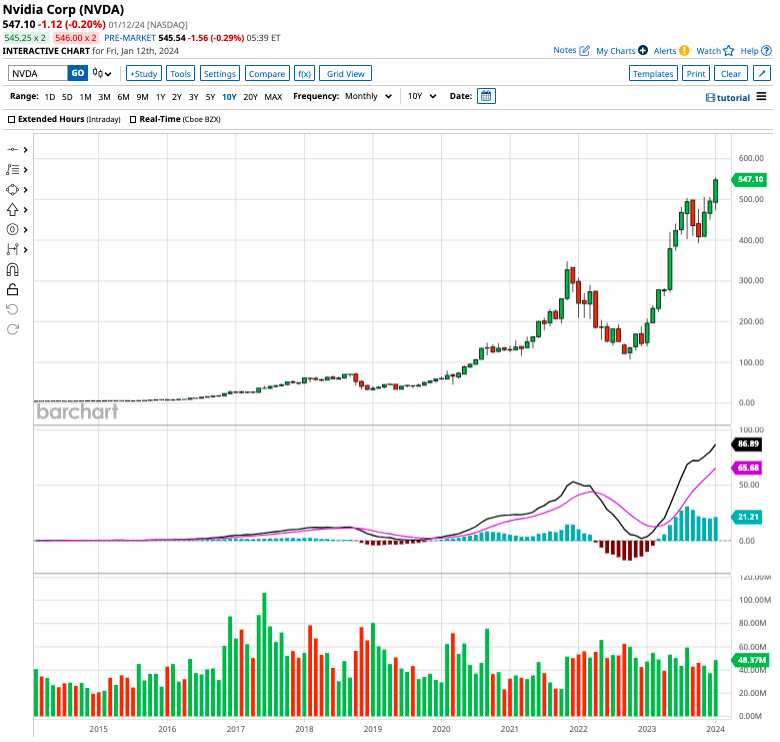

Nvidia (NVDA) has been a juggernaut in the semiconductor industry, with its remarkable return of over 14,100% in the last 10 years, creating unprecedented wealth for long-term shareholders. But beyond Nvidia, there are three other compelling AI chip stocks that deserve investor attention. Let’s delve into the potential of these top-rated players in the AI industry.

Broadcom Stock

With a market cap of $518 billion, Broadcom (AVGO) is a formidable force in the semiconductor space. The company’s strategic acquisitions have bolstered its product portfolio, particularly in data storage, optical, and wireless chips. Broadcom has successfully diversified its revenue base, emerging as a less cyclical entity and delivering consistent sales growth and impressive margins. The overwhelmingly positive outlook from Wall Street analysts reflects the stock’s strong potential.

Marvell Technology Stock

Marvell Technology (MRVL) exhibited resilience in its recent fiscal results, surpassing analyst estimates despite a challenging market environment. While the short-term outlook may have some headwinds, the company’s long-term prospects appear promising, with forecasts indicating a turnaround in sales and earnings in the coming years. The substantial “buy” ratings and target price premiums signal optimism among analysts regarding the stock’s future trajectory.

Monolithic Power Stock

Monolithic Power (MPWR), valued at $28.59 billion, specializes in integrated power semiconductor solutions catering to various industries including computing, automotive, and communications. Despite its relatively higher valuation, bullish sentiments driven by anticipated AI demand underscore the stock’s growth potential. The favorable analyst recommendations further highlight the positive sentiment surrounding this AI chip stock.