Last week’s largely favorable yet mixed Q4 reports from major banks have brought the finance sector into the limelight. Some financial industries are currently shining, making them worthy of investors’ attention.

Amidst this backdrop, it’s worth noting that several finance stocks are currently placed on the Zacks Rank #1 (Strong Buy) list. Not only are these financial companies potentially undervalued, but they also boast dividend yields over 5%, presenting an opportune moment for investment.

Investment Management Firms

Two wealth management players, AB and Janus Henderson Group JHG, are gaining attention as the Zacks Financial-Investment Management Industry ranks in the top 24% of over 250 Zacks industries. Significantly, their dividend yields far exceed the industry average of 2.78% and the S&P 500’s 1.39% average.

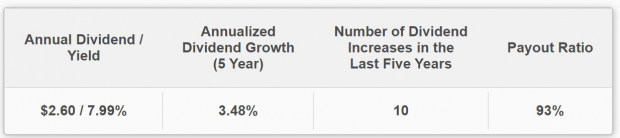

For instance, AllianceBernstein is currently offering an attractive 7.99% annual dividend yield, which complements its shares trading at 10.8X forward earnings – a sizable discount compared to its historical high and median. Meanwhile, Janus Henderson’s stock carries a reasonable 11.5X forward earnings multiple, with a 5.47% annual dividend yield.

Regional Banks

Several regional banks, including Citizens & Northern Corp CZNC and Financial Institutions’ FISI, are showcasing favorable valuations and substantial dividend yields. These stocks belong to the Zacks Banks-Northeast Industry, currently situated in the top 26% of all Zacks industries.

Citizens & Northern Corp’s shares trade at a reasonable 12.3X forward earnings multiple and offer a 5.63% annual dividend yield. In a similar vein, Financial Institutions’ 5.61% dividend yield surpasses the industry average, with shares trading at just 6.7X forward earnings.

Bottom Line

Correlating with their Zacks Rank #1 (Strong Buy) status, these finance stocks are witnessing positive earnings estimate revisions for fiscal 2024. Coupled with strengthened industry outlooks, these factors make them even more appealing to income investors.

Move over, zesty-sounding stock picks. There’s more to the finance sector than ticker symbols, share prices, and dividend yields. While high dividends might seem like the tastiest dish on the menu, investors should also keep an eye on these companies’ earnings potential and industry trends. So, while these stocks might be delicious to income investors, they might offer an even more flavorful recipe in the long run. Bon appétit!