Following a period of strong growth, artificial intelligence (AI) stocks experienced a slowdown in March, prompting questions about the future of the sector. However, recent corrections are likely to be short-term, offering a new lens for investors seeking opportunities.

Nvidia’s Promising Outlook Amidst Market Volatility

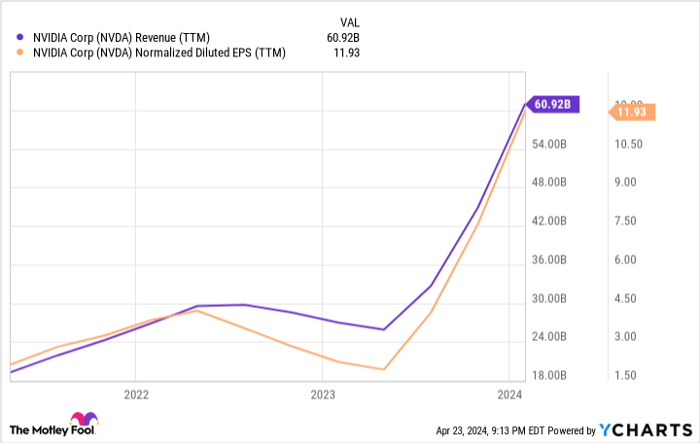

Justin Pope (Nvidia): Nvidia (NASDAQ: NVDA) emerges as a compelling pick in light of recent market fluctuations. Despite its impressive gains, Nvidia’s growth trajectory seems poised for longevity, underlined by its dominance in the AI chip segment.

Analyzing historical data suggests that Nvidia controls a substantial portion of the AI chip market, a key driver for its sustained growth. With AI set to revolutionize various industries, Nvidia stands to benefit from the expected surge in demand for computing power over the next decade.

Analysts predict a robust annualized earnings growth rate of 35% for Nvidia in the coming years, signaling a favorable valuation for the stock. Investors are advised to focus on the broader outlook, appreciating Nvidia’s potential as a long-term growth asset.

Microsoft’s Strategic AI Investments Reinforcing Market Position

Jake Lerch (Microsoft): Microsoft (NASDAQ: MSFT) presents an attractive opportunity following a minor dip in recent weeks, leveraging its early strategic forays into artificial intelligence to bolster its competitive edge.

Amid intensifying competition in cloud computing, Microsoft Azure’s accelerated growth compared to Amazon Web Services (AWS) signifies a shifting landscape. Microsoft’s integration of AI tools into its suite, such as Copilot, sets it apart from competitors.

Microsoft’s diversified business portfolio spanning gaming and advertising mitigates investment risks, offering stability beyond AI advancements. With ambitious revenue goals set for 2030, Microsoft’s proven track record under visionary leadership makes it a compelling investment choice.

Tesla’s Potential Upsurge Amid Market Skepticism

Will Healy (Tesla): Despite prevailing negative sentiment, Tesla (NASDAQ: TSLA) emerges as a strong candidate for investors aiming to capitalize on market uncertainties.

Amidst recent volatility, Investor interest in AI stocks remains unwavering, with Nvidia, Microsoft, and Tesla standing out as resilient options. Each company’s unique market positioning and growth potential make them attractive considerations for investors navigating the evolving AI landscape.

Tesla’s Rocky Road: A Robotaxi Redemption?

An electric vehicle (EV) company has faced a tumultuous journey, shedding nearly half of its value since the prior autumn. With a market cap plummeting by over 60% from its peak in 2021, Tesla stands battered amid challenges such as subdued EV sales growth, a hiccup with the Cybertruck, and uncertainties surrounding its planned affordable vehicle.

The Financial Landscape

In the first quarter, Tesla’s financials mirrored the prevailing pessimism witnessed in the market. Revenue saw a year-over-year decline of 9%, amounting to $21 billion. Operating expenses climbed, leading to a 55% plunge in quarterly net income to $1.1 billion.

AI: A Beacon of Hope

Despite the gloom, Tesla is banking on artificial intelligence (AI) to steer its fortunes. Set to unveil its robotaxi on August 8, Tesla’s recent enhancements to its full self-driving software and a price slash from $200 to $99 per month could reignite confidence in the upcoming robotaxi venture.

Ark Invest’s Rosy Prediction

Cathie Wood and her Ark Invest team have pinned a 2027 price target of $2,000 per share on Tesla, implying a potential twelve-fold appreciation from its current valuation. Wood’s track record includes forecasting Tesla’s rise from $23 to an equivalent of $267 in 2018, a milestone achieved in 2021 before facing a setback.

Navigating the Future Terrain

Tesla’s stock saw a resurgence following news of its plans to start producing a budget-friendly vehicle in the latter part of 2025. This development hints at a possible turnaround for Tesla, amid a growing appetite for economical EVs and a broadening customer base for robotaxis, heralding promising prospects for the company.

In Retrospect

Tesla’s road to redemption might lie in the synergy of AI innovation, disruptive business models, and evolving consumer preferences. With resurgence on the horizon and optimistic forecasts bolstering investor confidence, the narrative for Tesla may see a promising twist in the chapters to come.