Chasing opportunities amidst record-breaking Wall Street highs can feel like navigating a bustling marketplace. While some stocks may seem overpriced, the savviest investors know that hidden gems still exist. In the ever-evolving stock market tapestry, there are still treasures waiting to be unearthed.

Following a diligent hunt, three standout tech stocks have emerged as prime candidates for outperforming the market in the upcoming year: SentinelOne (NYSE: S), Netflix (NASDAQ: NFLX), and Sea Limited (NYSE: SE).

Unraveling SentinelOne’s Dominance in 2024 and Beyond

Justin Pope (SentinelOne): Combining the twin pillars of cybersecurity and artificial intelligence (AI), SentinelOne strikes a chord with two red-hot themes on Wall Street. The firm’s autonomous security platform, harnessing the power of AI, offers state-of-the-art defense against cyber threats, earning accolades from industry evaluations.

Recorded a remarkable 33% surge in revenue year-over-year in the second quarter of fiscal 2024, signaling its growth trajectory. Furthermore, the company’s strides towards profitability have instilled bullish confidence among investors, propelling its stock upwards by nearly 40% in the past year.

SentinelOne’s recent collaboration with technology behemoth Lenovo marks a strategic milestone. An analogous partnership with Dell Technologies has seen CrowdStrike rake in over $50 million in added revenue. Similarly, this alliance could drive SentinelOne’s revenue projections to $1 billion for the forthcoming year, painting a rosy picture for the company’s growth narrative.

SentinelOne’s valuation, despite an impressive ascent, remains conservative relative to industry peers like CrowdStrike, Zscaler, and Palo Alto Networks. The arrow still points upwards for SentinelOne, making it a compelling option for investors even amidst its meteoric rise.

The party started in 2024 for SentinelOne, but the stage seems set for a sequel in 2025.

Netflix’s Ascendancy in the Streaming Arena

Jake Lerch (Netflix): With a robust year-to-date surge of over 45%, Netflix stands out as a beacon of success in the current market climate. However, the streaming giant’s future prospects for 2025 seem even more promising.

The streaming landscape witnesses Netflix consolidating its dominance. Nielsen’s data from June reaffirms that streaming video now claims 40% of total TV viewership, leaving traditional cable and broadcast channels in its wake. In this realm, Netflix asserts its supremacy, commanding a notable 8.4% share of streaming, just behind YouTube in the pecking order.

Competitors such as Amazon’s Prime Video, Disney-owned Hulu and Disney+, and Tubi lag behind Netflix, amplifying its market stronghold. Streaming’s ascendance at the expense of traditional TV further solidifies Netflix’s position.

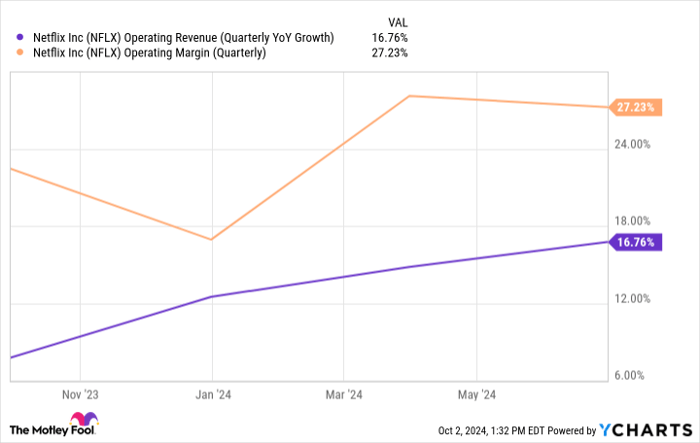

Netflix’s robust financials validate its market leadership. The latest quarterly report ending June 30, 2024, reveals a 17% revenue surge year-over-year and a commendable 27% operating margin growth compared to the previous year. These statistics underscore Netflix’s enduring resilience in the face of challenges.

Surviving intense rivalry and emerging stronger from the streaming wars, Netflix stands primed to harness its momentum. The forthcoming year holds promise as Netflix gears up to expand its ad-tier operations, setting the stage for a potentially stellar 2025.

Insights on Sea Limited: A Dive into Stock Recovery Amidst the Storm

The recovery is well underway in this pandemic stock

Investors looking to navigate the tumultuous waters of the market landscape might find a beacon of hope in the tale of Sea Limited. The Singapore-based conglomerate weathered the storm of the 2022 bear market, only to emerge stronger and more resilient. As the world shut down, Sea Limited’s diverse portfolio of retail, gaming, and fintech offerings attracted a captive audience, leading to a period of prosperity against a backdrop of uncertainty.

The tide seemed to turn as lockdowns lifted and economies cautiously reopened. Challenges emerged, notably with the decline in popularity of its flagship game, ‘Free Fire,’ alongside regulatory hurdles such as the game being banned in India due to security concerns. Additionally, strategic missteps in expansion led to significant setbacks, reflected in a staggering 91% drop in the stock value between late 2021 and early 2024.

Fortunately, the sea began to calm for Sea Limited shareholders as the company initiated strategic shifts. Exiting non-Asian markets, doubling down on logistical infrastructure investments in its core regions, and witnessing a resurgence in the popularity of ‘Free Fire’ brought rays of optimism. The fintech arm, Sea Money, emerged as a bright spot, contributing to a remarkable 23% year-over-year revenue surge, surpassing $7.5 billion in the first half of 2024.

However, amid the optimism, a surge of 73% in sales and marketing expenditure caused a sharp decline in net income. The bulk of this spending was directed towards e-commerce and the growth of Sea Money operations. While this hit to the bottom line might raise concerns, the company’s strategic investments are poised to pave the way for sustained revenue and profit growth in the long run.

Market sentiments have shifted in Sea Limited’s favor, as reflected in the stock’s impressive 115% surge over the past year. Despite the impact of reduced net income on traditional metrics like the P/E ratio, the company’s P/S ratio of 3.8 places it in close proximity to e-commerce giants like Amazon. With the stock still trading 75% below its 2021 peak, investors eye 2025 with hopeful anticipation for significant gains.

Should you invest $1,000 in Sea Limited right now?

Contemplating an investment in Sea Limited invites caution and contemplation. While the recent trajectory shows promise, prudent investors are advised to weigh various factors before diving in headfirst. The tumultuous journey of Sea Limited serves as a testament to resilience and adaptation, offering valuable lessons for those navigating the often tempestuous seas of the stock market.

Reflecting on historical precedents, such as Nvidia’s meteoric rise since its inclusion in elite stock lists, reveals the potential for significant long-term gains. Strategic advisors like Stock Advisor provide a roadmap for navigating the stock market terrain, offering insights, guidance, and curated stock picks to help investors navigate the turbulent waters with confidence.

Focus on the fundamentals, and let the storm subside: stay ahead with Sea Limited.

*Stock Advisor returns as of September 30, 2024