The Zacks Broadcast Radio and Television industry has been grappling with an escalation in cord-cutting despite a surge in demand for streaming content. However, industry players such as Netflix NFLX, Fox FOXA, Roku ROKU and TEGNA TGNA are reaping the benefits of a massive spike in digital content consumption. These companies are thriving due to their diverse content offerings, which include original, regional, and short-form content tailored for small screens like smartphones and tablets. Improved Internet speed and penetration, coupled with technological advancements, have been advantageous for industry participants. As monetization and revenues from advertising spending continue to be modest, strategies focused on profit protection, cash management and greater technology integration have gained significance and are expected to aid these companies in driving top-line growth in the near term.

Industry Description

The Zacks Broadcast Radio and Television industry encompasses companies that provide entertainment, sports, news, non-fiction, and musical content across television, radio, and digital media platforms. These entities generate revenues through the sale of television and radio programs, advertising slots and subscriptions. With technological advancements and a growing demand for virtual reality and Internet radio, industry players are increasing their investments in research and development, as well as sales and marketing efforts, to remain competitive. The industry’s focus is likely to shift toward sustaining current levels of operations, coupled with a renewed emphasis on flexibility. This approach would accelerate the transition to a variable cost model, thereby reducing fixed costs and enhancing agility in the face of evolving market dynamics.

4 Broadcast Radio and Television Industry Trends to Watch

Shift in Consumer Preference a Key Catalyst: To adapt to the evolving landscape, companies are diversifying their content offerings for over-the-top (OTT) services alongside traditional linear TV. The availability of streaming services across a wide range of platforms has enabled them to reach a global audience, expand their international user base and attract advertisers to their platforms, thereby boosting ad revenues. The utilization of services that aid advertisers in measuring their return on investment (ROI) and enhancing use cases is expected to benefit industry participants. Major leagues and events, such as the NFL, NHL, Olympics, European Games, EPL and elections, also contribute significantly to ad revenue generation.

Increased Digital Viewing Fuels Content Demand: Many industry participants, either launching their own OTT services or acquiring existing ones, leverage user insights to deliver tailored content. The surge in digital viewing has made consumer data readily available, allowing companies to apply artificial intelligence (AI) and machine learning techniques to create or procure targeted content. This approach not only boosts user engagement but also enables industry players to raise the prices of their services at opportune moments without the fear of losing subscribers.

Uncertain Macroeconomic Landscape Impedes Production and Ad Demand: Advertising is a significant revenue source for the Broadcast Radio and Television industry. However, industry participants are grappling with the effects of persistently high inflation, rising interest rates, increased capital costs, a soaring U.S. dollar and the looming threat of a recession. These factors have prompted advertisers to trim their ad budgets, which is expected to impact the top-line growth of industry players in the near term. Moreover, intense competition for ad dollars from tech and social media companies has been a significant impediment to the growth of industry participants.

Low-Priced Skinny Bundles Impact Revenues: The surge in cord-cutting has compelled industry participants to offer “skinny bundles.” These Internet-based services often contain fewer channels than traditional subscriptions and are, therefore, more affordable. This move aligns with changing consumer viewing dynamics, as growth in Internet penetration and advancements in mobile, video and wireless technologies have boosted small-screen viewing. While these alternative services are expected to keep users engaged with their platforms, increasing the need for additional content, the low-priced skinny bundles are likely to dampen the top-line performance of industry players.

Zacks Industry Rank Indicates Dull Prospects

The Zacks Broadcast Radio and Television industry is housed within the broader Zacks Consumer Discretionary sector. It currently carries a Zacks Industry Rank #184, which places it in the bottom 27% of more than 250 Zacks industries.

The group’s Zacks Industry Rank, which is the average of the Zacks Rank of all the member stocks, indicates dismal near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperform the bottom 50% by a factor of more than two to one.

The industry’s position in the bottom 50% of the Zacks-ranked industries results from a negative earnings outlook for the constituent companies in aggregate. Looking at the aggregate earnings estimate revisions, it appears that analysts are pessimistic about this group’s earnings growth potential. Since Nov. 30, 2023, the industry’s earnings estimates for 2024 have moved down 94.7%.

Despite the gloomy industry outlook, a few stocks are worth watching, as these have the potential to outperform the market based on a strong earnings outlook. But before we present such stocks, it is worth first looking at the industry’s shareholder returns and current valuation.

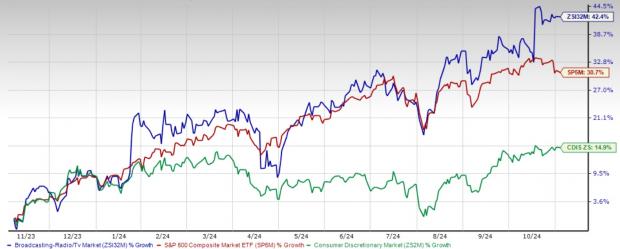

Industry Beats Sector, S&P 500

The Zacks Broadcast Radio and Television industry has outperformed the broader Zacks Consumer Discretionary sector and the S&P 500 Index in the past year.

The industry has gained 42.4% over this period compared with the S&P 500’s rise of 30.7% and the broader sector’s increase of 14.9%.

