Artificial intelligence (AI) has dominated the technology landscape over the past year and a half, seamlessly integrating into the mainstream, driven by the commercial triumph of generative AI tools such as ChatGPT.

The surge in stock prices of tech companies touched by AI has been an inevitable phenomenon. Investors have avidly seized on the recent boom, propelling these companies further. The success witnessed by many of these firms only hints at the potential for further growth.

Microsoft’s Potential Ascendancy

What emerges now is the rise of Microsoft, surpassing Apple to claim the mantle of the world’s most valuable public company, boasting a market cap exceeding $3.1 trillion. Microsoft’s AI journey is propelled by its strategic alliance with OpenAI, the mastermind behind ChatGPT.

The deep, symbiotic relationship between Microsoft and OpenAI, driven by a substantial $1 billion investment in 2019, has been mutually enriching. Microsoft’s Azure cloud platform, a bastion of supercomputing capabilities, serves as the backbone of OpenAI’s operations, enabling Microsoft to wield exclusive rights to OpenAI’s large language models (LLMs).

Integrating these LLMs into its products and services has imbued Microsoft with a competitive edge, enhancing the effectiveness and intelligence of its diverse service offerings. With a strong foundation already in place, bolstering these services with an AI component enhances their potential to dominate their respective industries.

CrowdStrike’s Data-Driven Superiority

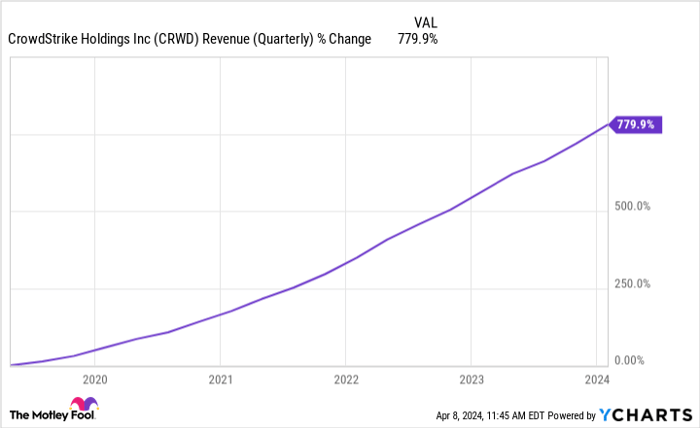

CrowdStrike, a pioneering figure in the realm of pure AI cybersecurity, has leveraged the technology to automate cybersecurity processes for over a decade. A key advantage is the wealth of data the company possesses. Effective AI tools require extensive training data, an area where CrowdStrike excels.

Exceptional business and financial performance underscore the effectiveness of CrowdStrike’s platforms. The company’s robust client base, utilizing multiple modules in its ecosystem, signals high customer engagement. With a dollar-based net retention rate of 119% in the last quarter of fiscal 2024, CrowdStrike’s established customers are spending significantly more, a testament to the value they perceive.

The burgeoning AI-native cybersecurity market presents ample growth opportunities for CrowdStrike, with projections indicating significant market expansion by 2028, cementing its place as a market leader delivering considerable long-term value to investors.

TSMC’s Crucial Role in the AI Ecosystem

Taiwan Semiconductor Manufacturing Company (TSMC), known for its semiconductor foundry operations, plays a critical, albeit subtle, role within the AI landscape. Described as the initial seed of the AI tree, TSMC’s semiconductor fabrication underpins the foundation of AI applications such as ChatGPT and other LLMs.

Essential to this infrastructure are data centers, pivotal for storing the vast volumes of data necessary for AI training, heavily reliant on graphic processing units (GPUs) for computational prowess. TSMC’s superior semiconductor fabrication processes position it as a global leader, attracting major tech players like NVIDIA due to the unparalleled quality of its semiconductors.

Without TSMC’s advanced semiconductor fabrication, the AI pipeline would undoubtedly suffer, potentially slowing progress in the field. This heavy dependence solidifies TSMC’s significance within the AI sphere, with estimates suggesting that AI-related semiconductors could account for a substantial portion of TSMC’s revenue by 2027.

In a world where data and algorithms reign supreme, the groundwork laid by TSMC sets the stage for AI innovation and progress.