Alphabet: Leading the AI Race

Google parent company Alphabet, symbolized as NASDAQ: GOOGL, has caught the eye of billionaire investors like Bill Ackman. The surge in public interest towards Artificial Intelligence resulted in a spotlight on companies like OpenAI’s ChatGPT, temporarily overshadowing Alphabet as an AI pioneer.

However, Alphabet quickly responded with Gemini, its generative AI product, showcasing innovation that spans back to 2001 when AI was first introduced to its search engine. Transitioning to an AI-centric organization in 2016, Alphabet continues to drive AI advancements through Google DeepMind, backed up by a substantial $108 billion in liquidity to maintain its competitive edge.

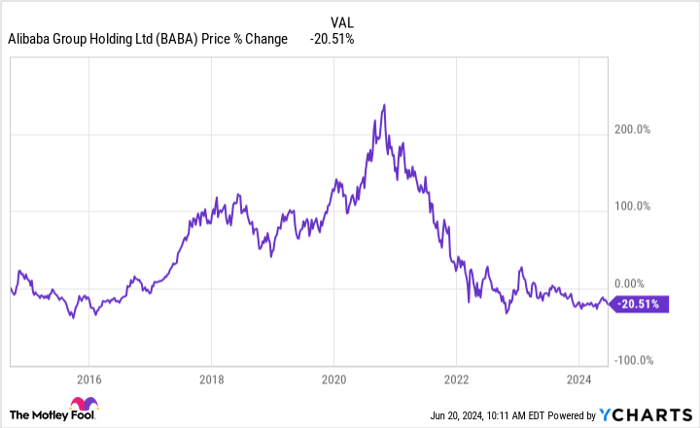

Alibaba: Weathering Political Storms

The e-commerce giant Alibaba, identified by the symbol NYSE: BABA, attracted the attention of billionaire David Tepper’s Appaloosa Management. Despite facing turbulence due to political challenges, Alibaba, an American Depositary Receipt, has sustained impressive revenue growth over the years.

While uncertainties persist due to US-China relations, Alibaba’s robust financial performance is undeniable, boasting substantial revenue growth and a low Price-to-Earnings ratio of 17, making it a lucrative buy for investors willing to overlook political fluctuations.

Snowflake: Warren Buffett’s Unexpected Bet

Snowflake, with the symbol NYSE: SNOW, surprised many with Warren Buffett’s Berkshire Hathaway diving into the data cloud market. Despite initial skepticism towards IPO investments, Snowflake’s innovative data management solutions have garnered significant attention, even from competitors like Amazon.

Although Snowflake faced challenges with a slowdown in earnings and changes in leadership, its robust business model, evidenced by a remarkable net retention rate of 128%, makes it an intriguing option for investors. Additionally, at a record low Price-to-Sales ratio of 14, buying into Snowflake during moments of adversity could prove rewarding as its data cloud services gain further traction.

Should you invest in Alphabet right now?

Before diving into Alphabet stock, consider insights from the Motley Fool Stock Advisor team who highlighted the 10 best stocks poised for substantial returns, with Alphabet missing the cut. Operating as a blueprint for investing success since 2002, Stock Advisor has significantly outperformed the S&P 500.

Reflecting back to Nvidia’s inclusion on the list in 2005, where a $1,000 investment would now be valued at $723,729, emphasizes the potential gains from well-informed investment decisions.

With experts providing ongoing guidance, Stock Advisor members receive timely stock recommendations, empowering them to navigate the market efficiently and capitalize on lucrative opportunities.