Anticipating the fleeting stocks that could metamorphose $1,000 into a princely million is akin to forecasting a capricious breeze – an elusive feat. The domain of investments is rife with unpredictable vicissitudes that can send a stock into a freefall or a meteoric ascent on a whim, making the foundation of diversification as crucial as cherry-picking top-performers. Navigating the murky waters of investments isn’t solely about scrounging up the capital or deciphering arcane financial scrolls; it’s about mustering the resilience to weather the storms and allowing the enchantment of compounded growth unfurl its magic.

Perusing the annals of financial history unveils titans like Amazon (NASDAQ: AMZN), Walmart (NYSE: WMT), and Home Depot (NYSE: HD). Despite enduring plunges into the abyss at various junctures, an early investment of $1,000 in any of these enterprises at their genesis would have burgeoned into a million-dollar treasure trove today.

The Phenomenon Called Amazon

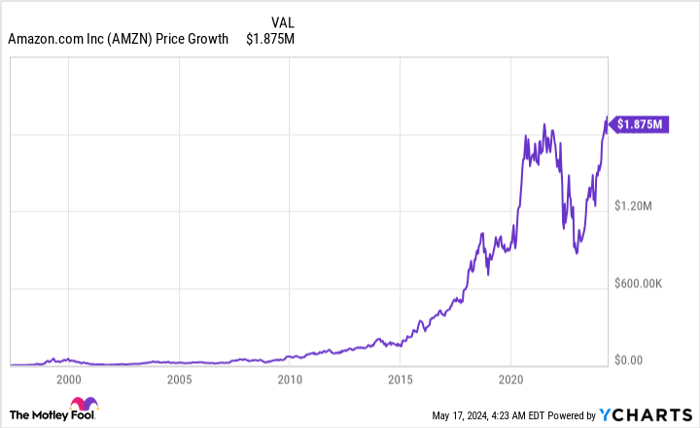

The Amazonian ascent has etched its name in the hallowed halls of stock market lore. If you had sown $1,000 in Amazon’s stock during its initial public offering (IPO), your coffers would now overflow with almost $1.9 million.

Data from YCharts showcases the rollercoaster ride, punctuated by the tumultuous downturn in 2022, on Amazon’s growth trajectory. Despite the undulations, Amazon continues to flaunt double-digit growth figures – a monumental feat given its colossal foundation. Capacious growth avenues in artificial intelligence and the evergreen e-commerce bastion further embellish its promising future.

The Colossus of Retail: Walmart

While Walmart no longer epitomizes growth, it defiantly holds its ground against Amazon’s relentless march towards retail supremacy. Walmart’s moderate single-digit growth, despite its colossal stature, is a testament to its enduring appeal. A $1,000 plunge into Walmart’s realm in 1970, with dividends reinvested, would have bloomed into a veritable cornucopia of over $4.6 million today.

Vying for the retail crown, Walmart’s foray into the streaming domain and retail refinement tailored to suit regional idiosyncrasies underscore its strategic agility. Though the world’s retail dominance might change hands someday, Walmart’s resilience and dividend growth are indelible hallmarks of its excellence.

The Dark Horse: Home Depot

Surprisingly nestled amidst the stock millionaires cohort is Home Depot, often overshadowed by its retail counterparts. A visionary $1,000 wager on Home Depot in its infancy would have reaped richer dividends compared to the Amazon or Walmart IPO odysseys.

The prevailing macroeconomic maelstrom is exerting pressure on Home Depot, causing its stock to hover around neutrality this year. Nevertheless, armed with technological investments and a niche stronghold, Home Depot’s ramparts remain impregnable. Seizing the moment might herald opportune entry points, buoyed by its ascending dividend trajectory.

Can Lightning Strike Twice?

From their current colossal perches, these titans may not replicate the 1,000-fold valorization, thus dampening the prospect of a millionaire metamorphosis for $1,000 invested today. However, their proven resilience and business acumen augur well for continual value creation, albeit at a moderated pace. While not every stock can orchestrate the millionaire overture, a diversified portfolio can navigate the wealth creation voyage adeptly.

Emphasizing the essence of long-term investment prudence, the stock market folklore seldom accommodates IPO Cinderella stories. However, investors embarking early on the voyage, anchoring their faith in stalwart enterprises, and harnessing the alchemy of compounding growth can undoubtedly unearth the fabled treasure trove and ascend to millionaire echelons.

To Be or Not to Be: The Amazon Conundrum

Contemplating an Amazonian plunge amidst the hallowed investment realms warrants due diligence:

The Motley Fool Stock Advisor savants have unearthed promising facets that merit exploration, harkening back to the historic trajectories of the renowned triumphant troika.

Unveiling the Hidden Gems: 10 Stocks Ready to Soar

10 best stocks for investors to buy now… and Amazon wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $635,982!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of May 13, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Jennifer Saibil has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon, Home Depot, and Walmart. The Motley Fool has a disclosure policy.