When stocks reach or approach all-time highs, it signals strong bullish sentiment, with buyers dominating the market. Stocks hitting new highs often continue their upward trajectory, especially when positive earnings forecasts are streaming in.

This scenario perfectly fits the profiles of Duolingo DUOL, SharkNinja SN, and DaVita DVA, all boasting a favorable Zacks Rank and currently trading near their 52-week highs.

SharkNinja Excels in Growth

SharkNinja, a Zacks Rank #1 (Strong Buy), is a diversified product design and technology company known for creating lifestyle solutions for consumers. The company’s outlook has turned bullish across the board post their robust quarterly results.

During the latest earnings, SN delivered 34% EPS Growth on a 31% sales surge, marking the fifth consecutive quarter of double-digit year-over-year sales growth.

Forecasts continue to show promising growth, with an estimated 31% increase in EPS and 21% rise in sales for the current fiscal year. Looking further ahead to FY25, expectations hint at a 14% bump in EPS alongside a 9% sales augmentation.

DaVita’s Compelling Valuation

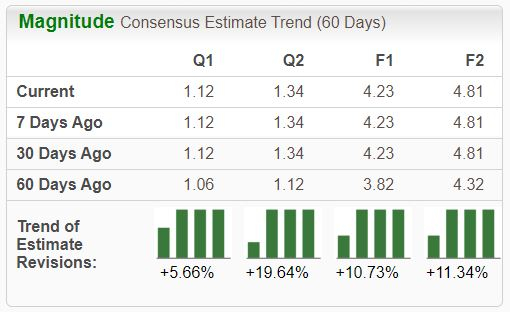

DaVita, a premier provider of dialysis services in the U.S., particularly for patients with chronic kidney failure, is presently a Zacks Rank #1 (Strong Buy). Earnings expectations have been on the rise across all time frames.

The valuation for DVA appears attractive, with a forward 12-month earnings multiple of 14.0X, in line with historical levels. Additionally, the PEG ratio at 0.8X signifies a value play relative to the anticipated growth.

A PEG ratio below 1.0 suggests a balance of growth and value, indicating a potentially favorable investment. The stock is also recognized with a Style Score of ‘A’ for Value.

Duolingo’s Promising Growth Projections

Duolingo, a Zacks Rank #1 (Strong Buy), offers a mobile language learning platform. The company’s growth outlook is robust, with estimates projecting a 430% surge in EPS and a 40% increase in sales for the current fiscal year.

Historically, Duolingo has displayed strong growth, recording double-digit year-over-year sales growth for the past ten quarters.

Bottom Line

Stocks hitting new highs often continue their ascent, especially when positive earnings forecasts are prevalent. This trend has been observed in Duolingo DUOL, SharkNinja SN, and DaVita DVA, with each holding a favorable Zacks Rank and trading near their 52-week highs.

Infrastructure Stock Boom to Sweep America

A substantial effort to revamp the deteriorating U.S. infrastructure is imminent. It’s a bipartisan, urgent, and inevitable movement. Trillions will be invested, paving the way for potential fortunes to be made.

The key question remains – “Will you seize the opportunity early by investing in the right stocks poised for significant growth?”

Zacks has introduced a Special Report to guide investors in identifying the top companies set to benefit from the extensive infrastructure developments ahead.