Artificial intelligence (AI) has been a driving force behind the significant market gains in 2023. The release of ChatGPT and the investment rush in generative AI reshaped market dynamics, redirecting attention from inflation fears and looming recessions. As the markets soar to near record highs, investors are eagerly eyeing the AI sector as a primary catalyst.

Two tech titans, Nvidia (NASDAQ: NVDA) and Amazon (NASDAQ: AMZN), stand as prime indicators for gauging AI investments in 2024. Here’s why.

Nvidia’s Sales Growth: A Barometer for AI demand

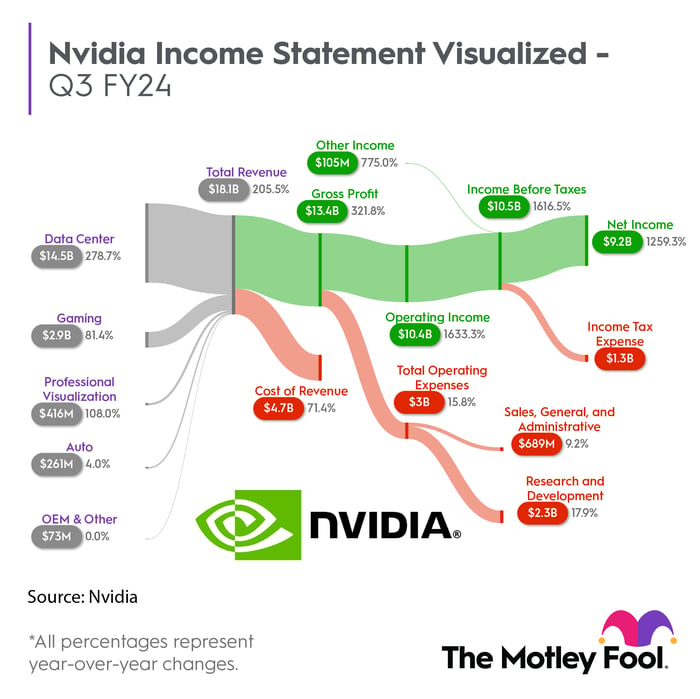

Nvidia’s recent success hinges on its high-performance graphic processing units (GPUs) and data-accelerating software, pivotal for generative AI and other data-intensive machine learning applications. Notably, the quarterly data-center sales for Nvidia surged by a staggering 450%, hitting $14.5 billion in fiscal Q3 2024, ending on Oct. 29, 2023.

The surge in data-center revenue and operating income serves as an explicit indicator of heightened AI demand. The $14.5 billion in data-center sales eclipsed the entire fiscal year 2023’s $15 billion. Moreover, Nvidia’s operating income soared to $10.4 billion last quarter, reflecting a remarkable 57% operating margin, a stark contrast to the 16% and 37% margins of fiscal 2023 and 2022, respectively. These metrics suggest a robust, AI-driven surge in company investments.

Following these compelling results, Nvidia’s stock soared by nearly 240% in 2023, currently trading close to its all-time high with a forward price-to-earnings (P/E) ratio of 40, surpassing Microsoft’s ratio of 34. While the valuation may seem exorbitant, continued performance in line with expectations will likely elevate Nvidia’s trajectory.

Watch AWS for Increased Data Usage

Amid Amazon’s notable 2023 performance, with gains of about 80%, investors expressed concerns over the decelerating growth of Amazon Web Services (AWS). Notably, AWS revenue growth plummeted from 37% in 2021 to 10% in the trailing 12 months leading up to Q3 2024.

AWS functions similar to a utility company, with customers paying for consumed resources. In 2023, many companies scaled back their data usage in anticipation of an imminent recession, prompting Amazon to collaborate with customers to curtail costs, thereby relinquishing some sales. This strategy, however, fostered customer loyalty, preparing the ground for potential growth as companies reinvigorate their AI and machine learning endeavors.

Even after its tremendous 2023 performance, Amazon’s stock remains undervalued historically on a price-to-sales (P/S) and price-to-operating-cash-flow basis. Coupled with the potential acceleration in AWS growth, Amazon’s stock holds compelling prospects for long-term investors.

The remarkable AI surge of the past year beckons investors to scrutinize the results of these two tech giants closely. The upward trajectory of Nvidia and the potential renaissance of AWS growth make compelling arguments for steering investment attention toward these AI-centric opportunities.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team recently identified what they deem the 10 best stocks for investors to buy now, and Nvidia did not make the list. The stocks that did make the cut promise substantial returns in the coming years.

The Stock Advisor service provides an easy-to-follow blueprint for investment success, including portfolio-building guidance, analyst updates, and two new stock picks each month. Since 2002, the Stock Advisor service has demonstrated returns tripling those of the S&P 500*

See the 10 stocks

*Stock Advisor returns as of December 18, 2023

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Bradley Guichard has positions in Amazon and Nvidia and has the following options: long September 2024 $630 calls on Nvidia. The Motley Fool has positions in and recommends Amazon, Microsoft, and Nvidia. The Motley Fool has a disclosure policy.