A Game-Changing SEC Decision

The US Securities and Exchange Commission’s (SEC) approval for rule changes, allowing the creation of Bitcoin exchange-traded funds (ETFs), on January 10, makes a colossal statement. This move opens the floodgates to an anticipated launch of 11 Bitcoin ETFs within this year.

Historical Context: SEC’s Evolving Stance

As the agency has been a vocal critic of cryptocurrency, this acceptance comes as quite the surprise. Previously, it was hesitant on spot Bitcoin ETFs. However, after a legal setback in August 2023 to Grayscale, the SEC shifted its position. This landmark decision projects the entire crypto domain as an integral part of mainstream finance.

Stocks to Watch

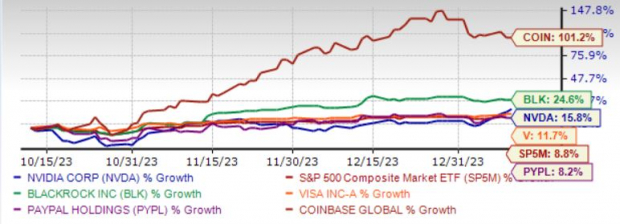

Key companies, such as BlackRock Inc., NVIDIA Corp., Coinbase Global Inc., Visa Inc., and PayPal Holdings Inc., are poised to witness significant changes amid the new development. Each firm has unique positioning and potential growth avenues in the wake of the approved Bitcoin ETFs. An analysis of their anticipated earnings growth, Zacks Ranks, and strategic moves is essential for investors keeping abreast with these evolving markets.

BlackRock Inc. (BLK)

BlackRock Inc., a stalwart in the investment management sector, had already thrown its hat into the Bitcoin ETF race in June 2023. With an expected earnings growth rate of 3.8% for the current year and a Zacks Rank of #3 (Hold), investors are understandably curious about the developments in store for BLK.

NVIDIA Corp. (NVDA)

A giant in the semiconductor industry, NVIDIA Corp. occupies a critical position in the evolving crypto landscape. With an expected earnings growth rate of 63.1% for the next year and a Zacks Rank of #2 (Buy), NVDA’s potential alongside the approved Bitcoin ETFs becomes a focal point for investors.

Coinbase Global Inc. (COIN)

As a prominent player in the financial infrastructure for the crypto economy, Coinbase Global Inc. stands to benefit from the approval of Bitcoin ETFs. COIN, carrying a Zacks Rank of #2, has an anticipated earnings growth rate of 34.7% for the current year, and its strategic positioning is set to draw great interest in the coming times.

Visa Inc. (V)

Visa Inc.’s foray into modernizing cross-border money movement, coupled with its expected earnings growth rate of 12.6% for the current year, with a Zacks Rank of #3, promises an intriguing trajectory amid the Bitcoin ETF furor.

PayPal Holdings Inc. (PYPL)

Operating digital wallets, PayPal Holdings Inc.’s foray into cryptocurrencies has positioned it to capitalize on the growing momentum. With an expected earnings growth rate of 11.2% for the current year and a Zacks Rank of #3, the impact of Bitcoin ETFs on PYPL is a matter of interest for analysts and investors alike.

The price performance chart of these stocks in the past three months paints an interesting picture of market sentiments.

Image Source: Zacks Investment Research