For investors, the unbridled roller-coaster of 2023 on Wall Street was enough to turn the bristliest of stomachs. After the harrowing plummet of 2022, the market rebounded with the Dow, the S&P 500, and the Nasdaq Composite rising by 13.7%, 23.9%, and 43.4% respectively. Confidence was trading high until the fateful first days of 2024 brought swift and brutal volatility, dragging all major indexes down in a precipitous whirlwind. Uncertainty now whispers in the wind, teasing investors as they bicker about the timing of the first cut to arrival. Will the tenuous bull run hold, or do darker days loom on the horizon?

A Promising Bull Run Awaits

The buoyant bull run appears primed to extend into 2024. Minutes from the December FOMC meeting hint at a substantial interest rate slash this year. Any talk of a hike is a mere whisper in the catacombs. The majority of FOMC members have their sights fixed on the full maturation of the current 5.25-5.5% interest rate range. This steady decline in inflation since June 2022 only adds weight to predictions of yet another cut.

A trimmed interest rate environment should accelerate economic growth and subsequently drive up business investment. This bodes especially well for small-cap companies which faced an excruciating triad of record-high inflation, surging interest rates, and looming recession in 2022. Relief finally grazed their metaphorical shores in 2023, but a rate cut would provide the fuel needed to surge forward. The allure is not limited to these minnows—the ripple will reach into mid and small-sized enterprises and beyond.

Certain sectors, principally the burgeoning technology and consumer discretionary domains, are poised to reap substantial benefits from a lower interest rate. These companies often rely on affordable lines of credit as their business matures over an extended period. A drop in the risk-free interest rate will slash the discount rate, injecting newfound vigor into investments within these industries.

Even the labyrinthine global supply chain is seeing a gradual, if sluggish, resurgence, while U.S. corporate titans cleverly reconfigure their supply line, shunning China. Beneath these convoluted movements, the bedrock of the U.S. economy remains staunch, weathering record inflation and interest rates. The Atlanta Fed’s latest report projected a 2% surge in U.S. GDP for the fourth quarter of 2023. And let us not forget the eye-watering $1.4 trillion finding shelter in U.S. money market funds, lured by the rarefied 5% yields. A gradual dwindling of market interest rates will soon tenderly coax a substantial portion of this treasure trove into the ever-hungry maw of equity markets.

Seize the Opportunity, Buy on the Dip

The market’s bewitching dance through 2023 has left many befuddled, suspecting a muted performance in 2024 as valuations stretch taut. To these uncertain whispers, we counsel patience. The long-term trumpet is playing a bullish tune, resonating with steadfast confidence. Yet the maze of stocks, in the short term, is bound to convulse amid profit bookings from overstretched valuations and unforeseen geopolitical upheaval or energy tumult.

In this strategic morass, every dip presents a prodigious buying opportunity, even for the stocks that exploded into the stratosphere in 2023 and harbor immense potential for 2024 and beyond. Human nature often succumbs to the tantalizing fear of missing out, but heeding this siren call of herd mentality is rarely the road to riches. Instead, resist the siren’s song and forge ahead with a SIP (systematic investment plan). Take bold strides, particularly in the stocks of companies that reign supreme in their respective arenas. Let each dip stitch another piece onto your burgeoning portfolio. At curtain call, this assemblage promises to outpace pedestrian market returns.

Selecting the Right Stocks

The market teems with stocks that beg for attention and bear the promise of future growth. Yet fear not, for a panacea exists in the form of four simple criteria. First—echoing the samurai of old—seek out U.S. corporate leviathans with a market capital exceeding $100 billion. These behemoths boast an established business model and a globally lauded brand name. Second, pry open the treasure chest of stocks with boundless potential for 2024 and the years that follow. Third, anoint stocks that have gazed into the crystal ball and glimpsed sanguine earnings estimates revised in the last 60 days. And lastly, and most assuredly, clasp to your chest stocks that bear either the Zacks Rank #1 (Strong Buy) or 2 (Buy). Behold before you the tapestry, brimming with promise and pulsating with potential.

