Earnings season presents a fascinating peek behind the corporate curtain, unveiling the successes and struggles of companies in the market arena.

The entrance of the big banks initiates a phase of heightened activity, with several other firms gearing up to disclose their financial health.

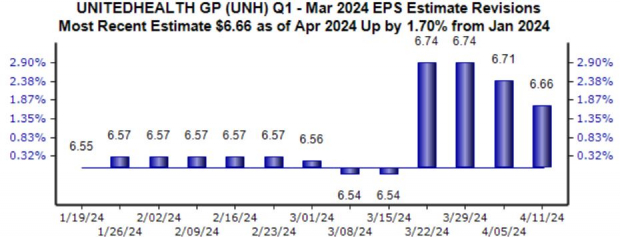

UnitedHealth Group (UNH)

Specializing in healthcare products and services, UnitedHealth has consistently outperformed expectations in recent times, with results surpassing the Zacks Consensus EPS estimate by an average of 2.7% over the last four quarters.

Analysts have displayed optimism through upward revisions, as the $6.66 Zacks Consensus EPS estimate has seen a slight 1.7% increase since mid-January, pointing towards a 6% year-over-year growth.

Although revenue projections have seen minimal changes, the anticipated $99.3 billion in sales reflects an 8% improvement from the corresponding period last year.

Johnson & Johnson (JNJ)

Functioning across pharmaceuticals, medical devices, and consumer products segments, Johnson & Johnson has consistently surpassed the Zacks Consensus EPS estimate by an average of 5% in its previous four releases.

Currently, the $2.65 Zacks Consensus EPS estimate has remained relatively stable, hinting at a slight 1.5% decline from the year-ago figures. Predictions for revenue have been adjusted slightly upward to $21.4 billion, with a 13.5% reduction anticipated year-over-year.

Despite JNJ trading flat over the last three years, investors might be eyeing a potential shift in fortunes.

Discover Financial Services (DFS)

Positioned in digital banking and payment services, DFS aims to reverse a streak of disappointing results, having missed the Zacks Consensus EPS estimate in each of its past four reports.

Projections for the upcoming quarter reflect a bearish sentiment, with the $2.96 Zacks Consensus EPS estimate revised downward by 14% since mid-January, implying a 17% decrease year-over-year.

Although revenue expectations show limited movement, the expected $4.1 billion in sales indicates an 8% rise from the comparable period in the prior year.

Looking Ahead

As the anticipation builds for these pivotal quarterly reports, investors are on high alert for insights that could potentially steer market sentiment.

Each company’s performance will serve as a litmus test, signaling the broader economic landscape and impacting investor confidence across various sectors.