- May invites a whirlwind on Wall Street, with a multitude of key market events in tow.

- In such choppy waters, recognizing lucrative prospects becomes paramount.

- Thus, investors should mull over including Salesforce, Walt Disney, and Okta in their portfolio as May dawns.

Venture into May, embracing the thrill of uncovering promising market gems in a landscape riddled with uncertainty regarding the inaugural Federal Reserve rate cut and persistent stickiness.

In this scenario, the spotlight shifts towards stocks like Salesforce (NYSE:), Walt Disney (NYSE:), and Okta (NASDAQ:).

These entities brace for not just looming earnings reports this month but also boast robust fundamentals and tailwinds that promise an uptick in share value.

Delve deeper into what makes these three underappreciated stocks tantalizing prospects for May investors.

Salesforce: The Tech Titan Poised for Flight

- YTD Performance 2024: +3.8%

- Market Cap: $263.1 Billion

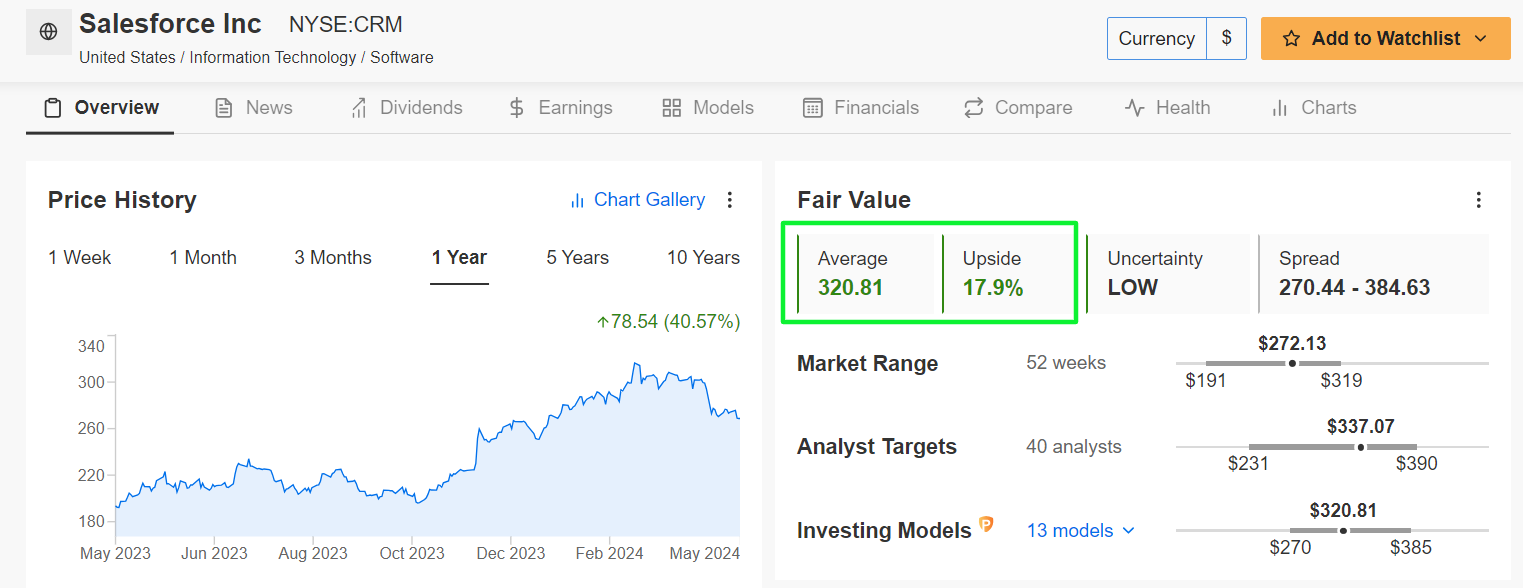

On a riveting Thursday finale, Salesforce (NYSE:) traded at $272.13, about 15% off its pinnacle of $318.71 scaled on March 1. With a market cap of $263.1 billion, Salesforce reigns as the crowned monarch among cloud-based software corporations, besting behemoths like SAP, Intuit (NASDAQ:), and ServiceNow (NYSE:).

Even with shares in glorious ascent – escalating by roughly 41% over the bygone year, in tandem with the tech sector – data suggests that current ‘Fair Value’ estimations portray CRM stock as undervalued.

