The Backbone of the Economy

Financial transactions, the lifeblood of the economy, weave a complex tapestry connecting individuals, businesses, and institutions. From the inception of currency to the intricate web of digital transactions today, the realm of financial services stands as a constant amidst the winds of change.

A Bright Outlook for Investors

In the ever-evolving landscape of financial markets, the Zacks Financial Transaction Services Industry emerges as a beacon of promise. Currently soaring in the top 19% of Zacks industries, this sector offers a fertile ground for investors seeking growth and stability in their portfolios.

MoneyLion: The Rising Star

MoneyLion, a digital financial platform, symbolizes the resilience and adaptability of modern financial services. With its recent foray into the public market, MoneyLion has captured investors’ attention, showcasing a remarkable +37% increase in its stock value year to date. Projections of profitability in fiscal 2024 paint a picture of burgeoning success, underlining the company’s potential for exponential growth.

RB Global: Driving Innovation

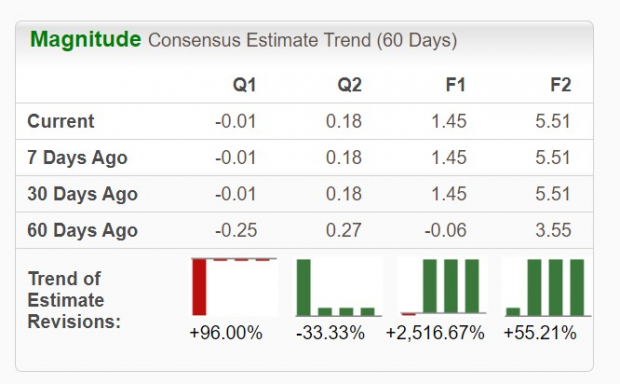

RB Global, operating as an omnichannel marketplace, exemplifies innovation in the financial transaction realm. With a steadfast commitment to providing value-added services, the company has seen an impressive +18% spike in its stock value this year. Projections of earnings and sales growth further solidify RB Global’s position as a compelling investment choice.

Western Union: A Beacon of Value

Western Union, with its longstanding legacy in the financial services domain, stands out as a beacon of value amidst market fluctuations. Offering a generous dividend yield of 7.42%, the company’s stock presents a unique opportunity for value investors. With strategic operational improvements and projections of earnings growth, Western Union remains a stalwart choice for investors seeking stability and consistent returns.

A Promising Horizon

Collectively, MoneyLion, RB Global, and Western Union represent not just companies, but pillars of strength in the financial transaction services sector. The positive trajectory of earnings estimate revisions underscores their potential to outperform the market, highlighting them as prudent investments for the discerning investor eyeing the long-term horizon of 2024 and beyond.