The Q4 earnings season has brought forth a picture of stability and resilience, with signs of accelerating growth momentum in certain sectors.

While corporate profitability is not outstanding, it has exceeded pessimistic forecasts, alleviating concerns of a drastic downturn.

With results from about two-thirds of S&P 500 companies already disclosed, here are five key features that have come to light.

Accelerated Growth Trend

The Q4 earnings and revenue growth pace has picked up, marking a departure from previous quarters. While the absolute level isn’t substantial, the improving trend indicates a positive shift for the upcoming periods.

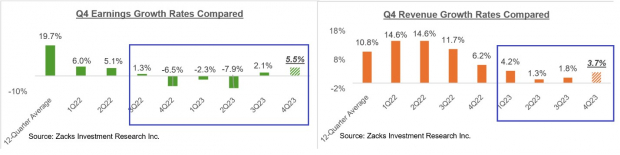

The total earnings and revenues for 338 S&P 500 members that have reported results show a 5.5% and 3.7% increase from the same period last year, with a significant portion beating EPS and revenue estimates.

The comparison charts situate the Q4 earnings and revenue growth rates for these 338 index members within a historical context.

Improvements in Profit Margins

The positive year-over-year change in net margins, after a prolonged period in negative territory, is a crucial factor driving earnings growth in the upcoming periods.

At the sector level, Q4 net margins have improved for 9 out of 16 sectors, with notable gains in Tech, Consumer Discretionary, Retail, Industrial Products, and Utilities.

However, Q4 margins have declined for 7 sectors, including Medical, Autos, Energy, and Transportation.

Resurgence of the Tech Sector

With Tech firmly back in growth mode, it is anticipated to continue on this trajectory. Q4 results show a broad-based increase in total earnings and revenues for the sector, with strong beat percentages.

Furthermore, the Tech sector’s resurgence is pivotal for the overall growth picture, with the aggregate earnings growth dropping to a decline when excluding the Tech sector.

Domination of the “Magnificent 7” Companies

The so-called Magnificent 7 companies, including Apple, Amazon, Alphabet, Microsoft, Meta, Nvidia, and Tesla, are pivotal contributors to earnings and market capitalization.

These companies are expected to bring in a significant portion of S&P 500 earnings, and their combined earnings for Q4 are anticipated to register a substantial increase, safeguarding the overall earnings growth.

Stabilization in Revisions Trend

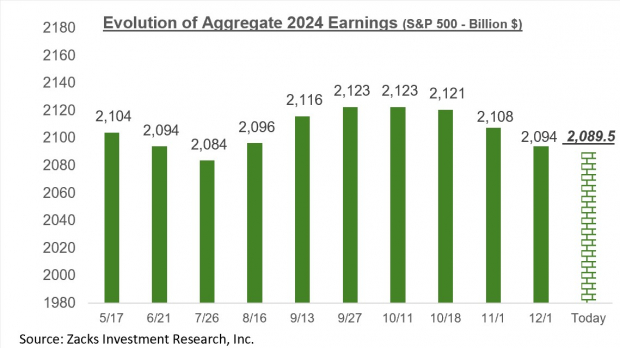

Estimates for 2024 Q1 and full-year 2024 have stabilized after a period of negative revisions, with modest declines in some sectors offset by positive revisions in others.

The evolving earnings growth expectations for this period are depicted in the chart below, as well as the aggregate earnings outlook for full-year 2024.

Game-Changing Investment Opportunities for 2023

Image Source: Zacks Investment Research

Discovering Potential Home Runs

Could there be a diamond in the rough amongst the plethora of investment opportunities available on Wall Street? According to Zacks Investment Research, a select few stocks have been overlooked by the masses, prompting discussions of potential gains. The enigmatic “5 Stocks Set to Double” report, cooked up by a cunning Zacks expert, raises the tantalizing prospect of enjoying a 100% or more elevation in 2023. This siren call is certainly appealing, especially when we take into account the stupefying performances of prior picks, which have soared by 143.0%, 175.9%, 498.3%, and a jaw-dropping 673.0%.

Flying Under the Radar

Wall Street, with all its glory and its relentless quest to unearth the next big thing, can still miss the mark. Despite this, the majority of the stocks in the aforementioned report have flown under the Wall Street radar, signifying a golden opportunity to establish ground-floor positions when prospects are fresh and laden with potential.