Investing in the current market climate is akin to navigating a turbulent ocean, with soaring valuations and Fed rate cuts throwing off potential investors. While caution seems sage, a shining beacon pierces the tempest – DraftKings (NASDAQ: DKNG), the online sports betting juggernaut, beckons with three compelling reasons to dive into its stock now.

Unlocking Value: Discounted Shares in Abundance

Unlike many peers, DraftKings stock remains 46% below its 2021 peak, offering a tantalizing entry point post a recent 16% drop from the year’s high in March. Analyst sentiment echoes this allure, with a consensus ‘strong buy’ rating and a lofty 12-month target price set at $49.62 – a 25% premium to its current valuation.

Diversification and Expansion: Beyond Sports Wagering

Evolved past its fantasy sports origins, DraftKings has morphed into a multifaceted entity embracing online casino gaming alongside its sportsbook offerings. The strategic maneuver into diverse revenue streams positions the company uniquely in the burgeoning US gambling market. Despite skirmishes with brick-and-mortar casino giants, DraftKings’ online ventures strive, heralding promising prospects.

As reported by the American Gaming Association [link], the online casino market in the US amasses robust year-on-year growth, nibbling away at traditional casino revenue shares. DraftKings’ pioneering role bolsters confidence in its future resilience and profitability.

Growth Trajectory: A Beacon of Prosperous Expansion

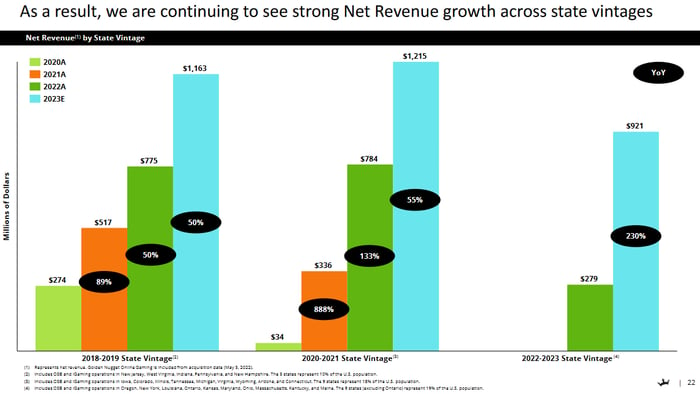

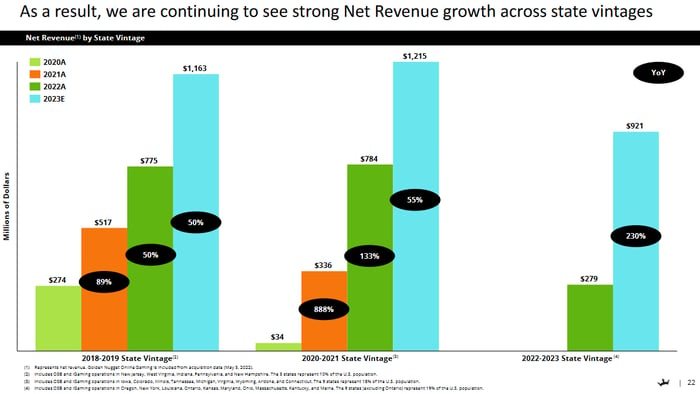

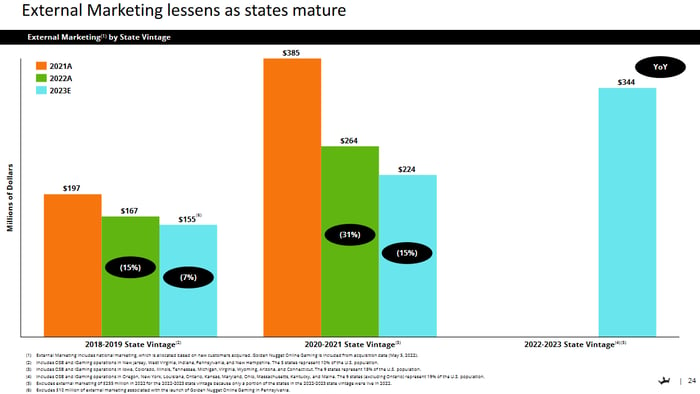

Embracing growth fervently, DraftKings boasts a 26% year-over-year revenue surge in the last quarter, propelling an upward revision of its yearly revenue projections. Bolstered by an EBITDA forecast bordering on ambitious, the company anticipates substantial growth, albeit amid a fiercely competitive landscape.

Given its calculated operational strategies, primarily focusing on state-wise expansion and customer loyalty, DraftKings anticipates a profitability surge in mature markets. Goldman Sachs’ optimistic vision and Vixio’s market forecasts lend credence to DraftKings’ growth narrative, painting a splendid future for the brand amidst adversities.

Image source: DraftKings November-2023 Investor Day presentation.

Image source: DraftKings November-2023 Investor Day presentation.

The Verdict: A Precious Gem in the Investment Arsenal

At first glance, DraftKings emerges as a compelling growth pick, teeming with potential. Navigating the volatile waves of the US gambling industry, the company stands resilient, though not devoid of risks. While it may not be the cornerstone of your investment edifice, DraftKings’ stock shines as a promising venture offering substantial returns atop measured risks for the discerning investor.

In the quagmire of contemporary investing, DraftKings emerges as an oasis of opportunity, beckoning with the promise of prosperity amidst the market’s maelstrom.

Unveiling the Prospects of Investing $1,000 in DraftKings

Consider the Potential Before Investing

Before diving into DraftKings stock, it’s crucial to weigh all factors at play.

The Analyst Insights on Top Stocks

The renowned Motley Fool Stock Advisor team recently unveiled their top picks for investors, hinting at potential groundbreaking returns. While DraftKings might not have made the list, the 10 selected stocks are forecasted to yield substantial profits in the foreseeable future.

Imagine the Nvidia Case

Reflect on the Nvidia scenario back on April 15, 2005 – a pivotal moment in stock market history. An investment of $1,000 based on their recommendation would have soared to an astounding $760,130. This profound example underscores the power of strategic stock picks.

Stock Advisor: Pioneering Success Blueprints

Embark on a journey of financial success with Stock Advisor and its well-crafted roadmap for aspiring investors. By offering expert guidance on portfolio construction, regular analyst updates, and two fresh stock recommendations monthly, the service has not just surpassed but catapulted past the S&P 500’s performance since 2002.

Discover the Top 10 Stock Picks

*Stock Advisor returns as of September 23, 2024.