In the vast sea of market turbulence, investors may feel like sailors lost at sea during a storm, yet the wise ones know that the market, much like the tides, ebbs and flows. Amidst the chaos, there are anchors of stability – companies with a steadfast commitment to dividends that weather the fiercest of financial storms, offering investors a safe harbor in uncertain times. Let’s set sail and explore three such stalwart vessels in the choppy seas of the stock market.

A Legacy of Endurance

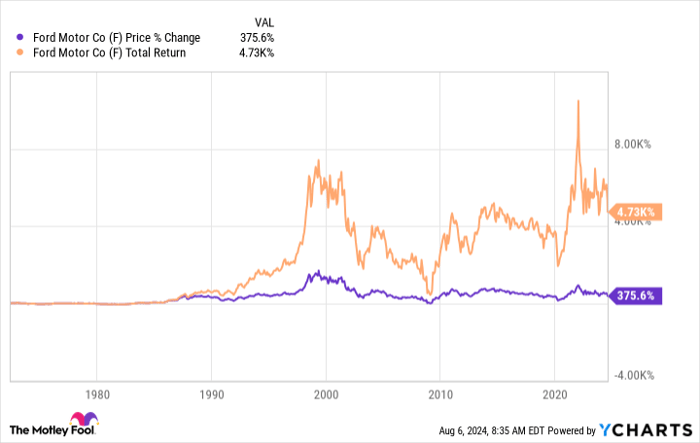

Diving into the automotive waters, we encounter the storied Ford Motor Company (NYSE: F), a name as familiar to investors as the hum of a well-oiled engine. Despite battling headwinds in China, quality control concerns, and electric vehicle losses, Ford’s resilience shines through. Like a sturdy pick-up truck navigating through rough terrain, Ford boasts a robust balance sheet, with ample cash flow from its core products. The Ford family’s unwavering commitment to dividends is the stuff of legend, rewarding shareholders with a lush 6.1% yield at recent prices.

With $27 billion in cash and $45 billion in liquidity, Ford is well-positioned to weather the storm. The company’s pledge to funnel 40% to 50% of its free cash flow back to its investors instills confidence. Unlike its peers, Ford’s laser focus on dividends, driven by the Ford family’s legacy, remains unwavering. Buckle up and set your sights on the horizon as you ride the waves of Ford’s dividend story.

Embracing the Winds of Change

Amidst the swirling clouds of change, Altria Group (NYSE: MO) stands tall as a beacon of resilience in the evolving landscape of tobacco alternatives. Pivot to smokeless substitutes? Altria is already ahead of the curve, offering adult smokers a range of e-vapor, heated tobacco, and oral tobacco products. While the transition from traditional cigarettes may be a daunting journey, Altria’s dividend payout remains reassuring, with a robust 7.9% yield at recent times.

Despite the shifting tides of consumer preferences, Altria’s dividends remain a steadfast lighthouse in the fog of economic uncertainty. With a track record of paying out $6.8 billion in dividends last year, Altria showcases its commitment to shareholder value. So, while the smoke clears on the tobacco industry’s evolution, investors can rely on Altria’s dividends as a steady anchor in the storm.

The Pillar of Health

Turning our gaze to the healthcare horizon, we spot Johnson & Johnson (NYSE: JNJ), a stalwart titan with a legacy etched in time. With over 60 years of dividend increases and a 3% forward yield, Johnson & Johnson is a tried-and-true dividend champion. Nestled in the healthcare ecosystem, the company’s diverse product portfolio and commitment to growth paint a picture of enduring strength.

Despite the looming shadow of legal battles, Johnson & Johnson’s focus on shareholder returns remains unwavering. By returning over 60% of its free cash flow to investors through dividends and buybacks, the company solidifies its commitment to long-term value creation. So, while uncertainties loom on the legal front, Johnson & Johnson’s dividends stand as a beacon of stability amidst the storm.

Navigating the Seas of Investment

In the tempest of market fluctuations, these three companies stand as beacons of stability, guiding investors through turbulent waters with the promise of dividends as sturdy life rafts. Ford, Altria Group, and Johnson & Johnson symbolize the enduring spirit of dividend investing, offering a lifeline of passive income in the churning seas of economic volatility. So, batten down the hatches, dear investors, and set your course towards the horizon of long-term prosperity.