Catalysts abound this May: anticipate a stately performance from Salesforce stock, potentially hurdling to uncharted pinnacles, fuelled by auspicious readings on the enterprise software behemoth’s nose-diving earnings and effervescent AI exploits.

Prepare for Salesforce’s Q1 revelation post-market closure on Tuesday, May 28, at 4:00PM ET.

Survey results from InvestingPro unveil a surge in analyst earnings revisions, with 33 enlisted analysts amplifying their profit predictions in the last 90 days, underscoring a crescendoing optimism around the cloud software colossus.

It’s fascinating to note that Salesforce has consistently eclipsed Wall Street’s quarterly estimates for profit and sales growth since at least Q2 2014, accompanied by burgeoning digital engagements and data-driven decision-making in the business sphere.

Walt Disney: The Entertainment Giant with Zeal

- YTD Performance 2024: +24.7%

- Market Cap: $206.4 Billion

Walt Disney (NYSE:) concluded at $112.62 recently, lingering within eyeshot of its 2024 zenith of $123.74, adorned on March 28. With a current valuation, Walt Disney parades a $206.4 billion market cap, a colossus within the global entertainment and media realm.

Year-to-date, shares have witnessed a stunning 25% spike, surging past competitors like Netflix (NASDAQ:) (+16%), Warner Bros Discovery (NASDAQ:) (-30.1%), and Paramount Global (NASDAQ:) (-6.3%) in the same timeframe.

Hinting at a potential 8.6% uptick in DIS stock from its recent closing price, the InvestingPro’s AI models indicate a closer rendezvous with the stock’s ‘Fair Value’ target of $122.34.

May showcases Disney’s prowess to dazzle with its buoyant earnings and sales growth prospects.

Expect Disney’s Q2 financial disclosures to grace the morning of Tuesday, May 7, at 8:00AM ET.

Gird up for an exultant journey with Disney’s optimistic profit estimates and promising cost-curbing initiatives.

Okta: The Identity-and-Access Maven

- YTD Performance 2024: +4.8%

- Market Cap: $15.9 Billion

Okta (NASDAQ:) concluded at $95.48 recently, sliding from its year-to-date crest of $114.50 hit on March 8. At present valuations, the San Francisco-based identity-and-access management whiz touts a $15.9 billion market cap.

With a 35.8% uptick in the last year, Okta illustrates the enduring rally ingrained in its seams.

The Rise of Okta in the Tech Sector

A Bargain Unveiled

InvestingPro’s AI model has unveiled an intriguing revelation: the present valuation of OKTA hints at a bargain waiting to be seized. The potential for a 20.7% surge from the previous closing price propels this security towards its ‘Fair Value’ mark, standing tall at $115.23 per share.

May Catalysts

Okta is on the brink of unveiling its first-quarter results post-market closure on Thursday, May 30, at 4:00PM ET. The financial arena anticipates double-digit profit and sales growth from the tech giant. Wall Street pulses with optimism, with EPS estimates up 33 times in three months, nearly tripling analysts’ initial projections.

The Financial Landscape

Forecast unveils Okta’s trajectory to $0.54 per share, marking a remarkable 155% climb from the year-ago period’s $0.22. Revenue paints a similar success story, soaring 16.6% year-over-year to touch $603.8 million. As demand skyrockets within large enterprises, Okta’s cloud-based identity and access management tools stand to gain immensely.

Market Ascendancy

Okta’s forte in cloud software management, ushering robust authentication for user access and aiding developers in embedding identity controls across applications, websites, and devices, places it in the vanguard of the briskly expanding identity and access management sphere. A prudent pick in the cybersecurity realm amid burgeoning expenditures in digital protection, Okta basks in the spotlight of market promise.

Embrace the Prospects

Empower your trading voyage by tumbling into the diversified insights proffered by InvestingPro. Move past the cacophony of inflation and soaring interest rates. The investment landscape broadens with tantalizing offerings beckoning novices and seasoned traders alike.

- AI-selected stock gems await in ProPicks.

- Dive into the world of simplified financial data with ProTips.

- Peek behind the veil with Fair Value’s intrinsic stock worth.

- Scan the horizon with the Advanced Stock Screener, filtering through a myriad of criteria for your ideal pick.

Conclusion

Okta’s meteoric rise in the tech realm is a testament to its prowess and resolute foothold. As the digital frontier evolves and cybersecurity stakes soar, Okta stands tall amongst its peers, beckoning investors with a promising narrative of growth and prosperity.