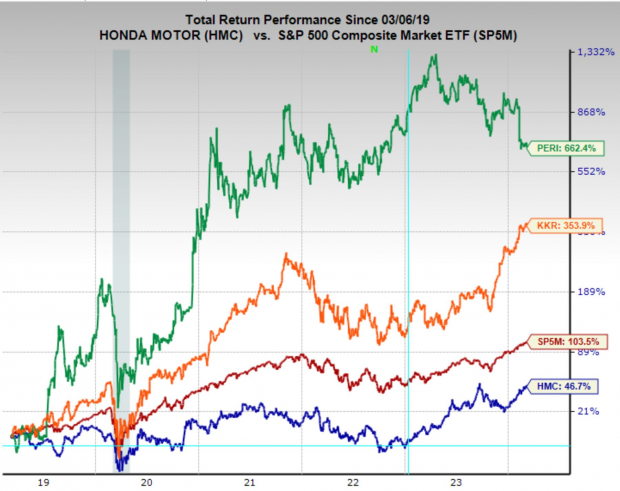

Perion Networks: A Beacon of Growth Potential

As the market continues its relentless upward climb, discerning investors may find solace in the undervalued gems sitting in the corners. Amidst the surge in valuations of prominent stocks, companies like Perion Networks offer a breath of fresh air with their bargain valuations. The attractiveness of stocks trading below historical valuations is akin to discovering a hidden treasure trove in a sea of overpriced assets.

Perion Networks: A Closer Look

Perion Networks, under the ticker PERI, operates a global advertising technology platform that serves as a vital link between advertisers, publishers, and consumers. The company’s expertise in targeted advertising across various mediums has positioned it as a formidable player in the adtech industry. Notably, Perion Networks has recently made significant strides in the connected TV advertising realm, showcasing its adaptability in a fast-evolving market.

Strong Fundamentals and Growth Projections

With a recent upgrade to Zacks Rank #1 (Strong Buy), Perion Networks has garnered attention for its robust growth outlook. Analysts’ optimistic revision of earnings estimates for the fiscal year 2024 bodes well for the company, with an expected 17% year-over-year sales growth for the current year and an additional 10% growth forecasted for the following year.

Compelling Valuation Metrics

Despite the market frenzy, Perion Networks stands out with its conservative one-year forward earnings multiple of 7.5x, significantly lower than its 10-year median valuation of 11.2x. Furthermore, the PEG ratio, reflecting earnings growth expectations, paints a compelling picture with an estimated annual EPS growth rate of 22% over the next 3-5 years, resulting in a discounted PEG ratio of just 0.34.

Honda Motor Company: Riding the Wave of Value

Amidst the electrifying buzz surrounding EV companies, traditional automakers like Honda Motor Company are quietly paving their path to value investor’s hearts. As electric vehicle sales plateau in the US and a resurgence in hybrid car interest emerges, Honda Motor Company, ticker symbol HMC, shines as an overlooked opportunity in the automotive sector.

Resilient Performance and Growth Trajectory

Contrary to the EV euphoria, Honda Motor Company showcases remarkable resilience and growth potential. With a standout Zacks Rank #1 (Strong Buy) designation, the company’s positive earnings outlook and anticipated 14% sales expansion for the current fiscal year emphasize its enduring appeal amidst shifting market dynamics.

Value Unveiled: Honda’s Valuation Metrics

Trading at a modest one-year forward earnings multiple of 8.5x, below its 10-year median valuation of 9.1x, Honda Motor Company presents a compelling case for value-conscious investors. The company’s PEG ratio of 0.4, supported by an estimated EPS growth rate of 20.8% annually over the next 3-5 years, underscores its status as an undervalued gem in the automotive landscape.

KKR & Co.: A Powerhouse in Value Investing

In a market swept by exuberance and inflated valuations, private equity stalwart KKR & Co., under the ticker KKR, emerges as a beacon of sanity for value-oriented investors. With its private credit business witnessing unprecedented growth amid cautious lending practices from traditional banks, KKR & Co. has become a favored destination for capital seeking both stability and returns.

The KKR & Co. Advantage

Over the recent months, KKR & Co. has outpaced the broader market, thanks in part to its thriving private credit segment. The company’s ability to navigate volatile market conditions and offer steady returns has garnered favor among investors seeking refuge from market uncertainties.

Growth Prospects and Value Proposition

Backed by a Zacks Rank #1 (Strong Buy) rating, KKR & Co. boasts positive earnings revisions across various timeframes, signaling a promising growth trajectory. With an anticipated 18% top-line expansion for the current year and 15% growth forecasted for the next year, KKR & Co. presents a compelling blend of growth potential and value in a frothy market environment.

Exploring the Financial Landscape of KKR & Co. Inc.

Valuation and Growth Prospects

In the realm of financial markets, KKR & Co. finds itself in a rather peculiar position. While it may not be trading at a historical discount with a one-year forward earnings multiple of 21.2x, significantly surpassing its 10-year median valuation of 14.4x, the company’s business and profits are expanding at a rate that can only be described as meteoric.

This juxtaposition has led to KKR enjoying a favorable PEG ratio—a metric that takes both valuation and growth prospects into account. With impressive earnings per share (EPS) growth forecasts of 27.2% annually for the next 3-5 years, KKR boasts a PEG ratio of 0.78, indicating a potential undervaluation considering its growth trajectory.

Investment Opportunity

For investors who prioritize value over mere growth, the allure of KKR & Co. Inc. remains palpable. The stock’s current standing beckons consideration for inclusion in investment portfolios, promising not just stable returns but the allure of long-term appreciation, an elusive prospect in today’s tumultuous market environment.