An impressive quarter that sets the stage

Walmart has showcased its prowess in the retail arena with stellar performance in the last quarter, manifesting revenue of $169.3 billion translating into $1.67 per share earnings. The figures outperformed the previous year’s results and surpassed analysts’ projections. The backbone of this growth came from solid grocery sales and a 4.2% increase in same-store sales (U.S., excluding fuel). E-commerce revenue surged by 21%, while gross margins witnessed an improvement.

The company’s upbeat second-quarter results prompted Walmart to up its full-year revenue and earnings projections. CFO John David Rainey expressed confidence during the earnings call, noting the lack of strain on consumer health within their business. This optimistic sentiment has elevated Walmart as a yardstick for the performance of other retail players in the market.

What sets Walmart apart from its competitors is its ability to capitalize on its size and infrastructure regardless of the economic climate.

Unveiling Walmart’s Edge over Competitors

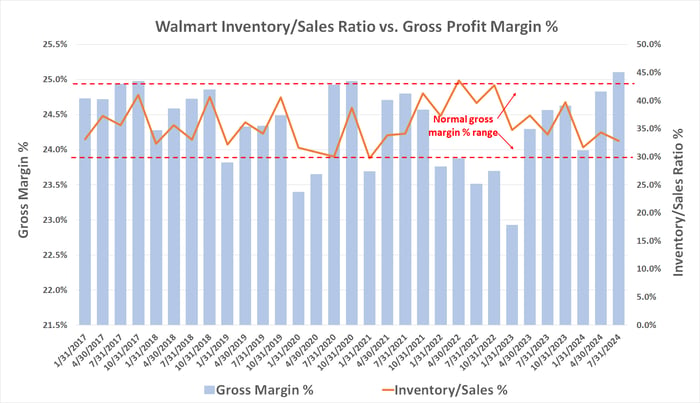

Firstly, Walmart’s depleting inventory levels reflect a strategic move, marking a shift to pre-pandemic ratios. This reduction indicates a mastery in managing merchandise levels, enhancing operational efficiency, and safeguarding against potential losses. In contrast, many retailers suffered from inflated inventory during the pandemic’s peak, resulting in decreased gross profit margins.

Data source: Walmart Inc. Chart by author.

Secondly, Walmart’s discreet enhancement in its advertising business, with revenue soaring by 26% globally and 30% in the U.S., sheds light on its diverse revenue streams. The retail giant’s digital advertising arm, though not a primary income source, significantly impacts the bottom line. Leveraging the robust e-commerce platform of Walmart.com, the company capitalizes on high-margin revenue, a testament to its foresight and adaptability.

Lastly, the exponential growth in Walmart+ memberships by double digits last quarter affirms the company’s expanding loyal customer base. This surge in membership income underscores the value proposition of Walmart+, contributing to a 23% rise in income. The ripple effect of this growth translates into increased transaction volumes and a soaring e-commerce sector, which competitors find hard to emulate due to Walmart’s market supremacy and vast inventory.

The Dilemma: Buy or Wait?

With Walmart’s dominant market position, the temptation to buy its stock might be alluring. However, it’s crucial to exercise caution and not rush into investment decisions. While premium valuation for quality stocks is commonplace, Walmart’s recent market surge warrants a moment of contemplation.

Unveiling Walmart’s Stock Performance Amidst Second-Quarter Reveal

Following the disclosure of Walmart’s second-quarter financials, investors have witnessed a surge in Walmart shares, which are presently trading at over 27 times the expected earnings for the next year. This valuation, even if potentially understated, places the stock on the pricier end compared to its historical benchmarks.

However, caution mixed with a dash of adventurous spirit could prove to be a prudent mix. A slight downtick in the recent post-earnings rally might be the only retreat on the horizon. It’s increasingly apparent that the revamped and revitalized Walmart has positioned itself for success across varied economic landscapes. Consequently, investors are poised to swoop in and rescue the stock from any impending decline, given its alluring prospects.

Exploring Investment Potential in Walmart

Prior to diving into Walmart stock, deliberation is key:

The financial gurus at the Motley Fool Stock Advisor recently pinpointed their top selections for investors, which Walmart surprisingly did not make the cut. The chosen 10 stocks have the potential to deliver substantial returns in the foreseeable future.

Consider the case of Nvidia making the list back on April 15, 2005 – an investment of $1,000 at that point would have blossomed into an astounding $758,227 by now!* This showcases the transformative power of savvy investment decisions.

The Stock Advisor service extends a roadmap to prosperity for investors, offering insights into portfolio construction, expert analyst updates, and bimonthly stock recommendations. Most impressively, the service has outperformed the S&P 500 by more than fourfold since 2002*.

Mesmerized by the potential of these investment revelations? Take a peek at the top 10 stocks for yourself and behold the possibilities that lie within.

*Stock Advisor returns are accurate as of August 22, 2024