The Dow Jones Industrial Average, consisting of 30 blue-chip stocks known for their robustness, kicked off the year on a positive note, despite a challenging April, maintaining a modest gain in 2024. However, tech giants Apple Inc. and Intel Corporation have languished among the underperformers.

Despite this, Morgan Stanley analysts are urging investors to seize the opportunity to invest in these Dow stocks, predicting transformative boosts from breakthroughs in artificial intelligence (AI) for both companies.

Rebirth of Apple Inc.

Apple Inc., based in California, is renowned for its iconic iPhone and boasts a market cap exceeding $2.6 trillion. The company’s diverse product lineup includes cutting-edge technology such as smartphones, personal computers, wearables, and accessories.

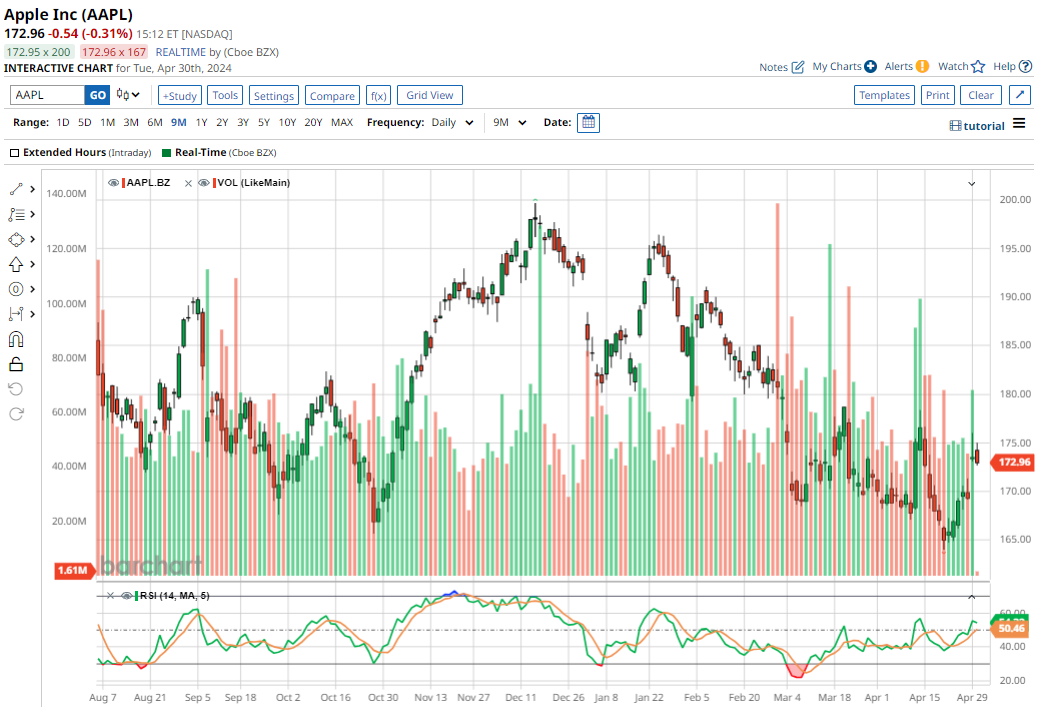

Apple’s stock has dipped by 9.9% year-to-date, trailing the Dow’s 0.9% rise during the same period.

The company remains dedicated to delivering value to shareholders, returning approximately $27 billion during Q1 and offering an annualized dividend of $0.96, yielding 0.55%.

In terms of valuation, the stock trades at 25.98 times forward earnings and 6.82 times sales, comparable to peers like Alphabet (GOOG).

Despite facing regulatory challenges and stricter sales regulations affecting iPhone sales in China, resulting in an initial downturn in 2024, Apple’s Q1 performance displayed remarkable resilience.

After four quarters of revenue declines, Apple reported a total net sales figure of $119.6 billion in Q1, exceeding Wall Street projections. The company’s EPS of $2.18 rose by 16% annually, beating analyst estimates by 4.3%.

Analysts forecast Apple’s profits to reach $6.54 per share in fiscal 2024, a 6.7% increase year-over-year, with further growth to $7.10 in fiscal 2025.

The company is set to release its Q2 earnings results shortly, anticipated on May 2, providing further clarity on its financial performance.

Additionally, Apple’s shares enjoyed a substantial 2.5% surge on April 29 after receiving an upgrade from Bernstein, attaining its most significant one-day percentage gain in over two weeks, fueled by advancements in generative AI technology.

Analysts have bestowed Apple stock with a consensus “Moderate Buy” rating, with price targets ranging from an 18.3% to a significant 44.4% upside potential.

Rise of Intel Corporation

Intel Corporation, headquartered in Santa Clara, is a global leader in designing, manufacturing, and selling computing products, with a market cap exceeding $132.6 billion. The company offers a wide array of products, including CPUs, SoCs, GPUs, and semiconductor products.

Intel’s stock has tumbled by 38.8% year-to-date, significantly trailing the Dow during the same period.

Intel declared a dividend of $0.125 per share for fiscal Q2, providing an annualized dividend of $0.50, yielding 1.59%.

Trading at 2.49 times sales, Intel’s valuation is below its five-year average and industry peer Taiwan Semiconductor.

Following its Q1 earnings report, Intel’s shares leaped by approximately 1.8%, with results exceeding Wall Street estimates. The company’s loss per share narrowed to $0.09, while adjusted earnings stood at 18 cents per share. Net revenue climbed by 8.5% year-over-year to $12.7 billion, slightly missing analyst expectations.

Intel’s CEO, Pat Gelsinger, expressed confidence in plans to reclaim process leadership in the upcoming year, focusing on accelerating AI solutions and maintaining commitment to execution and shareholder value creation.

For fiscal Q2, Intel anticipates revenue between $12.5 billion and $13.5 billion, with non-GAAP EPS and non-GAAP gross margin projected at $0.10 and 43.5%, respectively. Analysts foresee a profit surge of 57.9% to $0.60 per share in fiscal 2024, increasing further to $1.31 in fiscal 2025.

Despite Morgan Stanley’s optimistic outlook, Intel stock maintains a consensus “Hold” rating, with price targets hinting at a potential 40% to a substantial 121.7% upside from current price levels.