound AI’s stock has soared by a remarkable 211% in a mere two months into the year, vastly overshadowing the S&P 500 Index’s modest 7.9% uptick. This meteoric rise was catalyzed by chip titan Nvidia’s expressed interest in the up-and-coming AI company, coupled with SoundHound AI’s robust Q4 2023 performance unveiled on Feb. 29.

Despite the undeniable appeal of AI stocks, embracing diversification through growth stocks across different sectors can fortify a portfolio in the long haul. Kosmos Energy (KOS), priced at around $6 per share, emerges as a promising growth stock with robust prospects in the energy domain, as evidenced by its recent stellar fourth-quarter results.

The SoundHound Symphony: Unveiling Potential

Valued at $1.8 billion by market capitalization, SoundHound AI stands out as a premier voice AI solution provider, empowering businesses to deliver top-notch conversational experiences to their clientele. The company’s resilient AI solutions continue to bolster its foundational strength.

In a significant disclosure on Feb. 14, Nvidia outlined a lucrative $3.7 million investment in SoundHound AI through its 13F filing. Nvidia’s entrenched supremacy in the AI realm piqued investor interest, fueling the stock’s dramatic surge.

Harmonious Growth Trajectory

SoundHound AI’s revenue in the latest fourth quarter witnessed an impressive 80% year-on-year upsurge, reaching $17.1 million. Notably, the company ended the quarter with doubled cumulative subscriptions and bookings backlog, amounting to $661 million from the corresponding quarter in the prior year.

Although SoundHound AI is yet to achieve profitability, concerted efforts are underway to curtail its GAAP net losses – recording $0.07 in Q4, a marked decrease from the $0.15 in the previous-year quarter.

Looking ahead, management exhibits a bullish outlook, anticipating a revenue of roughly $70 million in 2024. The company aims to attain positive adjusted EBITDA by 2025, with revenue potentially surpassing $100 million.

In the backdrop of the company’s 2023 product launches – including innovative offerings such as Smart Answering, Employee Assist for restaurants, and SoundHound Chat AI for Automotive – SoundHound AI’s growth trajectory appears promising, setting the stage for future profitability. SoundHound AI boasts a substantial $95.3 million in cash and cash equivalents at quarter-end.

Investor Caution Amidst Opportunities

Analysts foresee a robust 49% year-on-year revenue growth to $69.3 million for SoundHound AI in 2024, with a narrowing of losses to $0.25 per share from $0.40 in 2023. While SoundHound AI’s long-term potential shines brightly, investors are advised to exercise caution given the company’s current unprofitable status.

The Unsinkable SoundHound and the Resilient Kosmos Energy

The Melodic SoundHound Symphony

SoundHound is currently riding a wave of optimism in the stock market, but the numbers tell a different story. Priced at a significant 27 times projected sales for 2024, the company appears to be reaching for the high notes without a clear tune.

A Crescendo of Analyst Ratings

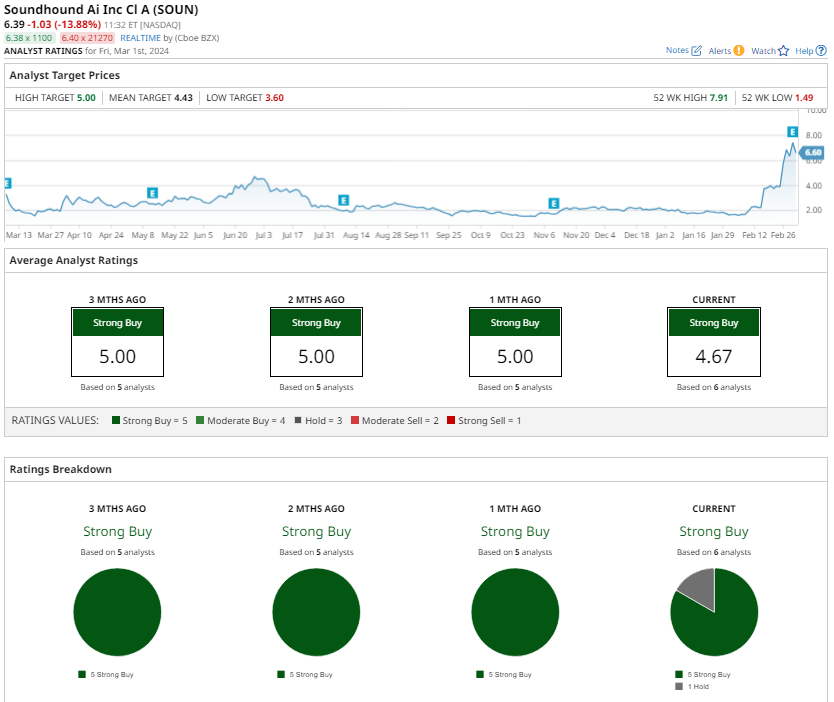

Their soaring stock price has led to enthusiastic ratings from analysts, with five out of six considering it a “strong buy.” Despite surpassing the average price target of $4.43 and the high target of $5, investors must exercise caution when treading these turbulent penny stock waters.

The Kosmos Energy Odyssey

Kosmos Energy, a stalwart in the oil and gas sector since its inception in 2003, has weathered its fair share of storms. Operating in energy-rich regions like West Africa, the Gulf of Mexico, and the Atlantic Margin, the company’s diverse portfolio acts as a sturdy ship in choppy seas.

While the stock has dipped by 6% year-to-date, Wall Street anticipates a substantial 45% upturn by year’s end. This projection paints a picture of resilience and adaptability in the face of market volatility.

The Financial Performance Sustenance

In its most recent quarterly report, Kosmos Energy showcased a 12% year-on-year increase in production, reaching 66,000 barrels of oil equivalent per day. Despite a slight revenue decline to $508 million, the company managed to turn a profit of $0.04 per share, a stark improvement from the previous year.

Chairman and CEO Andrew G. Inglis expressed confidence in the company’s trajectory, emphasizing the forthcoming growth opportunities and cash flow generation. With a strategic focus on new projects and operational enhancements, Kosmos is set to navigate the tides of change with finesse.

Forecasting Smooth Sailing Ahead

Looking towards the horizon, Kosmos Energy stands poised to capitalize on the transforming energy landscape. Analysts predict a double-digit revenue increase to $1.9 billion in 2024, alongside a significant 28.5% rise in adjusted earnings. The company’s prudent financial positioning and steady growth projections bode well for future success.

Trading at an attractive five times forward earnings, Kosmos symbolizes a beacon of hope in the energy sector, positioned for substantial expansion in the years to come.

Crystal Ball Predictions for Kosmos

The stock analysts have placed their bets, with six out of seven voting in favor of Kosmos as a “strong buy,” highlighting a clear consensus on the stock’s potential. With an average price target of $9.14 and a lofty high target of $10, the future looks bright for investors eyeing healthy returns.