The quarter’s earnings season draws to a close, unleashing a flurry of financial results that have kept market spirits soaring high, dispelling any lingering fears of an earnings calamity. Amidst this period, a trio of companies – Arista Networks, Netflix, and DICK’s Sporting Goods – have dazzled investors, unveiling impressive quarterly sales figures that have set new records.

Arista Networks: Cloud Networking Maestro

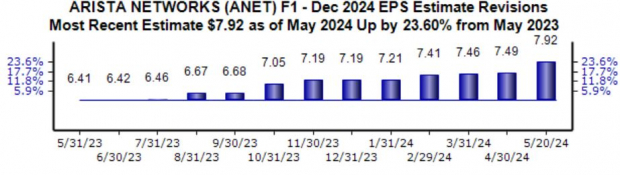

Specializing in cloud networking solutions for data centers and cloud computing environments, Arista Networks emerges as an enticing AI play. Fueled by a Zacks Rank of #1 (Strong Buy), the company’s earnings projections have soared, with a 24% surge to $7.92 per share for the current fiscal year, forecasting a 14% year-over-year climb.

Image Source: Zacks Investment Research

The latest figures reveal ANET’s EPS at $1.99, backed by robust sales of $1.6 billion, marking growth rates of 40% and 16%, respectively. The stock has been sizzling hot, with gains of nearly 30% in the past month.

Netflix: Streaming Sensation

Streaming titan Netflix shook the ground with a 17% blowout in EPS earnings relative to the Zacks Consensus estimate and slightly surpassed consensus sales metrics, boasting growth rates of 83% and 15%, respectively. The company’s robust revenue surge was fueled by a 16% rise in subscribers year-over-year, as its crackdown on password sharing reaps benefits.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Post-release, earnings expectations shot up, securing the enviable Zacks Rank #1 (Strong Buy). The growth trajectory of Netflix remains bright, with forecasts for the current fiscal year predicting a 52% surge in earnings alongside a 15% boost in sales. The stock garners an ‘A’ Growth Style Score.

DICK’s Sporting Goods: Retail Royalty

Powering as a leading omnichannel sporting goods retailer, DICK’S Sporting Goods parades a cornucopia of athletic shoes, apparel, and outdoor gear. The company recently raked in a robust $3.9 billion in sales in its latest reporting period, marking an 8% uptick from the previous year.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

To shareholders’ delight, the company sweetened the pot by increasing its dividend payout by 10% during the earnings release, pushing the quarterly dividend to $1.10 per share. Sporting a yearly yield of 2.3%, DICK’S Sporting Goods outshines the Zacks Retail sector average of 0.9%.

Closing Thoughts

Venturing through the dense underbrush of the Q1 earnings season is invariably a tumultuous journey, yet one laden with silver linings. The stellar performance of tech companies has lifted spirits, with a trio of standout performers – Arista Networks, Netflix, and DICK’s Sporting Goods – achieving record sales, all while basking in the favorable glow of the Zacks Rank.