Exploring Salesforce’s AI Evolution

The winds of May bring a promise of new beginnings, and for investors seeking a haven in the realm of artificial intelligence, Salesforce stands tall amidst the digital storm. Born from the fires of enterprise software, Salesforce (NYSE: CRM) has painted a masterpiece of resilience on the canvas of market fluctuation.

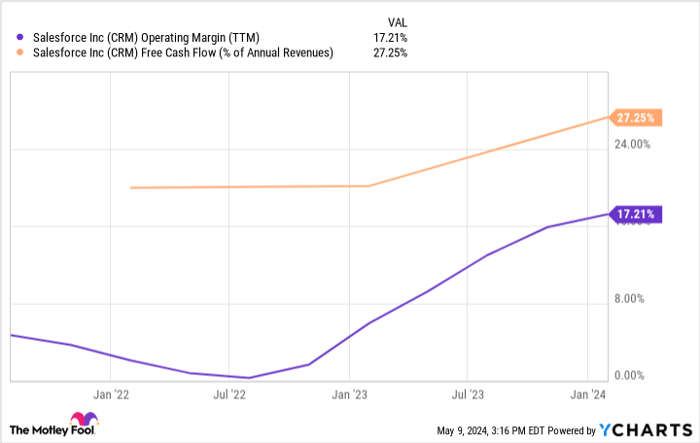

Guided by the hand of innovation, Salesforce has chiseled its way to greater heights, enhancing its operating margins and unfurling the sail of free cash flow generation. As the company steers towards its first-quarter earnings, the stage is set for a grand unveiling of its prowess.

Known for its stellar Customer Relationship Management (CRM) services, Salesforce has orchestrated a symphony of success through a web of innovation and strategic acquisitions. The company’s latest creation, Einstein AI, stands as a testament to its commitment to achieving excellence.

Trading at a premium with a forward price-to-earnings (P/E) ratio of 28, Salesforce has captured the attention of analysts predicting an annual 17% earnings growth trajectory in the coming years. With a strategic share repurchase plan in motion, the company’s future shines bright like a beacon in the night, offering investors a steady harbor at a reasonable entry point.

Unraveling the Elegance of UiPath in AI Automation

When whispers of AI replacing humans echo through the valleys, UiPath emerges as the hand guiding the algorithmic orchestra of robotic process automation (RPA). Specializing in software-based prowess over silver-screen robots, UiPath (NYSE: PATH) dances to the rhythm of efficiency in mundane computer tasks.

Anointed by corporate giants, UiPath’s RPA magic unfolds, promising a utopia free from the shackles of human errors. With over 11,000 customers mesmerized by its charm, UiPath’s net revenue retention rate shines as a beacon of customer satisfaction.

Witnessing exponential growth, UiPath’s revenue stream dances like a river flowing freely, nourishing the grounds for robust bottom-line profits. Analysts casting their gaze upon UiPath foretell a 22% annual earnings ascent over the forthcoming years, offering investors a glimpse of potential sunshine at a forward P/E of 34.

The Marvel of Super Micro Computer in the AI Galaxy

Amidst the cosmic realms of AI, Super Micro Computer (NASDAQ: SMCI) emerges as a celestial phenomenon, offering turnkey server systems for the AI era. The stock’s journey has been nothing short of a rollercoaster, soaring to the skies and diving deep into the abyss. But amidst the chaos, the fundamentals stand tall.

Blessed with an exponential growth spurt, Super Micro Computer rides the AI waves to triple-digit revenue increments, basking in the glow of industry-defying customer preferences. As the company’s story unfolds, the tale of 52% annual earnings growth whispers through the starlit night, beckoning investors towards a treasure trove of opportunities at a modest forward P/E of 35.

Remember, dear investors, in the fickle world of stocks, volatility is but a companion on the winding road to greatness. Embrace the winds of change, for within them lie the seeds of tomorrow’s prosperity.

The Wild Ride of Super Micro Computer Stock

Recently, the stock of Super Micro Computer took a nosedive, crashing 17%. This sudden plummet had investors on their toes, questioning the future trajectory of this volatile stock. Analysts cautioned against premature moves, advising a slow and vigilant approach to prevent getting entangled in the market uproar. Despite the turbulent dip, the stock still holds promise for investors with a keen eye for value-focused growth.

Reflections on Investing in Salesforce

If pondering an investment in Salesforce, it’s crucial to weigh the stakes. The renowned Motley Fool Stock Advisor analyst team highlighted a collection of the best-performing stocks, excluding Salesforce. However, the selected top 10 stocks are projected to yield substantial returns in the foreseeable future.

Looking back in time, when Nvidia made it to a similar list on April 15, 2005, an investment of $1,000 could have flourished to an astonishing $550,688. The Stock Advisor platform acts as a beacon for investors, offering a comprehensive roadmap to prosperity through portfolio construction, regular analyst updates, and bimonthly stock recommendations. Noteworthy is its track record of outperforming the S&P 500 index by more than fourfold since 2002.

*Stock Advisor returns as of May 13, 2024