Ever heard the phrase “cash is king”? Well, when it comes to companies that produce robust cash flows, they hold the scepter. Strong cash flows signal stability and enable a company to pay down debts, harness growth opportunities, and reward shareholders with hefty dividends. They also stand resilient in the face of economic downturns, making them choice picks for investors with a long-term perspective.

Broadcom: The Cash Carnival

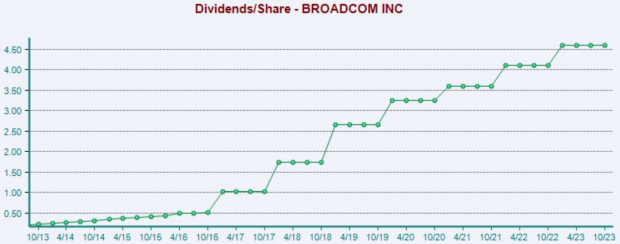

Leading the pack is Broadcom, a heavyweight player in the semiconductor industry. With a commendable 13.7% five-year annualized dividend growth rate, AVGO shares currently boast a solid 1.9% annual yield, surpassing the Zacks Computer and Technology sector average of 0.7%. The company’s energy is steered by its remarkable ability to churn out cash, generating a whopping $16.3 billion in free cash flow in the fiscal year 2022, marking a 22% uptick from the previous year.

Microsoft: The Tech Titan’s Treasure Trove

Another standout name in the cash-making realm is Microsoft. The company has recorded buoyant growth, with its $59.5 billion in free cash flow in FY23 and an equally impressive $63.3 billion in the trailing twelve-month period. With a 10% five-year annualized dividend growth rate and a respectable 0.8% annual yield, MSFT stands tall in the tech sector, showcasing prowess in enriching shareholders’ pockets.

Visa: The Cash Crusader

Visa is no stranger to the cash game, having racked up approximately $17.9 billion in free cash flow in FY22, a notable 23% surge from the preceding fiscal year. The financial juggernaut has further amplified its cash-generating abilities, producing an impressive $19.7 billion over the last twelve months. With favorable earnings estimate revisions and a $9.89 Zacks Consensus EPS Estimate suggesting 12.7% year-over-year growth for the current fiscal year, V is painting a pretty picture for potential investors.

The Power of Cash

Companies boasting robust cash flows are a haven for investors. They have the financial muscle to bolster growth, wax lyrical with dividends, and effortlessly clear their debts. And let’s not forget their ability to navigate economic storms with unfaltering resilience, painting the investment landscape in bright hues. Clearly, Broadcom AVGO, Microsoft MSFT, and Visa V tick all the right boxes for those seeking cash-generating companies.