One-Year Price Performance

Industry’s Current Valuation

On the basis of trailing 12-month EV/EBITDA (Enterprise Value/ Earnings before Interest Tax Depreciation and Amortization), which is a commonly used multiple for valuing Broadcast Radio and Television stocks, the industry is currently trading at 13.32X versus the S&P 500’s 17.09X and the sector’s 9.9X.

In the past five years, the industry has traded as high as 19.76X and as low as 9.3X, recording a median of 4.61X, as the chart below shows.

EV/EBITDA Ratio (TTM)

4 Broadcast Radio and Television Stocks to Watch

Netflix: This Zacks Rank #2 (Buy) company has been benefiting from its growing subscriber base thanks to a robust content portfolio and revenue initiatives like its crackdown on password-sharing and ad-supported tier. It has also hiked the prices of certain subscription plans. At the end of the third quarter, Netflix had 282.72 million paid subscribers across more than 190 countries globally, up 14.4% year over year.

Netflix’s diversified content portfolio, backed by heavy investments in the production and distribution of localized, foreign-language content, has been driving its growth prospects. Netflix’s sprawling games portfolio is also expected to boost user engagement in the near term.

Netflix now projects revenues to grow 15% year over year in 2024, at the high end of the company’s prior expectation of 14-15% growth. For 2025, based on F/X rates as of Sept. 30, 2024, Netflix expects revenues of $43-$44 billion, indicating growth of 11-13% from 2024 revenue guidance of $38.9 billion. Netflix expects revenue growth to be driven by a healthy increase in paid memberships and ARM. Netflix is seeing significant growth in its advertising business, with ad revenues expected to roughly double year over year in 2025.

The Zacks Consensus Estimate for 2024 earnings has moved north by 3.7% to $19.78 per share in the past 30 days. NFLX’s shares have returned 56.9% year to date.

Price and Consensus: NFLX

Roku: This Zacks Rank #3 (Hold) company is benefiting from increased user engagement on The Roku Channel and the popularity of the Roku TV program. The Roku Channel remained the #3 app on Roku’s platform in the third quarter in terms of reach and engagement, with streaming hours up nearly 80% year over year.

In the third quarter, the Roku operating system (OS) was again the #1 selling TV OS in the United States, with TV unit sales greater than the next two TV operating systems combined. The Roku OS was also the #1 selling TV OS in Mexico and Canada.

Streaming Households were 85.5 million, representing a net increase of 2 million from the second quarter of 2024. The Roku Home Screen, which is the beginning of viewers’ streaming experience, reaches U.S. households with more than 120 million people every day, reflecting greater engagement and more monetization opportunities. The launch of third-party streaming channels, including Peacock, Disney+ and HBO Max, is aiding user growth. These services have done well on the Roku platform owing to its large base of engaged users and promotional capabilities.

The Zacks Consensus Estimate for ROKU’s 2024 loss has narrowed by 34 cents to $1.10 per share in the past 30 days. The stock has lost 24% year to date.

Price and Consensus: ROKU

Fox: The company is riding on the growing demand for live programming. The robust adoption of Fox News and Fox Business Network is expected to drive the user base in the near term. The company is benefiting from the launch of Tubi in the United Kingdom, which has a vast library of more than 20,000 movies and TV episodes on demand.

This Zacks Rank #3 company generates a significant portion of advertising revenues from live programming, which is relatively immune to the rapidly intensifying competition from subscription-based video-on-demand services. The company has expanded its partnership with The Trade Desk to bring best-in-class innovation to advertisers to help them reach their audiences and measure campaign performance to meet their business objectives. Moreover, recovering ad spending in the local advertising market is a major positive for Fox. Also, increasing affiliate-fee revenues are expected to drive Fox’s top line.

The Zacks Consensus Estimate for Fox’s fiscal 2025 earnings has moved north by a penny to $3.70 per share in the past 30 days. The stock is up 46.9% year to date.

Price and Consensus: FOXA

TEGNA: It has evolved as one of the largest U.S. broadcasting groups and a leading local news and media content provider, thanks to a plethora of acquisitions. TEGNA’s portfolio of NBC, CBS, ABC and FOX stations operate under long-term affiliation agreements. The television stations sell available commercial advertising spots as well as produce local programming, such as news, sports, and entertainment. TEGNA carries a Zacks Rank #3 currently.

TEGNA’s focus on content creation rather than TV broadcasting lowers the risk of the cord-cutting threat that is affecting the U.S. Pay-TV industry. Live event programming, which remains the most-watched content for viewers, can be sold either to TV channels, websites or streaming services. Additionally, the company has been investing in digital initiatives and streaming services, potentially opening up new revenue streams.

The Zacks Consensus Estimate for 2024 earnings has remained steady at $3.07 per share in the past 30 days. TGNA’s shares have gained 5% year to date.

Price and Consensus: TGNA

Zacks Names #1 Semiconductor Stock

It’s only 1/9,000th the size of NVIDIA which skyrocketed more than +800% since we recommended it. NVIDIA is still strong, but our new top chip stock has much more room to boom.

With strong earnings growth and an expanding customer base, it’s positioned to feed the rampant demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>

Netflix, Inc. (NFLX) : Free Stock Analysis Report

Fox Corporation (FOXA) : Free Stock Analysis Report

TEGNA Inc. (TGNA) : Free Stock Analysis Report

Roku, Inc. (ROKU) : Free Stock Analysis Report