Positive Signs in CPI Show Promise for Tech

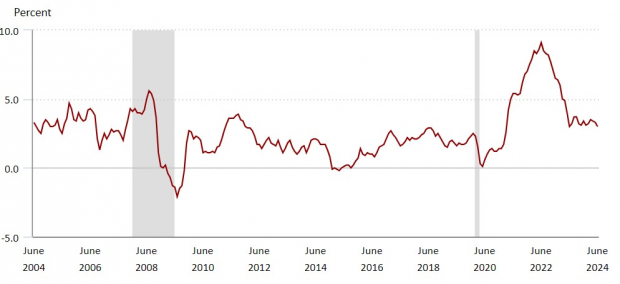

After two consecutive months of cooling down, the Consumer Price Index (CPI) brought encouraging news this June. Climbing at a rate of 3% compared to the previous year, the figures revealed a welcome drop from May’s 3.3% rate. Additionally, there was a monthly decrease of 0.1%, a shift from May’s stagnant numbers.

The Core CPI, excluding volatile food and energy costs, rose by 3.3% annually, a slight dip from May’s 3.4%. The monthly increase was also more moderate, up by 0.1% in June after a 0.2% rise in May. Such developments bring a wave of optimism to the broader market, especially the tech sector, which stands to gain significantly from this easing of inflation pressures.

Implications for Rate Cuts and the Tech Sector

With indications favoring a potential rate cut, Federal Reserve officials are presented with a compelling argument as inflation shows signs of tapering at a desirable pace. The stage is set for market players to benefit from this conducive environment, with the tech industry poised for substantial growth.

The Rising Stars in Tech Stock

The Rise of RNG and TWLO

Joining the Zacks Rank #1 (Strong Buy) list, RingCentral (RNG) and Twilio (TWLO) made an impressive entry, sparking investor interest. RingCentral, with its undervalued stocks trading at 7.9 times forward earnings, presents an attractive proposition post the inflation dip.

Despite experiencing a downturn earlier this year, the company’s robust growth projections, primarily in contact center software-as-a-service solutions, are set to propel RingCentral’s resurgence. On the other hand, Twilio, which witnessed a YTD stock dip of 23%, is also eyeing a promising trajectory as it offers real-time communication services for software applications.

Exciting Prospects for ARM Holdings

Amidst a challenging year for IPOs due to inflation concerns, Arm Holdings emerged as a bold player, debuting in 2023. The UK-based company, known for its processor designs and software platform tools, has garnered a strong clientele, including tech giants like Amazon, Alphabet, and Nvidia. With an impressive 150% surge since its IPO, ARM Holdings continues to captivate investors in a cautiously optimistic economic climate.

Key Takeaways

The anticipated growth of RingCentral, Twilio, and Arm Holdings hints at imminent breakthroughs in the tech sector, fueled by a backdrop of easing inflationary pressures.

In a market climate where cooler inflation prevails, tech investors have reason to rejoice as three key stocks have received an impressive “A” Zacks Style Scores grade for Growth. This commendable recognition, coupled with June’s Consumer Price Index (CPI) data, sets the stage for further market upswing.

Exploring Growth Potential:

Financial analysts may have inadvertently underestimated the potential of these tech stocks. With anticipated upcoming earnings announcements, the market could witness an immediate surge of 10-20% in stock values.

Stock Analysis Reports:

ARM Holdings PLC Sponsored ADR (ARM)

Diving Deeper into the Potential:

For investors seeking to capitalize on the growth of tech stocks amidst the current economic landscape, these key companies stand out as promising entities. Over time, historical trends have shown that such strategic investments can yield substantial returns, aligning with the sustained growth potential in the technology sector.

For a detailed analysis of these tech stocks and their growth trajectories, visit Zacks.com