The realm of semiconductors stands as a beacon of innovation, shining light upon the investment landscape. The artificial intelligence (AI) megalith has swept markets with its grandeur, extending a golden hand to investors and igniting wealth creation avenues. As the AI market shows no signs of relinquishing its throne, projections reflect a continued ascendancy in the years to come.

An indispensable aspect of the AI sphere is the semiconductor chips, akin to the trusted “picks and shovels” of the AI realm. These chips serve as the cornerstone, the very engine block propelling the domain’s functionality, bestowing the prerequisite processing power and efficiency. Envisioned to expand at a compound annual growth rate (CAGR) of 14.9% from 2024 to 2032, the global semiconductor arena is set to burgeon into an astounding $2.06 trillion titan.

The Broadcom Brilliance

Founded in 1991 within the throes of San Jose, Broadcom (AVGO) emerges as a luminary amidst the semiconductor constellation. With a colossal market capitalization of $806.8 billion, Broadcom orchestrates the design, development, and dissemination of an extensive array of analog and digital integrated circuits alongside supplementary products. Notably, they craft software for data center networking.

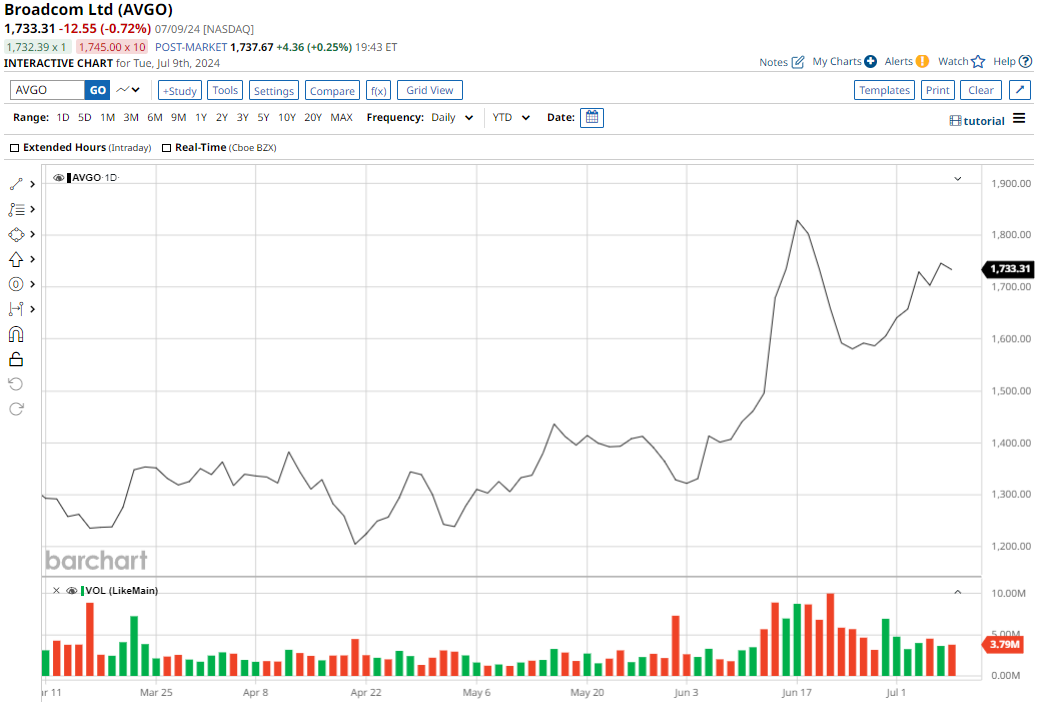

AVGO shares glimmer with a 56.3% ascent on a year-to-date (YTD) basis, entwined with a dividend yield of 1.21%, flaunting 14 years of perpetual growth. A moderation-friendly payout ratio of 46.73% hints at ample leeway for future dividend expansions and invigorating forays into novel ventures.

The twilight of the latest quarter illuminated Broadcom’s laudable performance, surpassing estimates with both revenue and earnings. The fiscal second quarter witnessed revenues scaling to $12.49 billion, ushering in a 43% annual upsurge. Adjusted earnings per share (EPS) surged by 6.2% year-on-year to $10.96, eclipsing the consensus estimate of $10.85. Noteworthy is the streak of Broadcom’s EPS eclipsing predictions in each of the last five quarters.

