The Appeal of Large-Cap Stocks

Large-cap stocks are a staple in many investment portfolios due to their stability and consistent track record. These stocks are favored not only for their potential dividends but also for providing a reliable investment option for more conservative investors.

Top Picks for Growth

Despite their stability, some large-cap stocks are also poised for significant growth. Notable among these are Target (TGT), Cardinal Health (CAH), and Arista Networks (ANET).

Arista Networks: Riding the AI Wave

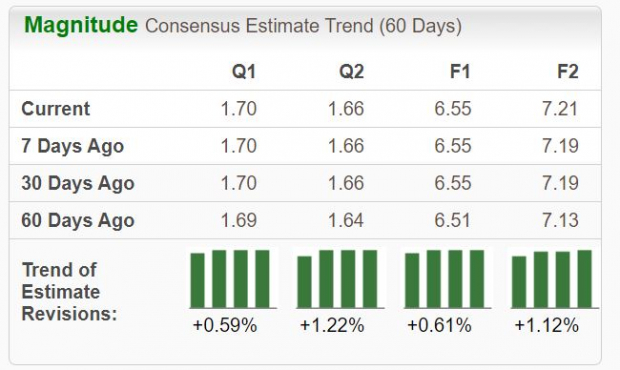

Arista Networks, a provider of network switches to hyperscalers, has experienced substantial gains due to the AI boom. The company holds a Zacks Rank #2 (Buy) and is projected to see impressive growth across all timeframes.

Target: From Retailer to Omnipresence

Target has successfully transitioned from a traditional brick-and-mortar retailer to a robust omni-channel entity. With a Zacks Rank #2 (Buy), the company is expected to witness substantial earnings growth and boasts a solid dividend yield of 3.1%.

Cardinal Health: A Strong Performer

As a nationwide drug distributor and service provider to healthcare entities, Cardinal Health stands as a Zacks Rank #2 (Buy) stock with a robust earnings outlook and a history of surpassing earnings and revenue expectations.

Potential Growth Indicators

All three stocks exhibit favorable growth expectations, with consensus estimates pointing towards substantial earnings and revenue increases in the coming years. These indicators underscore the potential for significant growth in the large-cap segment.

Investor Considerations

With the allure of stability and a positive earnings outlook, Target, Cardinal Health, and Arista Networks present compelling options for investors seeking large-cap exposure.