Overview of Tech Stocks Surge and ‘Wide Moat’ Concept

The tech stock sector has witnessed a meteoric rise buoyed by the AI fervor, propelling market indexes to unprecedented highs. Economic pundits foresee AI as a watershed moment that could rival the impact of the Industrial Revolution. Amidst this backdrop, the hunt for tech stocks with enduring competitive advantages, characterized by a “moat,” has intensified.

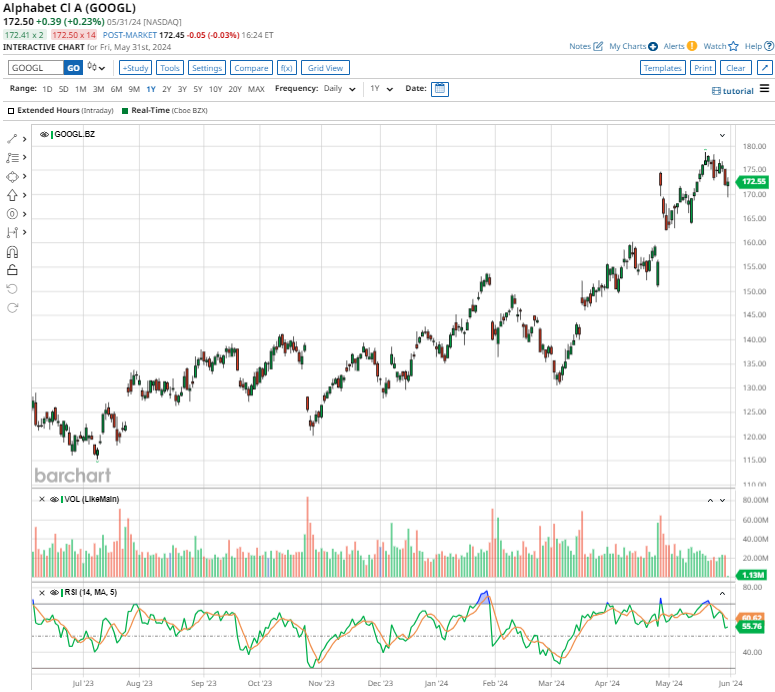

Alphabet Inc. (GOOGL): Tech Giant with Unmatched Innovations

Alphabet Inc., with a colossal market cap of $2.1 trillion, has transformed beyond being a search engine heavyweight. Its diverse product suite including Gmail, Google Drive, Google Maps, and YouTube, alongside a dominant market share in search, underscores its significance in daily life. The integration of AI further enhances its appeal, with share prices soaring amid impressive financial announcements.

Alphabet’s recent dividend initiation and strong Q1 earnings highlight its robust performance and growth potential. Analysts foresee sustained dominance in online search, buttressed by strong cash flows and AI utilization.

Amazon.com, Inc. (AMZN): Retail Titan Embracing Tech Evolution

With a $1.9 trillion market cap, Amazon’s expansion into various sectors echoes its adaptability and influence. Beyond retail, its ventures into entertainment and cloud services, notably AWS, underscore its tech proficiency. Amidst strong financial metrics and positive Q1 earnings, Amazon’s stock ascendance showcases its resilience and promising outlook.

Amazon’s impressive Q1 results, specifically in AWS, underline its tech prowess and growth trajectory. Forecasts of elevated profit margins and expanded revenue streams emphasize its position as a tech stalwart with enduring potential.

The Race of Titans in the Tech Terrain

As the financial landscape evolves, tech giants like Amazon and Meta Platforms continue to mesmerize investors with their prowess and growth potential. Let’s delve into the recent performances, future prospects, and analyst sentiments surrounding these industry juggernauts.

Amazon’s Ascendancy in E-Commerce and Cloud Services

Amazon, the behemoth of e-commerce and cloud services, asserted its dominance in the market yet again with a stellar Q1 performance. Morningstar analyst Dan Romanoff highlighted Amazon’s unwavering supremacy and noted the favorable demand across all business segments, particularly accentuating the notable improvement in Amazon Web Services (AWS).

Analysts remain bullish on Amazon, with a consensus “Strong Buy” rating. Out of 46 analysts, 42 advocate a “Strong Buy,” three endorse a “Moderate Buy,” and one opts for a “Hold” rating.

The average analyst price target of $220.29 presents a potential upside of 24.8% from current levels, with a promising Street-high target of $246 indicating a potential rally of up to 39.4%.

Meta Platforms: Pioneering the Social Media Universe

Meta Platforms, Inc., previously known as Facebook, stands tall with a market cap of $1.2 trillion, reigning as the world’s largest social media titan. The company, renowned for transforming connectivity since its inception in 2004, has expanded its global footprint through apps like Messenger, Instagram, and WhatsApp.

Meta Platforms is now venturing into immersive experiences with augmented and virtual reality, shaping the future of social technology.

Meta announced its second quarterly dividend, reinforcing shareholder value with a payout of $0.50 per share. The annualized dividend of $2.00 equates to a 0.42% yield, enriching investor returns.

Following a robust Q1 financial performance, Meta reported impressive revenue growth of 27.3% year over year, supported by an EPS surge of 114.1%. Founder and CEO Mark Zuckerberg underscored the company’s progress, emphasizing advancements in AI and the steady growth across Meta’s app ecosystem.

Looking ahead, Meta foresees heightened investments in AI research and product development, fueling accelerated infrastructure enhancements. Analysts predict a robust profit surge for Meta, with an estimated 35.8% increase in fiscal 2024 and a further 14.7% growth in fiscal 2025.

Recognition of Meta’s competitive edge resonates among analysts, emphasizing the company’s innovative features and user engagement strategies that culminate in a robust data pool. Leveraging this data, Meta crafts tailored ad campaigns, solidifying its position as a market leader.

The consensus “Strong Buy” rating for Meta’s stock showcases immense confidence among analysts, with 40 recommending a “Strong Buy,” one supporting a “Moderate Buy,” and the remainder offering a mix of ratings.

Analyst projections foresee a bright future for Meta Platforms, with the average price target suggesting an 11.34% upside from current levels, while the Street-high target hints at a remarkable 28.4% potential rally.