We present before you five stocks that fulfill these exacting criteria, their sheen dimmed not by their stretched valuations:

General Electric Co. The looming shadow of GE casts an expected revenue and earnings growth rate of 8.6% and 69.3% for the current year, with the Zacks Consensus Estimate for current-year earnings adorning a 4.2% uplift over the past 60 days.

Microsoft Corp. Behold the monolith of Microsoft, the expected revenue and earnings growth rate for the current year (ending June 2024) gleaming at 14.4% and 13.6%. Even the Zacks Consensus Estimate for current-year earnings has confessed a 0.1% uplift in the past seven days.

Amazon.com Inc.The titan of Amazon stands proud with an expected revenue and earnings growth rate of 11.7% and 34% for the current year. Let our gazes linger upon the Zacks Consensus Estimate, which whispers of a 2% uptick over the past 30 days.

Alphabet Inc.Cast your eyes heavenward to behold Alphabet, wreathed in an expected revenue and earnings growth rate of 11.3% and 15.6% for the current year. Even the Zacks Consensus Estimate for current-year earnings has murmured of a 0.7% ascent over the past 30 days.

Netflix Inc. The tantalizing siren call of Netflix entices with an expected revenue and earnings growth rate of 13.9% and 32.4% for the current year. The Zacks Consensus Estimate for current-year earnings offers the promise of a 0.4% rise over the past 30 days.

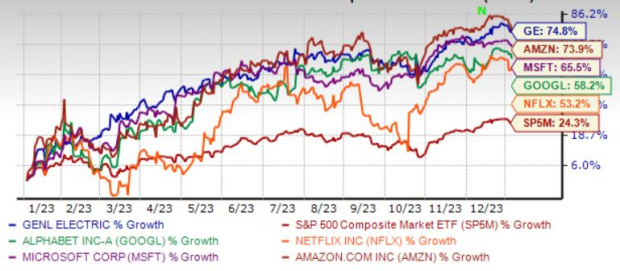

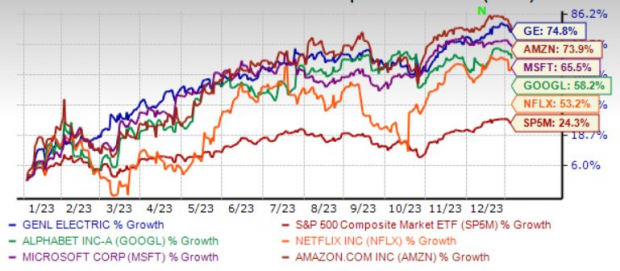

Gaze upon the chart below, a mosaic swirling with the price performance of the five aforementioned stocks in the bygone year.

Image Source: Zacks Investment Research

The Future of Investing: Analyzing Top Stocks for the Year Ahead

Unveiling Market Insights

As the financial world braces for the uncertainty of 2024, top stocks continue to captivate market watchers. Let’s take a closer look at some key players destined to shape the investing landscape in the year ahead.

The Power Players

Amazon.com, Inc. (AMZN), General Electric Company (GE), Microsoft Corporation (MSFT), Netflix, Inc. (NFLX), and Alphabet Inc. (GOOGL) have firmly established themselves as market heavyweights. A robust analysis of these industry titans unveils crucial insights for investors navigating the unpredictable ebbs and flows of the stock market.

Insights Uncovered

With the financial landscape evolving at a breakneck pace, gaining a deep understanding of these stocks is essential. By delving into the factors driving their growth, investors can make informed decisions that may steer them through market volatility.

A Roadmap for Investors

As you embark on your investment journey, the ability to read between the lines and decipher the nuances of these top stocks can make all the difference. With the market poised for twists and turns, a keen understanding of industry trends and company performance is your compass through the unpredictable terrain of finance.

In Conclusion

Staying ahead in the financial world isn’t just about numbers – it’s about understanding the stories behind the stocks. Keep a sharp eye on evolving market landscapes, harness the power of historical context, and remember, the best investments are often in the companies that fuel the future.