Charter Communications‘ CHTR division, Spectrum Enterprise, is relentless in its pursuit to expand its technology solutions.

Spectrum Enterprise focuses on providing Internet, phone, and television services to small businesses in 41 states across the United States. Recently, it launched its Internet, Mobile, TV, and Voice services in Cleveland County, NC, and other rural communities.

Spectrum Enterprise offers a fiber-rich, nationwide network with over 99.9% network reliability, increased speed, and bandwidth to fulfill the needs of business owners and employees.

Most notably, the company announced that its all-in-one solution, Managed Network Edge, has been chosen by Heritage Grocers Group to provide network monitoring, cybersecurity protections, connectivity, and managed IT services to ensure critical network uptime and security for various commercial operations such as credit card transactions and AI-driven inventory tools. It also supports environmental monitoring IoT sensors, online ordering, and delivery services.

The Spectrum Enterprise team continuously collaborates with clients to boost their business outcomes by providing personalized solutions that evolve with their needs.

Expanding Clientele to Drive Growth

Charter Communications’ division Spectrum Enterprise is buoyed by an expanding clientele and a robust enterprise customer base, which are anticipated to catalyze top-line growth in the near term. Spectrum currently serves about 30.6 million residential and small and medium business (SMB) Internet customers.

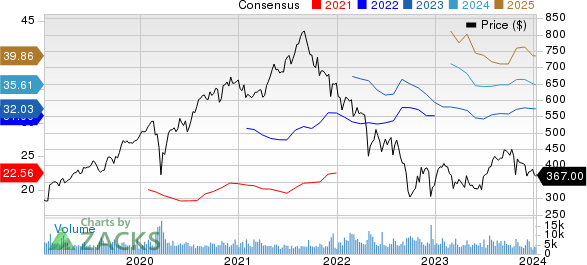

The Zacks Consensus Estimate for Charter Communications’ revenues for fiscal 2023 is pegged at $54.62 billion, indicating a 1.1% year-over-year growth.

The consensus mark for earnings has experienced a slight decline of 8 cents over the past 30 days to $8.93 per share.

Spectrum boasts a diverse client portfolio, including prestigious players like Red Studios Hollywood, Redman Realty Group, and many more.

Recently, Red Studios Hollywood engaged Spectrum Enterprise to bolster its digital network with a high-speed, low-latency Fiber Internet Access (FIA) circuit, supported by a second backup circuit.

Redman Realty Group also opted for Spectrum Enterprise’s technology solutions to upgrade its phone systems and enhance sales using the latter’s modern network.

Spectrum has also forged partnerships with market giants such as Cisco Systems, RingCentral, AOC Connect, and many others.

Furthermore, Spectrum recently introduced Secure Access with Cisco Duo and Cloud Security with Cisco+ Secure Connect, aiming to fortify cybersecurity solutions for businesses.

Spectrum has also collaborated with RingCentral to offer SMBs and other enterprise customers high-speed internet and network solutions, as well as a reliable, secure, and user-friendly communications platform.

Notably, in the last six months, Charter Communications’ shares have declined 4.1% against the Consumer Discretionary sector’s rise of 1.2%. This decrease is attributed to ongoing video-subscriber attrition, primarily due to cord-cutting and stiff competition from rivals like Netflix and Disney+.

Stock Assessment & a Promising Contender

Presently, Charter Communications holds a Zacks Rank #4 (Sell).

A more promising stock in the broader Consumer Discretionary sector is Netflix, currently carrying a Zacks Rank #2 (Buy). Netflix shares have yielded a significant return of 44.9% in the past year, with the long-term earnings growth rate pegged at 21.3%.

One relatively obscure company is poised to significantly impact the burgeoning Artificial Intelligence sector. By 2030, the AI industry is forecasted to have an economic impact equivalent to that of the internet and iPhone combined, estimated at $15.7 trillion. For further details, Zacks is offering a bonus report that outlines this game-changing stock and four other essential buys.

For more information, please visit Zacks Investment Research

To read this article on Zacks.com, click here.