The artificial intelligence (AI) market is currently on fire, evidence suggests. The rise of ChatGPT in 2023 reignited interest in the sector, spurring numerous companies to shift focus towards developing AI technology.

Data from Grand View Research highlights remarkable growth projections for the AI market, showing a compound annual growth rate of 37% through 2030. This would propel the industry towards annual sales exceeding $1 trillion by the decade’s end, making it a prime opportunity for savvy investment.

Advanced Micro Devices (NASDAQ: AMD)

Advanced Micro Devices is gearing up for an exciting year, with plans to challenge Nvidia’s dominance by launching a new chip, the MI300X graphics processing unit (GPU), in 2024. While Nvidia presently commands approximately 90% of the AI chip market, AMD’s efforts to refine its AI technology over the past year demonstrate a strong push into the sector. The company has garnered support from tech giants like Microsoft’s Azure, which will be the first cloud platform to use the MI300X GPU to optimize its AI offerings.

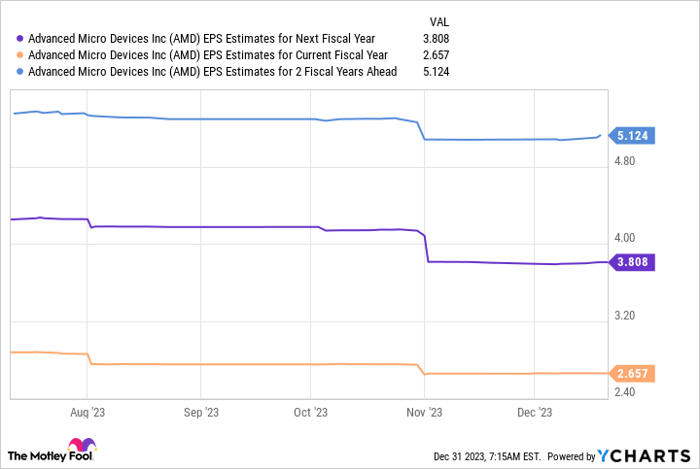

The chart above illustrates that AMD’s earnings could potentially hit $5 per share by fiscal 2025, signaling an 87% growth over the next two fiscal years. With a promising growth trajectory, AMD emerges as an intelligent investment choice this month.

Intel (NASDAQ: INTC)

Similar to AMD, Intel is diligently crafting a new AI chip to rival Nvidia in 2024. Despite facing challenges such as a decline in CPU market share and losing Apple as a partner, Intel has revitalized its ambitions. The company’s foray into consumer GPUs and its launch of the Gaudi3 chip exhibit a strategic move towards securing a strong position in the world of AI.

Intel’s earnings are projected to reach nearly $3 per share over the next two fiscal years, potentially delivering a monumental 180% growth by fiscal 2025. Hence, Intel is unquestionably worthy of enthusiastic investment this January.

Alphabet (NASDAQ: GOOG, GOOGL)

Alphabet experienced a stellar 2023, with its digital ad business witnessing an 11% year-over-year revenue surge in the third quarter of 2023, surpassing analysts’ expectations. The tech behemoth also boasts exciting prospects in AI, exemplified by the highly anticipated Gemini language model capable of advanced data analysis.

Gemini and Alphabet’s potent platforms, including Google Search and Android, present numerous opportunities for the company to expand in AI. Alphabet’s robust free cash flow, which surged 29% over the last year to $77 billion, underlines its financial capability to excel in the industry. Furthermore, a closer look at Alphabet’s price-to-earnings ratio and price-to-free cash flow in comparison to its competitors Amazon and Microsoft indicates that its stock is a bargain.

Alphabet’s substantial user base and Gemini technology position the company for substantial earnings potential in AI. Consequently, Alphabet is an indisputably compelling investment choice this month.

The Real Winners: Stock Advisor’s Top 10 Stocks for Long-term Investors

Outperforming the Rest

Stock Advisor’s recent report has shaken the investment world, bypassing Advanced Micro Devices and unveiling the 10 stocks that could potentially yield exceptional returns in the near future. The selection of these stocks is geared toward guiding investors through a lucrative and simplified path to success. The strategic insights and regular updates provided since 2002 have catapulted the Stock Advisor service to a position where it has tripled the return of S&P 500, reflecting its unparalleled ability to identify high-potential stocks.

Hidden Gems

The 10 best stocks, meticulously handpicked by Stock Advisor, are laid bare in the recent release. Realizing the potential they hold, investors are now presented with a rare opportunity to equip their portfolios with future wealth generators. With consistent guidance and invaluable stock picks, the Stock Advisor service has proven its mettle by guiding investors to the doorstep of prospective financial growth.

Steering Clear of the Obvious

While Advanced Micro Devices fails to make the cut, the 10 chosen stocks are positioned to deliver monumental returns in the years to come. Embracing a forward-thinking approach, Stock Advisor equips investors with the tools and knowledge to navigate the unpredictable waters of the stock market, indoctrinating them into a world of top-notch stock selections and ongoing analyst updates that have withstood the test of time since 2002.