In 2023, the stock market was dominated by the stellar performance of the “Magnificent Seven,” comprising Tesla (NASDAQ: TSLA), Nvidia, Apple, Amazon, Meta Platforms, Microsoft, and Alphabet. These tech giants saw their stocks soar between 50% and 250%, propelling the overall market to impressive gains.

However, amidst this euphoria, it is crucial for investors to discern which companies are primed to sustain their upward momentum and which may face challenges in the upcoming year.

2023: A Year of Hype vs. Results

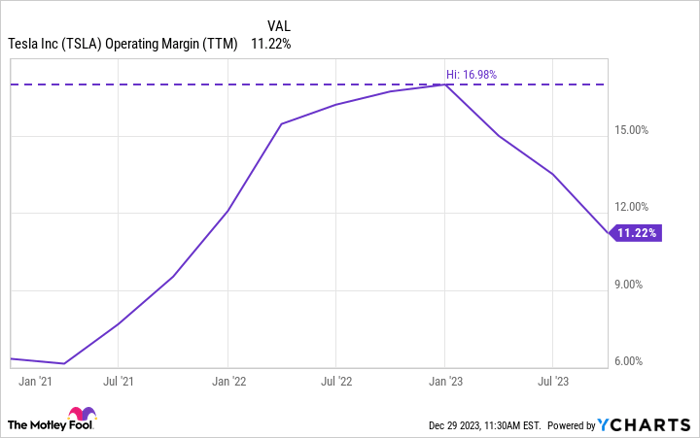

The phenomenal rise of Tesla in 2023 was driven by optimism about its future potential. CEO Elon Musk’s vocal presence and the buzz surrounding Tesla’s emerging products, such as the Cybertruck and advancements in artificial intelligence (AI), created a significant hype. However, Tesla’s current business relies on selling its existing electric vehicles, and it resorted to aggressive price cuts to boost sales, impacting profit margins. Operating margins have declined, raising concerns about the company’s short-term performance.

While Tesla’s strategy of using price cuts to gain market share and optimize factory efficiency may yield long-term benefits, the immediate impact on its financials remains uncertain.

Adjusting Expectations

Analysts have tempered their outlook for Tesla, with expected long-term earnings growth dropping from an average of 24% annually to under 17%. This decline in growth expectations underscores the evolving sentiment around Tesla’s prospects, indicating a need for a pivot in the company’s operating margins to drive bottom-line improvement. The trajectory of Tesla’s financials hinges on its ability to balance price cuts with sales volume.

The Price of Success

Interestingly, despite the challenges and uncertainties, Tesla’s stock soared by an astonishing 120% in 2023. However, the lack of corresponding earnings growth has inflated the stock’s valuation, resulting in it trading at a steep forward price-to-earnings (P/E) ratio of 78. This elevated valuation, coupled with declining margins and potentially slowing earnings growth, suggests that Tesla’s stock may be overvalued, making it vulnerable to a market correction in 2024.

As Tesla grapples with these challenges, investors are advised to exercise caution before chasing the stock at its current elevated prices. While the company’s future may hold the promise of a turnaround, the existing valuation leaves little room for error, heightening the risk for potential investors.

Where to invest $1,000 right now

When our analyst team has a stock tip, it can pay to listen. After all, the newsletter they have run for two decades, Motley Fool Stock Advisor, has more than tripled the market.*

They just revealed what they believe are the ten best stocks for investors to buy right now… and Tesla made the list — but there are 9 other stocks you may be overlooking.

*Stock Advisor returns as of December 18, 2023

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool has a disclosure policy.