Consumer Confidence Drives Cruise Industry Revival

Once in the doldrums due to the pandemic’s stranglehold on travel, the cruise industry is catching favorable trade winds again. After a prolonged spell of doom and gloom, cruise liners are set for a revival. Consumers, basking in rekindled confidence and economic buoyancy, are flocking back to book cruises, signaling a promising resurgence for the industry.

Strong Performance of Top-notch Players

Two of the prime beneficiaries of this revival are Royal Caribbean Cruises Ltd. (RCL) and Carnival Corporation & plc (CCL). Both companies, currently holding a Zacks Rank #2 (Buy), have been capitalizing on the surge in bookings and are poised for further growth in the months ahead.

Royal Caribbean Cruises’ Soaring Outlook

Despite the choppy waters of the pandemic, Royal Caribbean Cruises Ltd. managed to steer its way to an impressive financial performance. With a net income of $278 million in the fourth quarter and a whopping 28% increase in revenues, the cruise operator is on a trajectory pointing north. The company is anticipating a substantial improvement in net income as well as robust earnings per share for the first quarter.

Carnival’s Strong Positioning

On the other hand, Carnival Corporation & plc is witnessing a robust surge in travel bookings, reflecting consumers’ increased inclination to spend on leisure activities. With a predicted adjusted EBITDA of over $5.6 billion for 2024 and a remarkable 41% surge in revenues in the fourth quarter, Carnival is forging ahead with confidence.

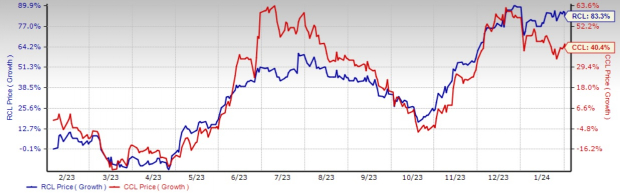

Stock Performance Comparison

In the stock market arena, both Royal Caribbean Cruises and Carnival have notched remarkable gains, outperforming renowned tech behemoths such as NVIDIA Corporation and Microsoft Corporation. This underscores the impressive rally of cruise stocks, with Royal Caribbean Cruises and Carnival posting gains of 83.3% and 40.4%, respectively, over the past year.

Image Source: Zacks Investment Research