Broadcom’s narrative of the past decade paints a portrait of revenue and EPS expansions at a CAGR of 31.33% and 32.65%, respectively. The company’s triumphant march is set to persist, fueled by its dominion over the AI expanse. Sales of AI-related chips soared by 280% year-over-year to $3.1 billion in the last quarter, claiming 25% of revenue.

The Microchip Mosaic

Taking root in 1989, Microchip Technology (MCHP) blossoms within the semiconductor sphere, boasting prowess as a premier microcontroller supplier. The company engineers, manufactures, and vends embedded control solutions spanning diverse domains like automotive, industrial, consumer, aerospace and defense, and communications. MCHP’s dominion commands a market cap of $49.5 billion.

MCHP shares radiate a 6.4% rise on a YTD basis, accompanied by a dividend yield of 1.96%. MCHP’s consistent dividend increments over the past 21 years, coupled with a modest 35.6% payout ratio, set the stage for expansive growth trajectories. In a testament to its dedication to shareholders, Microchip embarked on a monumental journey, repurchasing a record $387 million of stock and disbursing a record $242 million in dividends in the recently concluded fiscal fourth quarter of 2024.

On the closing notes of the fiscal fourth quarter, Microchip stumbled upon a conundrum, grappling with a “major inventory correction.” Net sales ebbed by 40.6% from the prior year to $1.33 billion, while adjusted EPS plummeted by 65.2% to $0.57, encapsulating the fiscal tumult beset by the company.

Analyzing the Resilience of Semiconductor Giants

The Microchip Narrative

In the tumultuous world of semiconductor stocks, a standout player with a resilient history is Microchip. Over the past five quarters, Microchip has consistently surpassed revenue and EPS forecasts, providing a glimmer of hope for investors in these uncertain times of inventory shortages and economic instability.

Despite a recent dip in cash flow from operations and free cash flow, marked by a more than one-third decrease in Q4, Microchip managed to enhance its free cash flow margin to 29.4%. While long-term debt levels remained static at $5 billion, the company’s proactive management, including substantial cost-saving measures and a significant reduction in capital expenditures, instills confidence in its ability to weather the storm.

The significance of Microchip’s product line and geographically diverse customer base cannot be overstated. With nearly half of its fiscal year 2024 revenue originating from Asia, the company’s foundation remains solid. Implementation of strategic measures to tackle inventory issues, including operational cost reductions and careful capital expenditure planning, indicates a commitment to sustained growth.

The company’s extensive portfolio of microcontrollers, surpassing its closest competitor by over 6,357 products, and recent successful product launches reflect a commitment to innovation and market leadership. An optimistic outlook from analysts, with a consensus rating of “Strong Buy” and a mean target price of $102.09, shines a positive light on Microchip’s future prospects, offering investors a potential 6.4% upside from current levels.

Under the Analog Devices Microscope

In the realm of semiconductor giants, Analog Devices has emerged as a formidable player. Founded in 1991, Analog Devices has navigated the market with agility, leveraging its high-performance semiconductor technology to bridge the physical and digital worlds with finesse.

Despite facing inventory challenges that led to a considerable decline in revenues and EPS in the fiscal second quarter, Analog Devices showcased resilience by outperforming consensus estimates. The company’s solid track record, with revenue and EPS growing at CAGRs of 14.61% and 11.54% over the past decade, underscores its ability to adapt to market fluctuations.

With net cash from operations and free cash flow soaring in Q2, Analog Devices closed the quarter with a comfortable cash balance, signaling financial stability. Encouragingly, the company’s Q3 guidance paints a picture of optimism, projecting the first year-over-year quarterly revenue increase, supported by positive trends across all business segments.

Amidst a landscape of evolving challenges, Analog Devices’ focus on innovation and diversification is evident through its forays into healthcare, industrial automation, and automotive sectors. Analysts have responded favorably to this approach, with a “Strong Buy” rating and a mean target price of $257.97, indicating a potential upside of approximately 8.2% from current levels.