Apple (NASDAQ: AAPL) has cemented its position as a beacon of growth in the corporate landscape. With an astonishing 800% surge in its stock value over the past decade, Apple has distinctly outshone the S&P 500‘s more modest 183% climb. The company’s exceptional brand loyalty and robust financial reserves have propelled it to unprecedented heights.

Despite recent challenges from macroeconomic headwinds and declining product sales, Apple has proven resilient. Factors such as general consumer belt-tightening and advancements in chip performance that diminish the allure of annual product upgrades have necessitated a strategic reevaluation within the tech titan.

Anticipating this shift, Apple has ventured into the burgeoning realm of artificial intelligence (AI). Simultaneously, the company has been steering away from reliance on third-party chips towards developing in-house hardware, a move aimed at enhancing profit margins and asserting greater autonomy over product design.

This strategic pivot indicates a new phase in Apple’s growth narrative, paving the way for the company to potentially soar to unparalleled heights in the foreseeable future. Here are three compelling reasons why investing in Apple stock right now is a prudent move:

1. Embracing In-House Chip Technology for Unprecedented Gains

For over a decade, Apple has integrated Qualcomm‘s modem chips into its iPhones. However, a transformative shift began in 2018 as Apple ventured into developing its own modems, steering towards a complete transition to proprietary chips in its smartphones. This transition is approaching rapidly, with Apple’s existing contract with Qualcomm set to expire in 2027.

The decision to move away from third-party modems follows Apple’s successful migration of its entire Mac product line from Intel processors to its custom Apple Silicon M series chips in 2020. This move proved immensely fruitful, enabling Apple to offer some of the most potent and energy-efficient personal computers available. Mac sales have surged by 31% since the introduction of Apple Silicon four years ago.

The shift to in-house chips promises several advantages for Apple. Primarily, it substantially reduces chip costs, thereby enhancing profit margins. While the company may still incur royalties to Qualcomm to avert patent disputes, the overall expense should pale in comparison to the previous per-modem payments. Furthermore, this move could herald the development of a new chip amalgamating Wi-Fi and Bluetooth capabilities while enhancing battery life, potentially fortifying Apple’s market position.

Assuming full control over its chips empowers Apple to streamline product design, exercising authority over nearly every facet of its devices. This newfound creative latitude fosters innovation and catalyzes the company’s capacity for inventive product development. Taking charge of iPhone modems may enable Apple to diversify its smartphone lineup by introducing foldable, AI-equipped devices that boast an enhanced user experience, potentially spurring a wave of consumer upgrades and propelling both earnings and stock value.

2. Revolutionizing its Portfolio with Artificial Intelligence

In tandem with its chip metamorphosis, Apple embarked on a substantial foray into AI in 2024. The company initiated a comprehensive overhaul of its product array to augment its AI offerings, positioning itself as the premier choice for consumers seeking AI-integrated devices.

In the upcoming month, Apple is slated to unveil the iPhone 16, its inaugural smartphone engineered with AI at its core. This launch will precede the introduction of Apple Intelligence, a substantial update to its operating systems. Apple Intelligence will introduce language, text, and image generation tools to iPhones, Macs, and iPads. Concurrently, Siri has undergone a comprehensive redesign, exhibiting advanced language comprehension and offering users access to OpenAI’s ChatGPT for specialized inquiries.

Initially, Apple Intelligence will be accessible solely on the company’s latest devices, including the iPhone 15 Pros and higher-end Macs/iPads outfitted with Apple Silicon chips. Apple anticipates this move will catalyze a surge in consumer device upgrades.

Nevertheless, these forthcoming launches represent merely the inception of Apple’s AI venture. Industry analyst Craig Moffett from Moffett Nathanson Research suggests that Apple “will eventually underpin a paid-for digital assistant, providing an additional impetus to their high-margin Services segment.”

Services constitute Apple’s most lucrative division, boasting a staggering gross margin of 74%. Moreover, the segment is experiencing rapid expansion, with a robust 14% revenue growth year over year in the third quarter of 2023. Integrating paid-for AI functionalities into its suite of digital products could substantially bolster the services division, fueling Apple’s financial growth.

3. Competitive Valuation in Comparison to Peers in the AI Sector

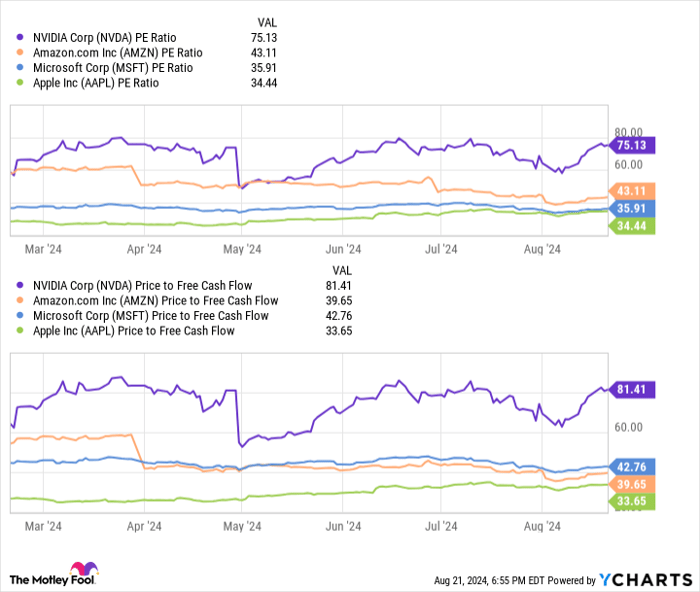

The valuation trends indicate that Apple might offer a more compelling investment opportunity than some of its AI counterparts. With a lower price-to-earnings ratio (P/E) and price-to-free cash flow than leading industry players, Apple’s stock presents a compelling value proposition.

In conjunction with the promethean shift in its chip supply chain and the ambitious AI foray, Apple’s stock stands as an irresistible investment prospect, one that prudent investors should seize with alacrity.