Positive Signals in the Finance Sector

As we delve into the financial realm, the Zacks Finance sector reveals promising data. Companies like JPMorgan (JPM), Citigroup (C), alongside other industry giants, have flexed their financial muscle by surpassing quarterly earnings expectations in 73% of cases. With JPMorgan and Citigroup leading the charge, the sector is abuzz with optimism.

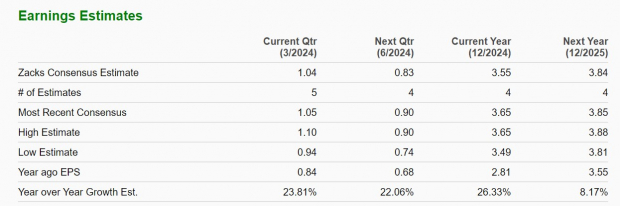

Brown & Brown: A Look into the Numbers

Let’s focus our magnifying glass on Brown & Brown, a company offering an array of insurance services that has caught the eye of investors. Projections indicate a 24% jump in Q1 EPS to $1.04 compared to last year, with sales expected to climb 8% to $1.21 billion. Looking further ahead, fiscal 2024 is forecasted to witness a 26% surge in annual earnings to $3.55 per share, with subsequent years not lacking growth prospects.

Image Source: Zacks Investment Research

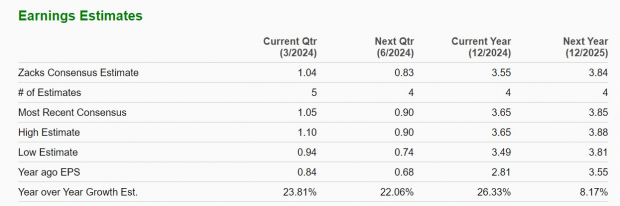

Equity Lifestyle Properties: A Property Worth Watching

Turning our gaze towards Equity Lifestyle Properties, a real estate investment trust managing a portfolio of home sales and rental operations, we find steady progress. Q1 earnings are poised to grow by 4% to $0.77 a share, with sales projected to increase by 5% to $389.49 million. With a focus on dividend growth, the company has upped its payout consistently, making it an attractive prospect for income-focused investors.

Image Source: Zacks Investment Research

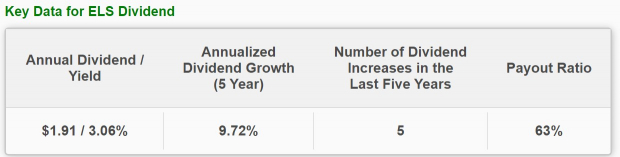

Globe Life: Illuminating the Insurance Sector

Lastly, Globe Life, an insurance holding company, paints an encouraging picture. Predictions signal a 10% rise in Q1 EPS to $2.80 per share, with sales also on the upward trajectory. In the subsequent years, Globe Life anticipates further earnings growth, coupled with an appealing dividend yield and an undervalued status, making it a compelling option for discerning investors.

Image Source: Zacks Investment Research

Final Thoughts: A Glimpse into the Future

With Brown & Brown, Equity Lifestyle Properties, and Globe Life showcasing sturdy growth in the first quarter, these finance stocks stand out in the crowd. Holding a Zacks Rank #2 (Buy), these companies have the potential to soar even higher as they reveal their favorable outlooks next week.