Zacks Thematic Screens provides a gateway into 30 vibrant investment themes that are molding the future. Whether your interests lie in state-of-the-art technology, renewable energy, or healthcare breakthroughs, our thematic approach empowers you to invest in the ideas that resonate with you.

Let’s dive into the ‘Mobile Payments’ theme and delve into a few stocks identified by the screen, including Discover Financial Services (DFS), American Express (AXP), and PayPal (PYPL).

Mobile Payments Theme

The dramatic transition from physical cash to digital transactions, fueled by a quest for convenience and security, has sparked explosive growth in mobile payments.

Mobile payments have revolutionized everyday transactions, from buying lunch and groceries to indulging in high-end products and services.

The theme encapsulates a wide array of innovations, ranging from payment infrastructure and software services to virtual wallets and smart cards.

AXP to Report Quarterly Results

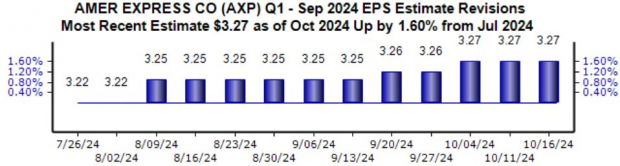

Revisions for AXP’s upcoming quarterly report have been overwhelmingly positive since mid-July, with an anticipated earnings figure of $3.27 per share. While this estimate indicates stagnant year-over-year earnings growth, the prevalent trend of positive revisions stands out as a key highlight.

The company showcased outstanding performance in the last period, achieving an all-time high quarterly revenue of $16.3 billion. A substantial increase in its customer base, with 3.3 million new card acquisitions, along with double-digit growth in fee revenues, underscored notable achievements.

Post-pandemic, AXP’s revenue trajectory has remained impressive, as illustrated in the quarterly chart below.

DFS Posts Strong Results

In its recent release, DFS not only surpassed consensus EPS and sales expectations but also demonstrated growth rates of 70% and 20%, respectively. While the initial market reaction was subdued, subsequent bullish activity ensued in the following trading sessions.

DFS’s shares have climbed to record highs following the release, registering nearly a 40% increase in 2024 and outperforming the S&P 500 by a significant margin.

The company benefitted from modest loan growth during the period, reflecting optimism surrounding the economic outlook. With total loans amounting to $127 billion, a 4% rise from the previous year, and a 10% year-over-year jump in Personal Loans, DFS exhibited favorable trends. Additionally, a slight improvement in credit quality further echoed positive sentiments.

PayPal Raises Guidance

As one of the leading online payment solutions providers and an industry pioneer, PayPal has witnessed a substantial improvement in its outlook, signaling optimism.

Following a resilient performance in 2024, marked by a 30% surge in its shares, PayPal raised its guidance for the year and expanded its share repurchase program. These initiatives triggered a bullish response post-earnings. The increased buybacks could potentially bolster share prices, especially considering the company’s history of aggressive share repurchases in recent years.

The uptrend in positive revisions bodes well for PayPal’s short-term prospects, supported by its current valuation metrics. Trading at a forward 12-month earnings multiple of 16.9X, the stock remains far below its five-year median of 28.5X and significantly lower than its five-year peak of 84.9X.

The PEG ratio, at 1.4X, also positions PayPal favorably compared to historical averages.

Bottom Line

Zacks Thematic Screens present a lens into 30 dynamic investment themes that are shaping the future. Whether you have an affinity for cutting-edge technology, renewable energy, or healthcare breakthroughs, our thematic offerings empower you to invest in ideas that resonate with you.

Upon running the Zacks Mobile Payments Thematic screen, three standout stocks – Discover Financial Services (DFS), American Express (AXP), and PayPal (PYPL) – surfaced.