In 2024, inflation, interest rates, and the presidential election will likely be on top of ETF investors’ minds. Here are four other lesser-known trends and insights — both positive and negative — to consider in 2024.

1. Navigating Through Short-term Periods with Pricing Power

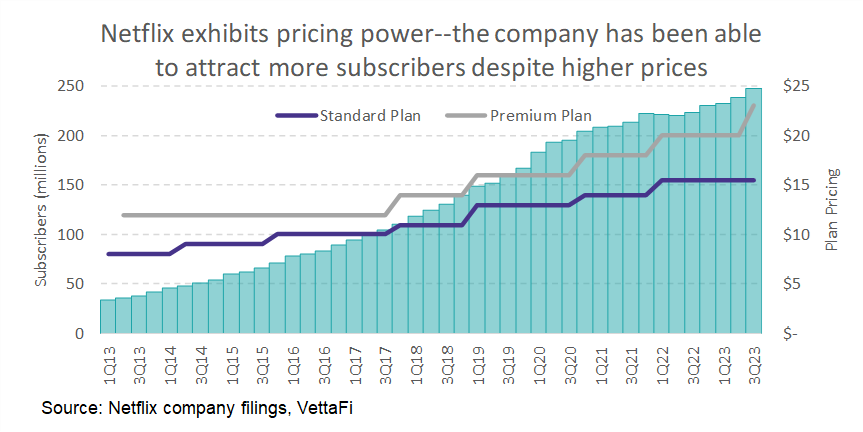

Predicting demand trends is one thing, but maintaining sustainable revenue growth requires pricing power. Companies like Netflix and Tesla, which already dominate their markets, sustain revenue growth by implementing price hikes, a phenomenon known as pricing power. This allows them to weather market fluctuations and inflate margins amid rising inflationary costs. Looking beyond these giants, consumer staples sectors and luxury goods companies are primed to benefit from their robust pricing power, offering potential growth and resilience. Related ETFs such as the Consumer Staples Select Sector SPDR Fund (XLP) and Tema Luxury ETF (LUX) can capture this strength. The Invesco Bloomberg Pricing Power ETF (POWA) is also worth noting as it encompasses companies with strong pricing power.

2. Managing Labor Issues from an ETF Viewpoint

In 2024, persisting labor strikes could affect certain industries due to the imbalance between inflation and wage increases. However, the impact on ETFs tends to be modest since not all companies within an industry are unionized, providing room for competitors to gain advantage. For example, while Ford, General Motors, and Stellantis employees went on strike, non-unionized competitors like Honda and Tesla stood relatively stable with lesser profit losses. ETFs such as the Global X Autonomous & Electric Vehicles ETF (DRIV) could thrive owing to diversification among various automotive manufacturers and related segments, outperforming individual stocks.

3. Embracing Small-Cap Stocks for Portfolio Diversification

While large-cap equities have long been popular for their perceived safety, investors are recognizing the potential of undervalued small-caps that are rebounding against their larger peers. While the Magnificent Seven stocks continue to perform well, it’s critical to avoid overallocation to them, prompting a shift toward small-caps. The SPDR Portfolio S&P 600 Small Cap ETF (SPSM) exhibited notable growth, surpassing the SPDR S&P 500 ETF Trust (SPY). This advice doesn’t discredit large-caps but highlights the need for diversification away from the seven dominant stocks, which often dominate domestic equity, technology, and thematic ETFs.

4. Beyond Spot Bitcoin ETF Launch: Unveiling the Real Potential of Crypto ETFs

While the foreseeable spot bitcoin ETF launch is generating hype, the wider acceptance of crypto among institutional and retail investors is expected to propel the market into a new era of maturity. A halving event, which occurs once every four years, is also anticipated, further affecting bitcoin prices. Crypto equity ETFs, including the Valkyrie Bitcoin Miners ETF (WGMI), VanEck Digital Transformation ETF (DAPP), and the Invesco Alerian Galaxy Crypto Economy ETF (SATO), have already proven to be top performers in 2023, offering potential gains with the increasing interest in crypto. The spotlight on these ETFs is expected to intensify following the launch of the spot bitcoin ETF, along with the projected rally in bitcoin prices after the halving event.