Investing in promising, up-and-coming growth stocks can lead to significant returns for buy-and-hold investors. You don’t need to invest a fortune into a growth stock to make a lot of money – if you pick the right one – but it can require a lot of patience.

Apple (NASDAQ: AAPL), Netflix (NASDAQ: NFLX), and Booking Holdings (NASDAQ: BKNG) have each turned four-figure investments into more than $1 million during the course of a couple of decades. Here’s a look at how they’ve performed exceptionally well and what a $6,000 investment in these stocks 20 years ago would be worth today.

Apple: A Journey to $2.5 Million

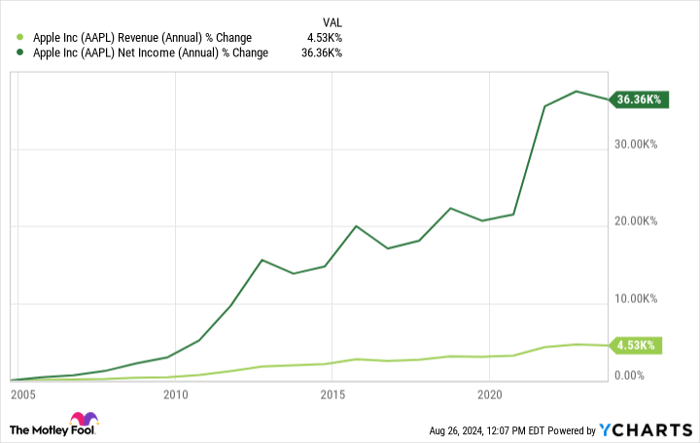

Steve Jobs unveiled the first iPhone back in 2007, marking a pivotal moment in Apple’s trajectory. The iPhone became a cornerstone of Apple’s business, leading to a robust ecosystem of services. While Apple’s hardware sales continue to be prominent, its services segment has been a significant revenue driver with promising growth potential.

Over the past two decades, Apple has exhibited remarkable growth, turning a $6,000 investment 20 years ago into $2.5 million today. Despite its evolution into one of the world’s leading technology companies, Apple’s stock remains reasonably priced, offering continued growth opportunities, especially with advancements like AI-capable phones on the horizon.

Netflix: Scaling to $1.8 Million

Netflix has undergone multiple transformations over the past couple of decades, from a DVD rental service to a streaming platform curating content. As competition intensifies, Netflix has shifted focus to producing original content, diversifying its offerings while maintaining profitability.

A $6,000 investment in Netflix 20 years ago would now be valued at a remarkable $1.8 million. Despite the stock’s relatively high valuation at over 42 times trailing earnings, Netflix’s position as a leader in the streaming industry justifies its premium, especially with the expansion into ad-supported plans driving growth prospects.

Booking Holdings: Reaching $1.1 Million

Booking Holdings has emerged as a global leader in travel technology, operating popular booking sites like Priceline.com and Kayak.com. Despite pandemic challenges, Booking Holdings has rebounded strongly, reflecting a resilient business model with promising growth potential in the recovering travel sector.

An investment of $6,000 into Booking Holdings two decades ago would now be valued at approximately $1.1 million. With a reasonable valuation at 27 times earnings and an attractive price/earnings-to-growth (PEG) multiple of 1.1, Booking Holdings stands out as the best-valued growth stock on this elite list.

The Allure of Growth Stocks

Exploring the incredible journeys of Apple, Netflix, and Booking Holdings reveals the remarkable wealth generation potential of growth stocks. These companies have navigated market challenges, adapted to evolving consumer trends, and capitalized on innovation to deliver exceptional returns to long-term investors.

As the investment landscape continues to evolve, recognizing and seizing opportunities in promising growth stocks remains a compelling strategy for investors seeking lucrative returns over the long haul.

Uncovering the Untapped Investing Gems: The Story of Nvidia and the 10 Best Stocks

A Glance at the Past: Nvidia’s Staggering Rise

Back on April 15, 2005, Nvidia earned a coveted spot on the list of top 10 stocks. If you had seized the opportunity and invested $1,000 at that pivotal moment based on this recommendation, today, you’d be sitting on a jaw-dropping $769,685.*

Stock Advisor: Pioneering Pathways to Success

Stock Advisor is akin to a treasure map for investors, providing a user-friendly blueprint for navigating the unpredictable waters of the stock market. Armed with valuable insights on portfolio construction, regular updates from seasoned analysts, and the unveiling of two new stock picks each month, this platform has been a beacon of light for many investing enthusiasts. In an impressive feat that speaks volumes about its prowess, Stock Advisor has outperformed the S&P 500 by more than fourfold since the dawn of 2002.*

Diving Deeper: Unveiling the Potential

These 10 carefully curated stocks, deemed as the finest gems in the investment world, are believed to possess the ability to yield monumental returns in the years to come. Dissimilar to the heavyweight presence of Apple, these hidden treasures promise a refreshing and potentially lucrative journey for investors bold enough to explore beyond the obvious choices.

The Author’s Insight

David Jagielski, the insightful mind behind these revelations, maintains a neutral stance in the stock market, harboring no positions in the stocks under discussion. The Motley Fool, revered for its foresight, not only endorses but also holds positions in and recommends stocks like Apple, Booking Holdings, and Netflix, showcasing an unwavering dedication to fostering informed financial decisions.